FedEx Corp (FDX) will report their fiscal Q4 results tonight after the close. The options market is implying about a 5% one day move in either direction vs the 4 quarter average one-day post earnings move of 4.25% and well above the 10 year average of 3.4%

Shares of FDX are up 12.5% year to date, massively outperforming peer UPS which is down 4% on the year, and the IYT, the iShares Transports etf, of which FDX makes up 13.5% of the weight, which is up 5% ytd. The break in relative performance between the two came in late January on UPS’s disappointing Q1 results and guidance:

FDX earlier this month broke out of the consolidation it has been in for most of the year between $185 and $200 and has not looked back:

The stock h as very healthy long term support at the late 2016 breakout level in the low $180s, also a level the stock found support in 2017:

FDX is a cheap stock, trading below at market multiple at 17.5x expected fiscal 2017 eps growth of 10%, on sales growth of about the same, vs UPS that trades 18x expected 2017 eps growth of 4% on 5% sales growth.

With Amazon in the news following last week’s $14 billion bid for Whole Foods Markets (WFM), I think it’s important not to forget their designs to disrupt existing delivery and logistics business that for now, they rely on, from the WSJ in Sept:

Amazon’s Newest Ambition: Competing Directly With UPS and FedEx

To constrain rising shipping costs, the online retailer is building its own delivery operationThis logistical dance wasn’t performed by United Parcel Service Inc., FedEx Corp. or the U.S. Postal Service, all longtime carriers for the online retailer. It was part of an operation by Amazon.com Inc. itself, which is laying the groundwork for its own shipping business in a brazen challenge to America’s freight titans.

While that headline seems to be a distant memory, I think it makes sense not to underestimate Amazon’s ambitions when it comes to not relying on other companies outside their expanding network for distribution. At some point, Amazon’s growth will go from a massive tailwind to a headwind as they continue to deploy their capital. I’ll direct you to L2’s Scott Galloway commentary regarding Amazon’s disruption in retail to Recode’s Kara Swisher recently on her RecodeDecode podcast, which I think can be extrapolated to areas like shipping (emphasis mine):

Basically I would argue what Amazon has done is Amazon is conspiring with 600 million consumers, infinitely cheap capital offered by fanatical groupie-like investors, an incredibly deft execution and understanding technology. That they’ve collaborated with all of these entities to basically starch the margin out of brand and retail, and they’re doing it pretty effectively. The winners are consumers, the winners are Amazon shareholders, but the losers are the retail ecosystem, which includes 11 million cashiers, which includes the 40 million households that have a share of Gap or Walmart. You’re effectively seeing this giant sucking sound out of the entire retail ecosystem into a small number of players.

So what’s the trade into the print?

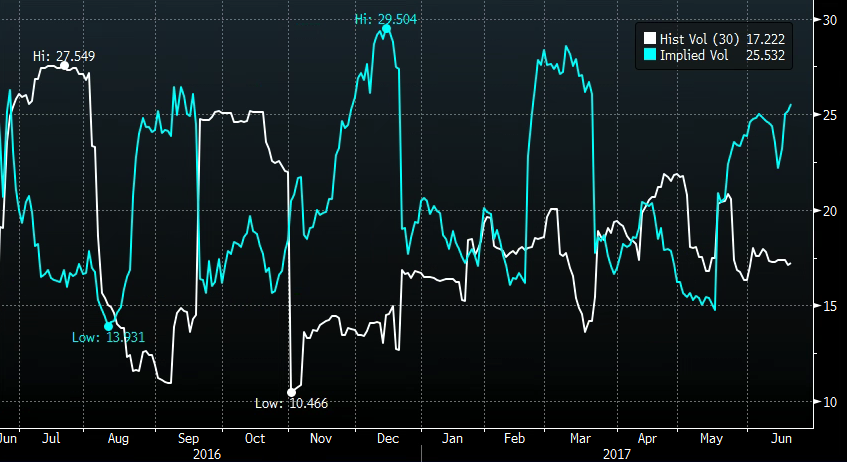

Defined risk strategies into the event make sense for those looking to express a directional view. Short-dated options prices are obviously elevated into the print, with 30 day at the money implied volatility (the price of options, blue line below) at 25.5%, while 30 day realized volatility (how much the stock is actually moving, white line below) at 17%, a fairly wide, signaling options prices to be expensive. Strategies that sell short-dated to buy longer-dated options also make sense:

In this case (for those who are inclined to position bullishly into the print) we’d look to define risk to as little as possible while targeting slightly above the implied move looking out to the end of June:

Bullish

FDX (210) Buy the June30th 210/225/240 call fly for 3.40

- Buy 1 June30th 210 call for 5.00

- Sell 2 June30th 225 calls at .85 (1.70 total)

- Buy 1 June 30th 240 call for .10

Breakeven on June 30th – This trade breaks even at 213.40 which is 3.40 higher than where the stock is trading, so it’s for those looking for higher highs that want to limit losses in case the stock gets hit on the print.It can make up to 11.60 if the stock is 225 on June 30th.

Rationale – The implied move is about 219 on the upside and 201 on the downside so this defines risk to much less than that move, and gives room to the upside in case the stock out performs the move higher.