Last Friday on the site (here) and on CNBC’s Options Action I detailed a near-dated, defined risk bearish strategy in Tesla (TSLA) in front of last night’s Q1 earnings announcement either as a hedge for longs who have enjoyed massive year to dated gains, or those looking to take a punt into earnings. Here is what I had to say on Friday:

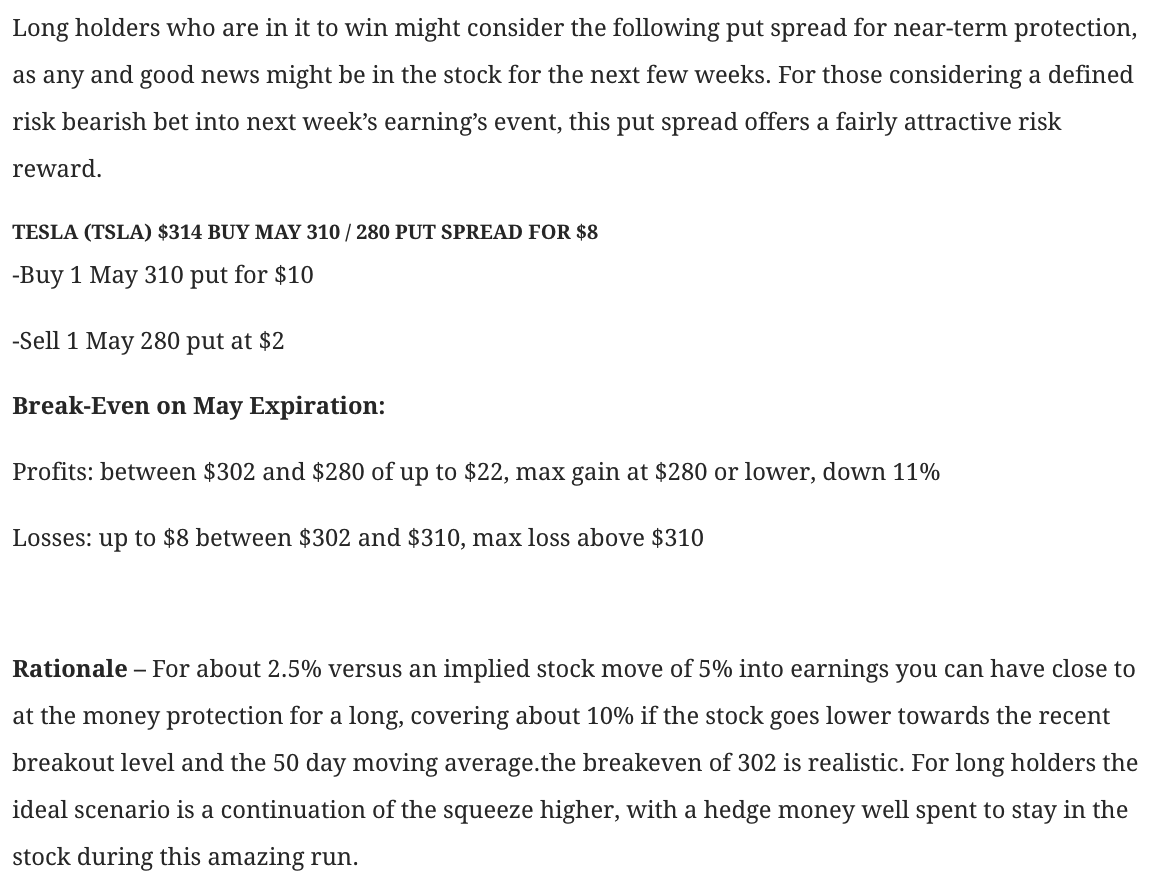

Here was the trade idea on the site:

So what to do now? With the stock down 6% post results at $291, the put spread that could have been put on for $8 when the stock was $314 is now worth about $17, a little more than a double. And it is really a market call for longs at this point, but you might consider stopping the hedge at the premium paid for it.

If this was put on as a hedge, then you have mitigated half of the stock’s loss. if it was an outright bearish bet, then it might make sense to close half and take you cost off of the table and play with the house’s money.

To My eye, $280 looks like healthy near-term support and might be a great level to monetize a near-term earnings hedge: