In the days immediately following the presidential election, shares of Altria (MO) declined nearly 8% before bottoming out and going on a fairly epic run to new all-time highs and then some in just a couple months.

The brief decline was not attached to some sort of potential regulatory risk from the new administration, more likely reflecting the quick and violent spike in bond yields, causing bond proxies in the equity market to take a breather:

What’s interesting about the two charts above is that as gains in treasury yields have consolidated well below the recent highs in mid-March, so has shares of MO, down about 6.5% during the same time period.

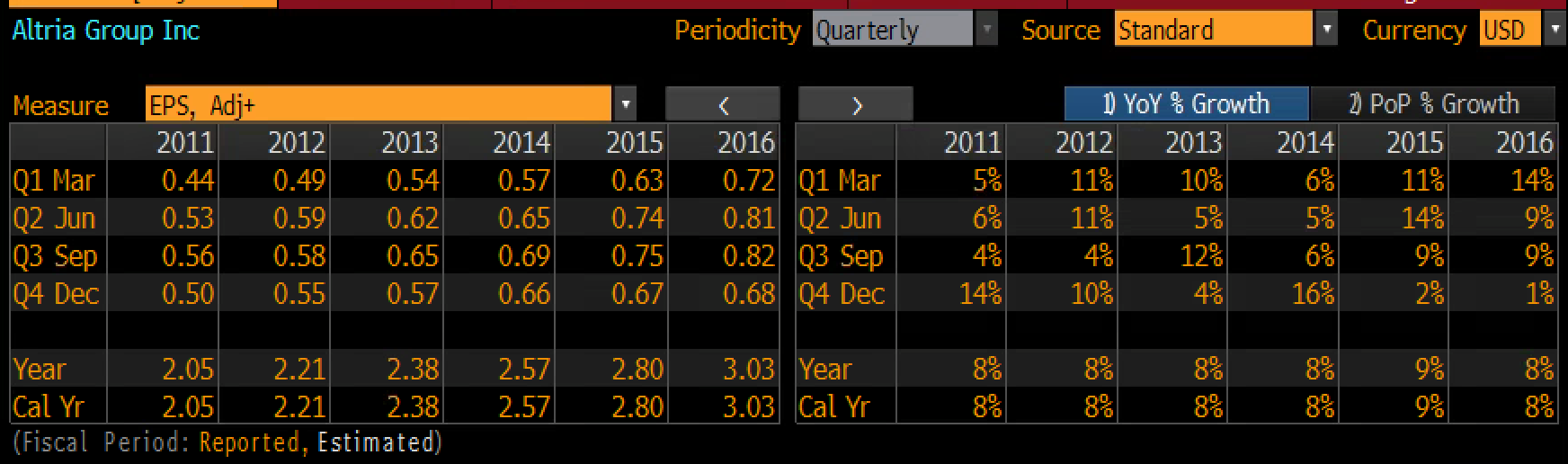

Shares of MO trade nearly 22x expected 2017 eps growth of 9%, very near a 20 year high, despite consensus expecting only 2% sales growth. The fact that sales of tobacco products have actually grown year over year over the last decade is fairly shocking but they have, and MO has grown eps like clockwork at 8-9% a year since 2010:

A big part of the MO investment theme is cash return, obviously, with a current dividend yield of 3.4% and continued commitment to share buybacks, back in Oct the company added $5 billion to their existing program.

MO will report Q1 results tomorrow morning before the open. The options market is implying about a $1.45 move in either direction or about 2%. Which is rich to its 4 qtr average of only 1% and its ten year average of 1.15%. So the stock is not a big mover on earnings, but cheap options prices present the opportunity for dollar cheap hedges and or attractive defined risk strategies.

To my eye, $70 is very important near-term technical support, while $75-76 is formidable technical resistance.

Because of cheap options prices out of the money call sales against long stock look less than attractive. For instance with the stock at $71.60, the June 75 call can be sold at about 27 cents, I am not sure that does anything for a long holder looking to add short-term yield, aside from cap upside for a small reward.

On the flipside though, the June 70/65 put spread offered at 80 cents or so might offer dollar cheap protection if you thought bond yields could rise quickly during that time period, equities could sell off broadly or there was stock specific fundamental risk.