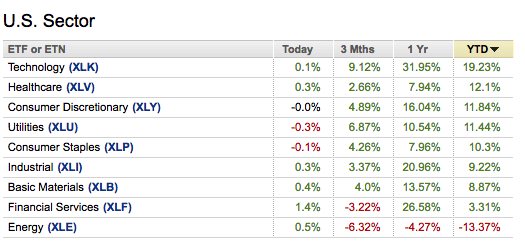

Utility stocks, measured by the etf XLU that tracks the sector are the 4th best performing group in the S&P 500 (SPX) year to date:

One reason for this might be the year to date weakness in U.S. Treasury Yields, down from just over 2.6% in December to as low as 2.15% earlier in the week, and 2.22% as I write:

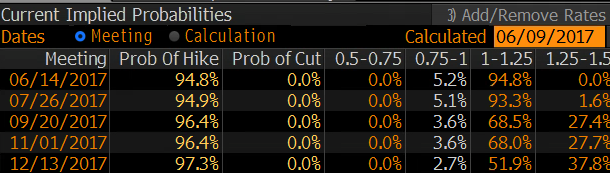

And Fed Funds Futures are pricing a near certainty that the Fed will raise interest rates by 25 basis points at their meeting next week:

The XLU recently broke out from a months-long consolidation to new 52 week highs as Treasury yields made lower lows. But to my eye, as the SPX makes higher highs near daily, I suspect a check back to the prior support/breakout level at $51-52 could be a knee-jerk reaction on tighter Fed rhetoric:

And short dated options prices don’t appear to be priced for movement, with 30 day at the money implied volatility at multi-year lows:

So What’s the Trade?

One way to play for a short term pullback to 52 or so would be to simply buy the June 53.5 put for .50. That could pay off about 2 to 1 on a pullback and has a breakeven only .55 below where the stock is currently trading. But it very binary with only 7 days until expiration, but capturing the FOMC meeting. For those looking out a bit farther a calendar could make sense, selling that 52 support level in July to finance the same strike in September:

Bearish

XLU (53.55) Buy the July/Sept 52 put calendar for .60

- Sell 1 July 52 put at .35

- Buy 1 Sept 52put for .95

Breakeven on July and Sept expirations: Before July expiration the ideal situation is XLU lower and around 52. If thats the case the July puts can be closed and rolled, positioning for further weakness over the Summer. The most that can be lost on the trade is .60.

Rationale – This positions for both near term weakness down to 52 by July expiration, captuiring the FOMC meeting, but then positions for even more below that into September. It has several ways it can make money, and if it loses and XLU continues higher the most that can be lost is .60. IF July expires worthless the risk can be further reduced by spreading the Sept puts.