I often get asked how I come up with trade ideas, specifically as it relates to the sort of options trade ideas detailed on Risk Reversal and on CNBC’s Options Action. Almost always the idea starts with some known event, maybe earnings, analyst meeting, or a product launch. Something I can evaluate from a fundamental perspective. Then I look and see what the options market is pricing in for potential movement into and out of the event, determine whether options appear cheap or expensive and design the trade accordingly. There are plenty of other inputs that will be considered before I arrive at a trade, but that’s usually how they get started.

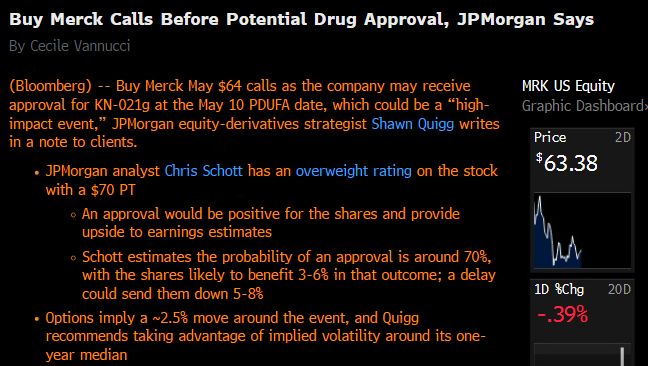

This morning JPM’s derivative strategy group has a note out, suggesting short dated calls in Merck (MRK) into a potential positive catalyst “as the company may receive approval for KN-021g at the May 10th PDUFA date, per Bloomberg:

Don’t fret… some of that’s greek to me too. But there is some good math in there, based on reasonable guesses on probabilities of outcomes, upside reward, downside risk, and most importantly for us, the date in which the event will occur.

On a binary scale, buying calls (or puts) or puts less than 100 deltas is worse than a 50/50 profit probability because they contain extrinsic premium. Obviously you have to get the direction right to make money on a call, but you also need the stock to move past the breakeven of the call, which is above that of the current stock price. But that’s a tradeoff to define risk. In this case from JP Morgan, the desk is saying the likelihood of the event being positive is more than it being negative, but the potential move to the upside (on positive) is less than a move to the downside (on negative). And therefore buying calls that define that downside risk while participating in the more likely (in their view) upside reward is the way to go.

Shares of MRK have actually outperformed the S&P 500 (SPX) year to date, up 7.6%, has a better dividend yield near 3%, solid balance sheet, trades below a market multiple and has a very constructive technical set up with very solid support near its August gap just below $60 and the potential for a breakout to new highs:

Short-dated options prices are cheap, with 30 day at the money implied volatility (blue line below) at near 2017 lows, but its worth nothing that realized volatility (how much the stock has been moving is at multi-year lows (white line below) which could actually mean that on a relative basis, MRK options are expensive into the PDUFA date, especially if nothing happens:

The MRK May 64 calls (vs $63.38 close yesterday) went out offered at 71 cents, or only 1.1% of the stock price, and break-even at $64.71, or up about 2% in two weeks. If you convicted that whatever KN-021g is will get approval and the stock could rise 5% then those calls could be a very nice buy, but again, long premium directional trades into events are tricky, you need to get a lot of things right to just break-even, direction first and foremost, and magnitude of the move. We will follow up with some defined risk alternatives to outright call purchases for those who are into PDUFA’s and know what KN-021g is, because a catalyst is a catalyst, and traders gonna trade!