Facebook (FB) will report Q2 results tonight after the close. The options market is implying about a 4.5% one day move tomorrow which is rich to the average post-earnings move over the last 4 quarters of only 2.5%, but well shy of the 7% average one day move since its 2012 ipo.

With the stock trading at $165, the weekly 165 straddle (the call premium + the put premium) is offered at $7.40. If you bought that and thus the implied earnings move you would need a rally above $172.40 or a decline below $157.60 to make money.

The stock’s 43% year to date gains is nothing short of astounding, but the stock’s 10% gains since early July might discount a beat and raise.

There is obviously NO overhead technical resistance in the stock having just made a new all-time high this morning, while the March – April consolidation between $139 and $143 might serve as healthy near-term support:

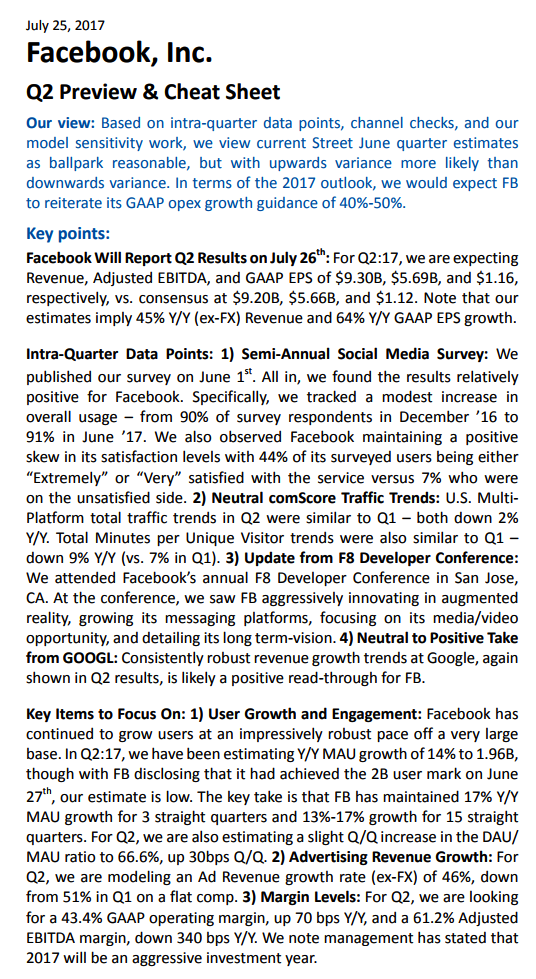

RBC Capital’s star internet analyst Mark Mahaney highlighted the key items to focus on in a note to clients yesterday:

My View: shares of FB have performed far beyond the most bullish expectations in 2017, in only 7 months. There is little reason to suspect investors abandon the stock on a mild disappointment, possibly in line with the implied move, much like Alphabet’s (GOOGL) response yesterday, down a little less than 3%, after its stock ran 7% into its Q2 print Monday night. On the upside, it would take a meaningful beat and raise for the stock to outperform the implied move.

Elevated short dated options prices make yield enhancements strategies like call sales against long stock attractive, or possibly long collars to finance the purchase of downside protective puts by selling out of the money calls. Last week we highlighted some large bullish options flow (Big Printin’ – Facebook (FB) to $200?) where at least one trader was playing for new highs to the high $170s this week following the results and another trader is playing for a rally into September expiration above the 175 and 180 strikes, capping gains at $200.

So What’s the Trade?

Stock Alternative

Buy the FB (164.70) July28th 165/175/185 call fly for 2.30

- Buy 1 July28th 165 call for 4.40

- Sell 2 July28th 175 calls at .60 (1.20 total)

- Buy 1 July28th 185 call for .10

Breakeven on Friday – Losses of up to 2.30 below 167.30. Gains of up to 7.70 between 167.30 and 182.70 with max gain at 175.

Rationale – This trade targets a move slightly higher than the implied move to the upside. Its breakeven is a few dollars higher than where the stock is currently trading but it defines risk to just 2.30 in case the stock gets hit on the event.