Netflix (NFLX) will report Q2 results tonight after the close. The options market is implying about an 8% one-day move tomorrow, which is a tad shy of the 7.1%* average over the last four quarters, and well shy of its 10-year average one-day post earnings move of 13%.

*The July 21st (this week) 160 straddle (vs $160, the call premium plus the put premium) is offered at about 13.50, if you bought that and thus the implied move you would need a rally above $173.50 or a decline below $146.50 to make money by Friday’s close.

Shares of NFLX are up nearly 31% on the year, a few percent below the all time high made in early June, but importantly up about 12% in the last two weeks after suffering its worst peak to trough decline since November. The stock found some near term support in early July at what was a breakout level from late April, but might also find some near term resistance at the prior high just below $170:

What to expect – In a note to clients on July 9th, RBC Capital’s star internet analyst Mark Mahaney highlighted the following:

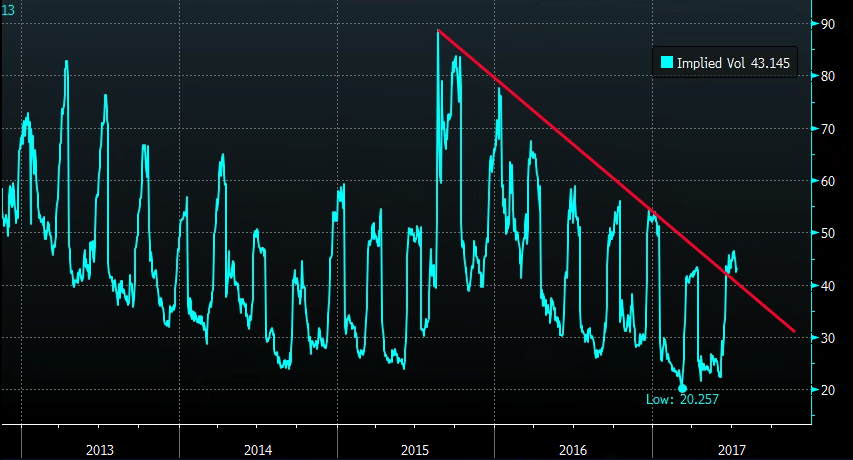

Short dated options prices are above levels prior to thier Q1 report in April, with 30 day at the money implied volatility at 43%, for the first time above the downtrend from its August 2015 flash-crash levels, that also happen to be five year highs:

This does not mean a whole heck of a lot if the stock doesn’t make a large move post results. But if the stock were to make a larger than expected move to the downside, then it might mean investors got trapped being too complacent and the stock could make a sustained move.

With a nearly $70 billion market cap, or about 6.25x expected 2017 sales, and 150x expected GAAP earnings of $1.06, the company is increasingly a difficult acquisition target as it would be amazingly dilutive for any buyer. Given the onslaught of competition in streaming video and original content, its my view that NFLX should consider broadening the type of streaming content it offers subscribers, specifically in the U.S. where the market is becoming saturated and acquire a company like Spotify that has about 55 million paying subs for its streaming music service. Such an acquisition would likely come at a 30% premium to Spotify’s most recent valuation of about $13 billion and likely be viewed with a bit of skepticism. But if NFLX were able to raise Spotify’s mid teens % margins anywhere near its low 30s % margins and then also offer the potential for bundles, such a deal could end up raising the combined entities profitability in a meaningful way and possibly create a more defensible moat to Amazon and Apple’s ambitions in the streaming media space. Maybe pie in the sky, but original video content is becoming a bit of an arms race, while licensing in music has constrained margins due to label payouts, increased scale with lower customer acquisition costs might be the way to this. I suspect NFLX far more likely to be an acquirer than an acquiree.

Let’s save that discussion for another time, now what to do now into the print?

Defined Risk Long

NFLX ($160) Buy the July 160/172.50/185 call fly for 3.40

- Buy 1 July 160 call for 7.00

- Sell 2 July 172.50 calls at 1.95 (3.90 total)

- Buy 1 July 185 call for .30

Breakevens on Friday: Profit range of 163.40 to 181.60 with max gain of 9.10 at 172.50. Loss of entire amount below 160 (or above 185)

Rationale – This trade plays for a move in line with the expected move while only risking 3.40, much less than the implied move. It’s extremely binary as it expires on Friday so any decent move lower and it’s likely worthless. However, to the upside, it has a wide range of profitability.

Hedge vs Existing Long

vs 100 shares of NFLX ($160) Buy the July 150/175 collar for $1

- Sell 1 July 175 call at 1.40

- Buy 1 July 150 put for 2.40

Breakeven on Friday – Profits and losses in the stock (less the $1 hedge) between 150 and 175. Losses capped below 150 and gains capped at 175.

Rationale – This is a nice collar for those with profits that want to stay in the stock but are willing to cap some upside on the event to protect their gains down $10 in the stock. The call sale is just outside the expected move to the upside and the put buy is just inside the move to the downside