In case you missed it, in the last couple days, the market cap of the digital currency Bitcoin passed that of the etf that tracks the price of gold, the GLD $35 billion vs $34 billion). This is truly astounding. I for one don’t really get either, but I am starting to understand why former goldbugs are getting on the digital currency train as they much prefer a decentralized currency like Bitcoin to that of Gold.

From my perch I am hard pressed to find any real uses for my current day to day, but I have little doubt that a digital currency and the blockchain technology it operates on will continue to disrupt long-standing financial practices and have far-reaching applications that few at the moment can foresee. But that’s big thinkin stuff, and that’s not what we are here for. In the last couple months, the price of Bitcoin has more than doubled and I agree with many other pundits who know far more about this than me that this could have something to do with investors curiosity for new safe have assets in a time of increasing geopolitical uncertainty.

If I were inclined to buy Bitcoin for fear of an impending market dislocation like the one we saw in Q1 2016, and late Q2 2016 during the Brexit scare, I might also be inclined to take a crack at Gold on the long side, through GLD. From its early 2016 lows to its highs in early July right after the Brexit vote, GLD appreciated close to 30%:

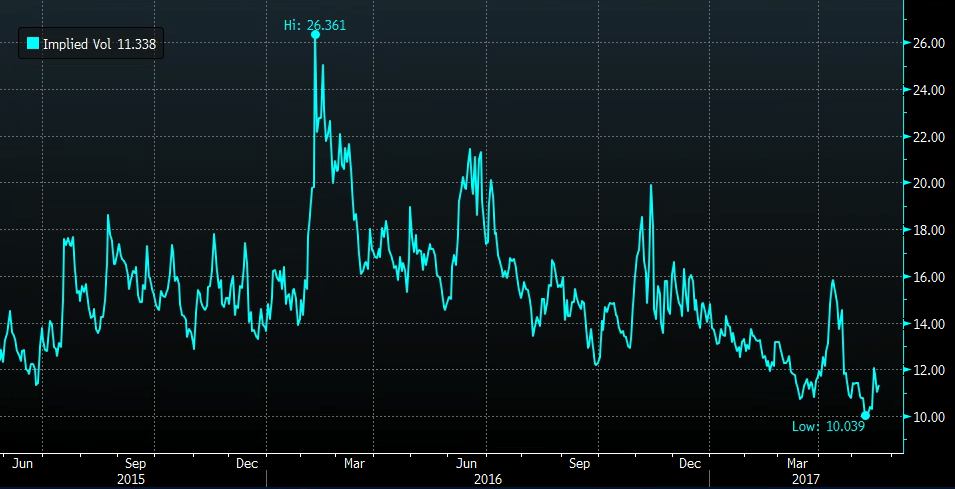

For those inclined to play for a move back to the prior 52 week highs near $130 for fear that the mess in Washington will turn into a full-blown scandal this summer, options prices in the GLD make long premium directional trades very attractive, with 30 day at the money implied volatility very near multi-year lows:

Call Spreads look attractive, for instance, you could…

Buy GLD ($120) Aug 120 / 130 call spread for $2.50

-Buy 1 Aug 120 call for 3.10

-Sell 1 Aug 130 call at 60 cents

Break-Even on Aug expiration:

Profits: up to 7.50 between 122.50 and 130 with max gain of 7.50 above 130

Losses: up to 2.50 between 120 and 122.50 with max loss of 2.50 below 120

Rationale: This trade has a good risk/reward profile, offering 7.50 payout to 2.50 risk. Things are starting to whip around in alternative currency spaces so a higher breakeven of 122.50 isn’t that huge a sacrifice looking out to August, yet also because things are starting to whip around, risk is defined the other way to just 2.50.

Oh and we have not even mentioned the weakness in the US dollar, having roundtripped the entire move since the election, could have further to go, if the Fed holds back on rate hikes due to political uncertainty, and investors start to view currencies like the Euro and the Yen as a safe bet. I don’t have the data on the inverse relationship to the US dollar, all i know is that there are plenty that reach for gold during periods of expected dollar weakness.