Shares of Boeing (BA) are up 21% year to date, and up 50% from its 52-week lows made in late June 2016 following the surprise Brexit vote. The stock has held its uptrend since mid-September like a boss, with just one brief break below which came mid last month, but has since made a new all-time high on Friday:

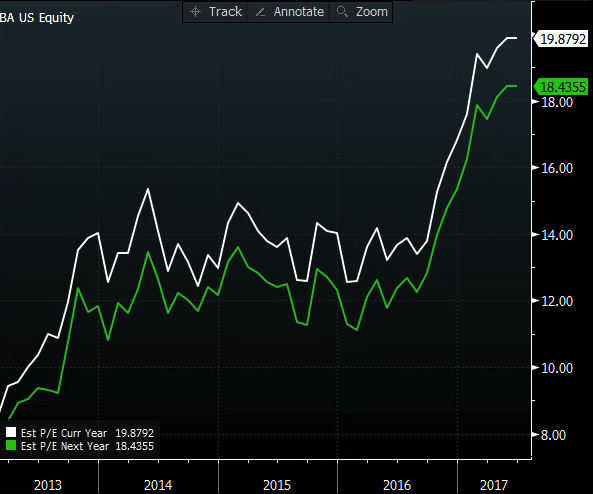

Shares of BA trade rich to the market at about 20x expected 2017 eps, and about 18.5x next year’s expected eps, both at a 5 year high, despite a 3% expected sales decline in 2017 and only a 2% expected increase in 2018:

The company has a killer balance sheet with 8% of their $113 billion market cap in cash, and a little less than $11 billion in debt. BA bought back nearly $7 billion in stock last year and pays a dividend that has a current annual yield of 3%, and late last year authorized a $14 billion share buyback program to replace the recently exhausted.

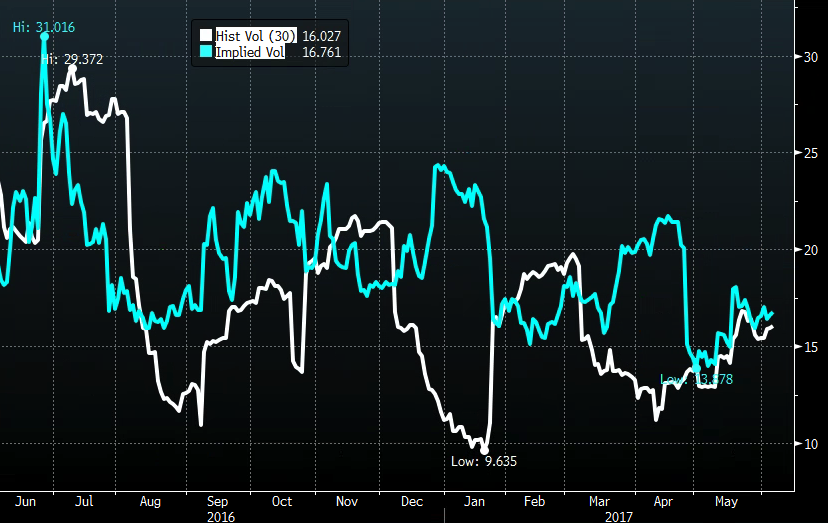

All seems very good in the hood, except for that recent break to nearly $175 last month. Short-dated options are a couple percentage points from their 52-week lows made last month (30 day at the money implied volatility, blue below), while 30 day realized volatility, white below) has been picking up, might imply that options prices are cheap for those looking to make long premium directional views:

The next identifiable catalyst will be the company’s Q2 earnings which should fall in the last week of July. One way to play for a pullback to the mid to low $170s is to consider the following trade:

Buy BA ($187.50) August 190 / 170 / 150 Put Butterfly for $5

-Buy 1 Aug 190 put for 8.15

-Sell 2 Aug 170 puts at 1.75 each or 3.50 total

-Buy 1 Aug 150 puts for 35 cents

Break-even on August expiration:

Profits: up to 15 between 185 and 155 with max gain of 15 at 170.

Losses: up to 5 between 185 and 190 & between 150 and 155 with max loss of 5 above 190 or below 150.

Rationale: This put fly starts in the money, so its breakeven is just below where the stock is currently trading (breakeven is 185) and it has the potential for up to $15 in profits. This is a very realistic target for those that are bearish, with defined risk, and only giving up 2.50 on the entry/breakeven.