In cased you missed it, in the nearly two months since retail stocks went into a death spiral following the news that Amazon.com (AMZN) would pay $14 billion to acquire The Whole Foods Market (WFM) in mid-June, many beleaguered stocks in the sector have started to pick their heads up again. Walmart (WMT) has rallied 11% since early July and is actually trading very near a 52 week high, while Target (TGT) is up nearly 20% from its 52-week lows made in June, despite still being down 27% from its 52-week highs. In the last week brands such as Nike (NKE), Michael Kors (KORS) and Ralph Lauren (RL) have had sharp short squeezes following earnings reports that were better than expected.

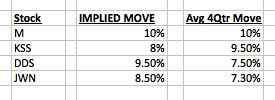

Tomorrow we will get earnings reports from the big department stores, all with some pretty hefty implied moves post results:

Following that will be earnings from The Home Depot on Aug 15th, TGT on Aug 16th and WMT on Aug 17th.

We have not been alone in our fundamental view that this space challenged for a whole host of secular changes afoot, but earlier in the summer, when sentiment seemed at its lowest following the AMZN/WFM deal we defined risk contrarian bullish trades in TGT (here), M (here) and Kroger (here) given what we thought was an overshoot, as all three of these companies might find a seat in the game of musical chairs that may be in its very early rounds.

That said the technical backdrop for retail stocks as a whole remains fairly nasty, despite the recent bounce with the XRT, the S&P Retail etf having its recent bounce paused yesterday at the downtrend from its 52-week highs:

Regular readers might recall on a few occasions over the last year referring to this chart as the ‘worst chart ever’ forming what clearly looks like a head and shoulders top, with $39 critical longer term support serving as the neckline:

It’s been our trading view to short on rallies. The heavy slate of retail earnings between now and next Friday night provide the opportunity to sell short dated puts to finance the purchase of longer dated ones for those who think a break of long term support is coming in the Fall. There are no October options listed yet but this is how we’d trade it now. When October is listed on Monday this strategy could use that expiration instead of December for less overall risk:

So what’s the trade?

XRT ($40.65) Buy the Aug / Dec 40 put calendar for 1.50

- Sell to open 1 Aug 40 put at .25

- Buy to open 1 Dec 40 put for 1.75

Breakeven/Rationale – the Ideal situation is a move lower towards 40 by next Friday. At that point, the Aug puts can roll off and either re-established as a calendar in Sept or a vertical in Dec. Total risk out to Dec is 1.50, that’s the most that can be lost under any scenario, but even a move higher in the near term won’t mean massive losses on the position as gains in the near term puts will help with losses in the Decembers. If XRT does break out the Dec puts can be closed or rolled higher at a 50% stop loss.