After the close tonight, IBM will report its Q2 earnings. The options market is implying about a 4.4% one day move tomorrow which is rich to the average of about 2% over the last four quarters and the 10 year average of about 3.66%. With the stock $152.60 the July weekly 152.50 straddle is offered at about $6.65, or about 4.4%, if you bought that and thus the implied earnings move you would need a rally above $159.10 or a decline below $145.90 to make money, or about 4.4% in either direction.

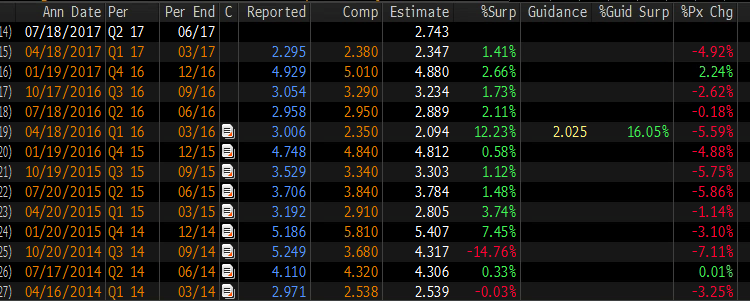

It’s worth noting that the stock has only rallied the day after earnings on one occasion in the last three years, despite a string of “earnings” surprises:

While past performance is not indicative of future returns, the company got into the habit of using all of their cash flow to buy back stock to manage earnings, and benefited from an unusually low tax rate (see below). But during that three year time period the company’s sales declined from about $93 billion in 2014 to $80 billion last year, and the stock has declined more than 20% from mid 2014 vs the S&P 500 (SPX) which is up about 25% since mid 2014.

The stock has been nothing short of a disaster when you consider how much value has been destroyed through the company’s buybacks. The stock is down 8% on the year, which doesn’t tell the whole story when you consider it is down 16% from its 52-week highs in Feb, and is now once again approaching important near term technical support at $150 in front of a potentially volatile event:

The longer term set up doesn’t not paint a better picture as a break of $150 likely has the stock back near $140 quickly and below that there is an air-pocket back to about $119, the 2016 low:

But the stock is cheap right? It trades 11x earnings, expected to grow eps only 1% this year and next, while sales are expected to decline 2%, the company’s 6th consecutive annual decline. Yeah, a nearly 4% dividend yield is nice, but the company’s second largest shareholder, Warren Buffett’s Berkshire Hathaway started to unload, selling a third of its 80 million share stake in Q1 (I suspect more in Q2).

But, But Watson?? I’ll defer to tech investor Chamath Palihapitiya the CEO of Social Capital back in May on CNBC:

“Watson is a joke, just to be completely honest,” he said in an interview with “Closing Bell” on the sidelines of the Sohn Investment Conference in New York.

“The companies that are advancing machine learning and AI don’t brand it with some nominally specious name that’s named after a Sherlock Holmes character.””I think what IBM is excellent at is using their sales and marketing infrastructure to convince people who have asymmetrically less knowledge to pay for something,” Palihapitiya added. “I put them and Oracle in somewhat of the same bucket.”

[Editor’s Note: Watson is named after original IBM CEO Thomas Watson]

IBM remains a value trap. I suspect one more meaningful miss and guide down and IBM CEO Ginny Rometty will be forced out by her board (see GE and Ford of late), possibly at the behest of an activist investors looking to break up the company the way that Hewlett Packard and Ebay / Paypal have done in the last couple years in an effort to extract shareholder value. All 4 stocks have out-performed the market considerably since their splits.

Near term though, expectations are aren’t high. Wall Street analysts in particular are decidedly negative, with only 6 Buy Ratings, 18 Holds and 5 Sells. As mentioned above, a big driver in IBM’s eps has been their tax rate, per Credit Suisse research, via Barron’s Online:

We continue to believe it is increasingly likely that International Business Machines will miss the 2017 earnings-per-share guidance at some point, at least operationally. We retain our below-consensus 2017/2018 EPS estimates at $13.03/$12.50, respectively, and free cash flow of $10.4 billion/$10.3 billion, respectively.

Over the past three years, we have noted that IBM’s (ticker: IBM) declining tax rate has helped EPS materially by around 7% on average. Now its tax rate could reach as low as 4% (11% excluding discretes for the rest of 2017), the lowest of its tech peers and leading S&P 500 companies. Following a detailed analysis, we conclude that current rates of tax are unsustainably low, and that this lever could run out over time, along with other non-operational levers such as intellectual property sales.

The only way the stock could have a sustained bounce would be with a high-quality beat and raise, where buybacks and tax rates don’t materially aid the beat, higher margins demonstrating some pricing stability and possibly a year over year uptick in revenue growth.

A material miss and guide lower and the stock is probably down commensurate with the percentage miss on eps. Could the stock find some support near $140? It’s possible technically and there’s maybe a bid below on the hope for activists. But activists emerging could take some time. And the replacement of the CEO by an insider yielded an initial pop for Ford and GE in the last couple months, but both stocks quickly forfeited those gains and made lower lows as investors realized that c-level changes would only be the start.

So What’s The Trade?

For those that are long or looking to scoop shares on weakness defined risk is the name of the game.

Defined Risk Bullish / Stock Alt

IBM (153.35) Buy the July 160/ Sept 155 diagonal call calendar for 2.30

- Sell 1 July 160 call at .80

- Buy 1 Sept 155 call for 3.10

Breakeven on July Expiration – Gains of up to 2.70 at or above 160. Mark to market losses on a stock decline but value likely left in the Sept call. Total risk on the trade is 2.30, and after expiration on Friday the Sept call can be spread if the stock is still below 160

Rationale – This is bullish both for the event itself and afterwards. If the stock rips higher on earnings, above 160 the trade can be more than a double. If the stock is higher but below 160, the trade will be profitable and have opportunity to make considerably more if the stock goes higher into September. If the stock declines on earnings it will be a loser but it is unlikely to be worthless.

OR

Bearish/ Hedge

IBM (153.35) Buy the July 150/140 put spread for 1.75

- Buy 1 July 150 put for 2.00

- Sell 1 July 140 put at .25

Breakeven on July Expiration (Friday) – Losses of 1.75 above 150, gains of up to 8.25 below 148.25, no gains (or protection) below 140

Rationale – A breakdown below 150 likely sees the stock threaten 140. If the stock goes nowhere or higher the max risk is just 1.75. The worst possible scenario is the stock declines slightly but above 150 in which case this will expire worthless despite getting direction correct.