I’ll keep this simple, on a couple occasions over the last couple years I have owned AT&T (T), usually looking to add some yield (by overwriting) to a stock that already has a killer dividend yield. I have liked their acquisition strategy, as they closed their nearly $50 billion acquisition of DirecTv in mid-2015, continue to aggressively pursue wireless spectrum with their $1.6 billion acquisition of Straight Path earlier in the year, and is now focused on getting regulatory approval for their proposed $85 billion bid for Time Warner (TWX).

In an environment where bond yields can’t get out of their own way (10 year Treasury yield straddling 2.25%) its fairly shocking to see shares of T trading at 52-week lows, down 15% on the year, while sporting a dividend yield of nearly 5.5%!

To my eye, the stock has pretty healthy looking technical support at what would be a double bottom low from 2015 & 2016 near $32, down about 11% from current levels:

For longs kicking the tires on the name at current levels, with a time horizon equal to greater than a year, which it might take to get approval for TWX deal, the dividend yield is spotting you half of what might seem like the downside risk in the meantime.

Taking a slightly longer term view, the stock might find near term support at the intersection of the uptrend from the 10 year low made in 2008 and the breakout level from early 2016:

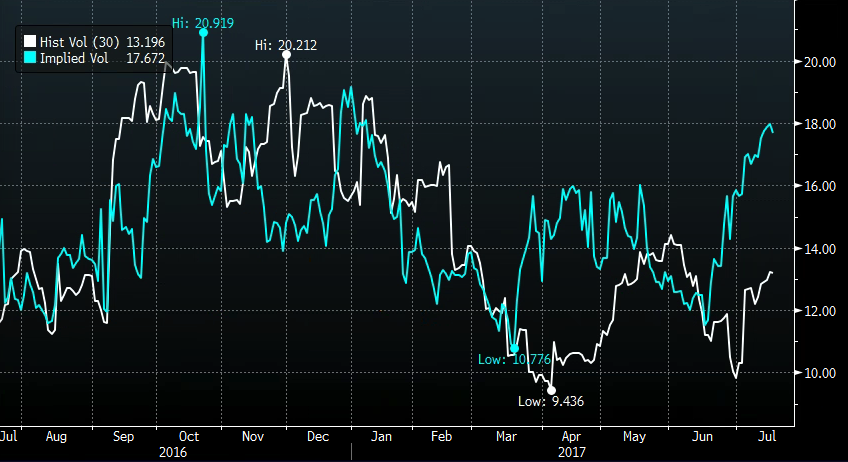

The fairly extreme volatility in the stock over the last year has caused an unusual situation as it relates to options in the name, with 30 day at the money implied volatility (blue line below, the price of options) at 2017 highs, well above levels prior to their Q1 report in April, and well above 30 day realized volatility (white line below, how much the stock has been moving). This set up might make call sales vs long stock attractive in the near term to juice the already fat yield:

The only problem here is that upside calls are too dollar cheap to sell given the sharp decline in the stock and the potential for an unexpected quick sharp bounce. For instance with the stock at $35.82 the Aug 37 call can be sold at 28 cents, or a little less than 1% of the stock price. That’s not bad if you annualized it, selling a 3% out of the money call against long stock that already pays a 5.45% dividend yield. Annualize that and you have a holding easily yielding 10%.

Tonight after the close wireless competitor T-Mobile (TMUS) will report Q2 earnings. Next Tuesday AT&T will report, and next Thursday Verizon (VZ) will report. For the time being I don’t see any real foreseeable catalysts compared to the larger story at play. I suspect guidance for wireless ads might be soft for all carriers prior to the launch of new iPhones in the Fall, and the stocks might have more room near term to the downside. I am buying a little stock here at $35.82 with an eye towards averaging down a little, and strongly considering routinely selling a month out 3% out of the money call to super yield this mofo as we get more clarity on the likelihood of approval of TWX, and event that would make this stock a must own in my opinion.