Broadcom (AVGO) will report their fiscal Q2 results tonight after the close. The options market is implying about a 5% one day move tomorrow, which is rich to its 4 quarter average one-day post earnings move of 3.3%. With the stock at $240, the June 2nd weekly 240 straddle (the call premium + the put premium) is offered at about $12, if you bought that, and thus the implied move for earnings, you would need a rally above $252, or a decline below $228 to make money.

Shares of AVGO are up a whopping 36% already in 2017, with the stock making a new all-time high this morning, and nearing the $100 billion market cap milestone.

When I look at a chart like this over the past five years, up nearly 700%, almost double that of AMZN’s gains during the same period, one would think the stock is sporting a frothy valuation… AVGO trades at only 16x expected FY2017 eps growth of 30%! While these two companies and stocks have little in common, the angle of the charts ascent over the last five years are very similar, while their valuations are not:

Just like the stock, Wall Street sentiment towards it is white hot with 31 Buy ratings, only 2 Holds and No Sells, while short interest is non-existent at less than 1% of the float.

Obviously, there is no overhead resistance in the stock, so the stock is already in uncharted territory, but to the downside, $220, the intersection of theQ1 earnings gap and the uptrend from the Dec lows looks like healthy near-term support:

I think it is worth noting that Analog Devices (ADI) reported a beat and raise quarter the other day, yesterday morning the stock gapped up about 7% to a new 52-week and 17 year high and then spent the rest of the day selling off, closing at the lows of the day and followed through this morning and is now down nearly 3%, nasty price action after good news:

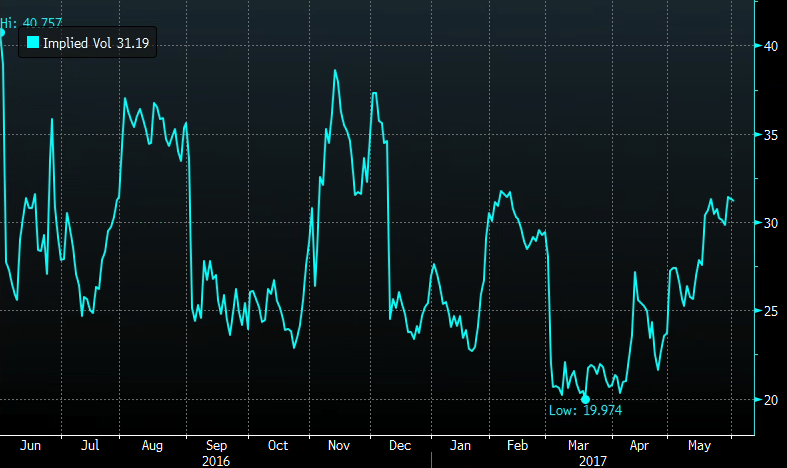

Long holders might consider defined risk stock replacement strategies with the stock up so much year to date, or possibly collars to better define risk on an existing position. At the very least long holders might look to take advantage of elevated short-dated vols and consider overwriting their stock as 30 day at the money implied volatility is likely to come into the low 20s after the print:

So What’s the Trade?

There’s several options we mentioned above but we want to focus on the bullish side of things and how to define risk.

Bullish/ Stock Alternative

Similar to what we detailed into PANW earnings yesterday, we can define our risk, provide upside exposure and limit risk on higher than normal volatility

AVGO (237) Sell the June 2nd weekly 235/230 put spread, to Buy the July 240/260 call spread risk reversal for 3.75

It starts with selling a put spread near term:

Sell the June 2nd 135/130 put spread at 2.00 (risking $3)

- Sell 1 June2nd 235 put at 4.75

- Buy 1 June2nd 230 put for 2.75

and then buying a call spread farther out in time.

Buy the July 125/150 call spread for $5.75

- Buy 1 July 240 call for 8.20

- Sell 1 July 260 call at 2.45

Breakeven On July Expiration – As long as the stock is above 135 on Friday, the July 140/160 call spread comes at a cost of 3.75, with the chance to make up to 16.25 if the stock is at or above on 160 on July expiration. Its break-even in that case is 143.75 with gains above and losses up to 3.75 below. However, the risk profile is different if the stock is below 135 into Friday.

Risk/Reward into Friday, June 2nd expiration – If the stock is below 135 on Friday there is added risk to the position as the put spread sold at 2.00 can lose up to 3.00. That is the maximum it can lose.

Total Risk/Reward – The most that can be lost on this trade overall is 8.75 (less than the implied move), the most that can be made is 16.25. The 8.75 is at risk if the stock is down sharply on earnings. The max gain is possible if the stock is higher than 135 on Friday’s expiration, at which point, the risk is reduced to just 3.75 out until July.

Rationale – This trade takes advantage of high implied vol in the weeklies to finance a wide call spread in July. It is a slightly more complicated trade than what we normally detail, but it’s an interesting one with fairly favorable defined risk/reward.