After massively outperforming the Nasdaq in 2016 (up 35% vs up 7%), the semiconductor space (via the etf SMH) is doing it again in 2017 (up 18% vs 14%) despite any participation by the second largest component, Intel (INTC) which is down 1% on the year. As we have written on numerous occasions over the last couple years, aggressive M&A activity by semi companies heavily exposed to PCs and Smartphones has driven much of this outperformance of the group, resulting in more than $200 billion worth of deals, here are a few of the big ones:

Qualcomm (QCOM) to Acquire NXP for $47 billion

ARM Holdings (ARMH) of the U.K. agreed to be acquired by Japan’s Softbank for $32 billion.

Analog Devices (ADI) is making a near $15 billion offer to acquire Linear Technology (LLTC)

Western Digital (WDC) paid $16 billion for NAND flash chip maker Sandisk (SNDK)

NXP Semiconductors (NXPI) made a nearly $12 billion bid for Freescale (FSL)

Avago Technologies (AVGO) paid $37 billion ($17b cash & $20b in stock) for Broadcom (BRCM)

Intel (INTC) bought Altera (ALTR) for $17 billion in all cash

You get the point, its been a bit of a frenzy. But it’s not just the premiums paid by the old of the new, the SMH’s largest component, Taiwan Semi (TSM) is up 23% year to date at all time highs as investors look toward’s its largest customer, Apple’s release of their 10th anniversary iPhone which many analysts predict will be the start of a “super-cycle”.

And of course Nvidia (NVDA) the SMH’s third largest component is up a whopping 28.5% ytd, this after being the best performing stock in the SPX last year, up more than 200%. NVDA’s market cap at $81 billion is now $2 billion greater than that of Texas Instruments (TXN) a company expected to book $14.3 billion in sales (7% yoy growth) vs NVDA’s expected $9 billion in sales (10% yoy growth). Things are getting a tad whacky imho.

Yesterday research shop BlueFin had some cautionary comments about current ordering patterns in semis that could play out in a negative fashion in the back half of the year, per Barron’s Online:

Industry conditions are relatively healthy near term. Our current reads suggest that June targets are well within reach and if demand remains stable, we’re likely to see another solid collective beat in the June quarter. However, we’re starting to see early signs of the supply chain overheating that could pose challenges for the back half of the year.

…

Yet double ordering isn’t the primary concern at this time, in our opinion. The bigger issue is that lead time extensions are forcing customers to place orders further out in time, where customer visibility is extremely limited. Customer forecasts are historically awful outside a 12-week window. When forced to place orders further out in time, customers will err on the high side, figuring they can always cancel those orders if demand doesn’t materialize. Consequently, these elevated backlog levels are not likely a true reflection of demand, raising the probability that some of these longer term orders will get pushed out or canceled. Adding to our concerns, the semi material suppliers are getting foundry forecasts that indicate suppliers are projecting 7-8% sequential production growth in Q3, well above seasonal norms.

….

We’d expect early push-outs to be followed by a deceleration of order rates, and in a sharper correction, outright cancellations.

So no cause for alarm for the June quarter which is nearly two-thirds done, but we might see some cautious Q3 guidance.

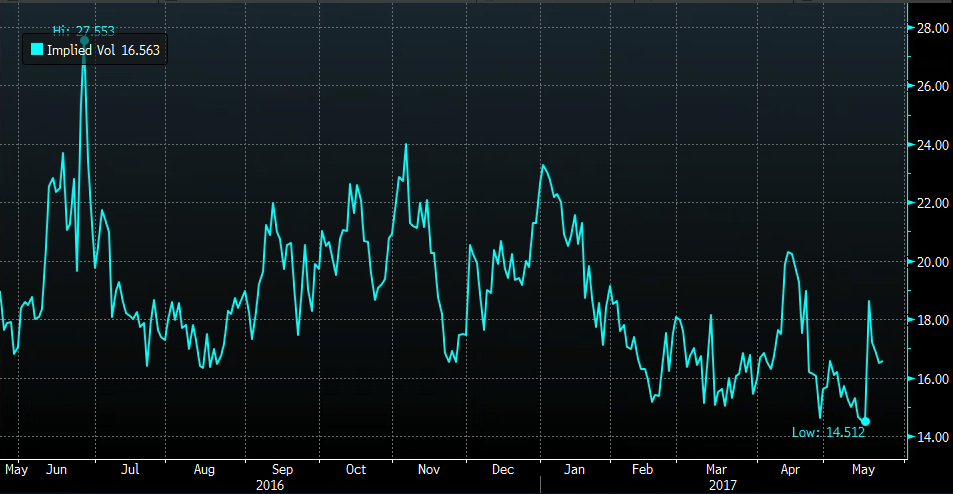

Short-dated options prices in the SMH recently bounced off of a multi-year low, which might be worth keeping an eye on as today’s 6% decline in Xilinx (XLNX) after the company guided full-year sales growth slightly below consensus might signal that most in the group very near 52 week or 17 year highs might be priced for perfection.

SMH options might prove to be a cheap way (in vol terms) to hedge existing outperformers in the space, or for those daring enough to make a contrarian bet against the group:

If we want to play a game of connecting the dots, from the 2016 low, the SMH has held the uptrend like a BOSS, and the intersection of that trend line and the late April breakout level at $80 looks like a good spot to target a breakdown in Q3.

So what’s the Trade?

SMH ($84.28) Buy June / August 80 Put Calendar for $1.25

-Sell to open 1 June 80 put at 40 cents

-Buy to open 1 August 80 put for 1.65

Rationale – This trade can win in a number of ways. It’s big win would be a breakdown below 80, following June expiration. But the index simply declining toward 80 on June expiration will be profitable in and of itself, as the June puts decay and the August puts gain on their short deltas.

If the stocks in this space continue higher and go parabolic, the entre trade would be at risk, but the most that can be lost is just 1.25. On the reward side, the trade could easily approach a double if the stock was 80 on June expiration and it could then be further spread if it looked like the decline could continue.