The president’s tweets get a heck of a lot of scrutiny from the political press. But some tweets are also of note to financial media, and investors. That they can move markets initially has been proven out, what happens after is uncertain and depends on actual policy being implemented. White House policy can be polarizing from a political standpoint, but also polarizes investors perceptions about specific industries and companies. Take for example the tweet this morning regarding the originally proposed travel ban back in late January. It has been blocked by courts on a few occasions, even “watered down” versions of it, but now the president is suggesting via tweet that his Justice Department should seek an expedited hearing on the matter prior to the Supreme Court’s review. CNBC has had numerous guests on this morning considering the potential impact of an enacted ban on travel to the U.S. The CEO of Hilton Hotels didn’t seem too bothered by this potential, but he also doesn’t seem to fear the threat of AirBnb as a headwind to his business that is “booming”!

Back on May 8th Priceline (PCLN) was trading at an all-time high just below $2000 and issued Q2 guidance that was below expectations, with gross travel bookings to be up 12 to 17% vs consensus expectations of up 21%. That sent shares down 4.5% the next day. Shares of PCLN have filled in that earnings gap, and are now about 1.5% below the prior all-time high. The stock bounced off of near-term technical support at $1800, which was the late April breakout level, and might find near term resistance at the prior high of $1927:

It’s important to note that (per The Motley Fool), Hotel bookings is a huge part of the growth story, while airline tickets are in decline:

Priceline continued to rely on its hotel business for most of its growth. Room-nights booked were up 27% from year-ago levels to 173.9 million, slowing down only slightly from its recent pace of growth. Rental car days had a healthy gain of 15% to 18.6 million — the biggest gain in nearly two years. Airline tickets kept disappointing investors, however, falling another 2% from the year-ago quarter to 1.8 million.

But as the WSJ recently suggested, For Hotels, There’s No Room Left for Online Travel Agencies

Hotel bookings are the biggest source of growth for online travel agencies. Last year, the value of hotel bookings through third-party travel agencies in the U.S. grew to $31.4 billion, surpassing direct hotel online bookings for the first time since the data was tracked beginning in 1998, according to Phocuswright. The sites spend heavily on marketing: The more than $8.5 billion spent globally on sales and marketing by Expedia and Priceline Group alone last year is likely on par with the entire world-wide hotel industry, the group estimated.

Higher marketing costs for the online travel portals is one of the causes of the weak guidance for PCLN. The consensus is calling for eps growth of 12% and sales growth of 15% in 2017, which healthy, despite a deceleration from 2016. But the stock’s PE multiple near 26 might cause some investors to balk if marketing costs are to rise and weigh on profitability, and growth of sites like Airbnb and One Fine Stay start to take their toll on bookings.

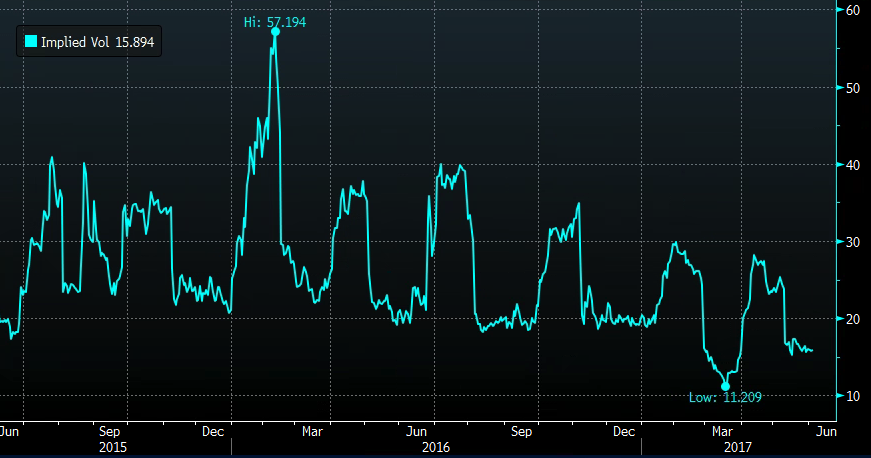

Short-dated options prices are fairly cheap, a few percent above 2-year lows made in late March, possibly presenting an opportunity to play for another guide lower when the company reports Q3 results in the first week of August. That also catches most of the Summer season where we could see reduced travel from on both uncertainty of visas to the US, as well as worries about terrorism at popular tourist destinations like we’ve recently seen in the UK.

To my eye, a meaningful guide lower like causes a break of near term support at $1800 and possibly results in a gap fill down to $1600, the intersection of the February breakout to then new all-time highs and the uptrend from the early 2016 lows:

So What’s the Trade?

The Summer tourist season and August earnings is the catalyst. One way to reduce overall premium risk while positioning bearishly for the report in August is through a calendar put spread:

Bearish

PCLN (1895) Buy the July/August 1800 put calendar for $22

- Sell to open 1 July 1800 put at $13

- Buy to open 1 August 1800 put for $35

Breakevens on July and Aug expiration: Before July expires, this trade does best with the stock near 1800. Below 1800 profits begin to trail off as the position becomes long delta, and if the stock goes higher it will see losses as short delta. The overall risk is $22 into July expiration. After July expiration, The trade becomes a long August put that captures earnings, at a cost of $22. That $22 can be further reduced after July expiration as the Aug 1800 put can be spread once again as a vertical.

Rationale – This is an inexpensive way with defined risk to position for PCLN to go lower. Initial support is 1800 and that area is what’s targeted near term on any signs of slower summer travel. After July, the trade is targeting lower than 1800, capturing earnings, which would be the major catalyst.