This week Congress passed legislation to roll back post-financial crisis legislation. Next week the Fed will raise short term 25 basis points. Bank stocks after massively underperforming the broad market since March 1st bounced 3%, registering its best weekly performance since late April. It’s my belief that the relative weakness of the last few months is very much in sync with the undoing of the post-election strength of the Trump Trades, like the U.S. Dollar Index roundtripping most of its move since Nov 9th, U.S. Treasury Yields doing nearly the same, energy stocks, commodities, material stocks etc. I think Bank Stocks have completed the first leg of this move and Q2 results / Q3 guidance will confirm weak trends, coupled with a flat yield curve limiting an expected increase in net interest margins.

The technical set up for the XLF, the S&P Financial etf, primarily made up of bank stocks is at a curious spot. $23 has been staunch support since mid-December, but a failed breakout of the nearly 3-month range and a retest of support might complete what looks like an obvious head and shoulders top pattern:

Longer term there seems to be a healthy downside target near $21 which would be the intersection of the November breakout and the uptrend since the 2011 European Sovereign Debt Crisis lows:

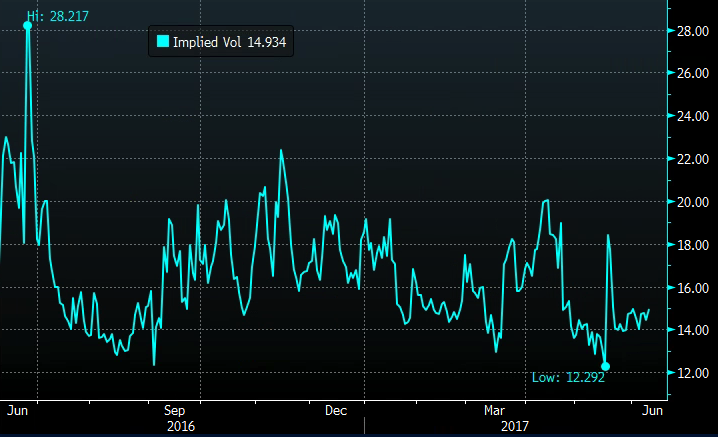

Short-dated options prices are very low, a couple percentage points above its recent 52-week lows, making long premium directional bets attractive:

So what’s the trade?

TRADE: XLF ($24.25) Buy Sept 24 puts for 75 cents

Break-even on Sept expiration 23.25, down 4%

Losses of up to 75 cents between 23.25 and 24 with max loss of 75 cents or 3%

If the etf were to dip below 23 we would look to spread these puts by selling a lower strike put.

Rationale – Vol remains low and a simple at the money put purchase out to September takes advantage of that with a realistic breakeven given the time involved. We’d look to spread on any weakness. The most that can be lost under any circumstance is .75