Tonight is the World Series, Stanley Cup Finals and Super Bowl of Technology earnings. Alphabet (GOOGL), Amazon (AMZN and Microsoft (MSFT) will report. That’s about $1.6 trillion in market capitalization or about 25% of the Nasdaq 100 index (NDX). These three companies are expected to have about $350 billion in sales in the current year, at varying levels of profitability (sorry AMZN 😉

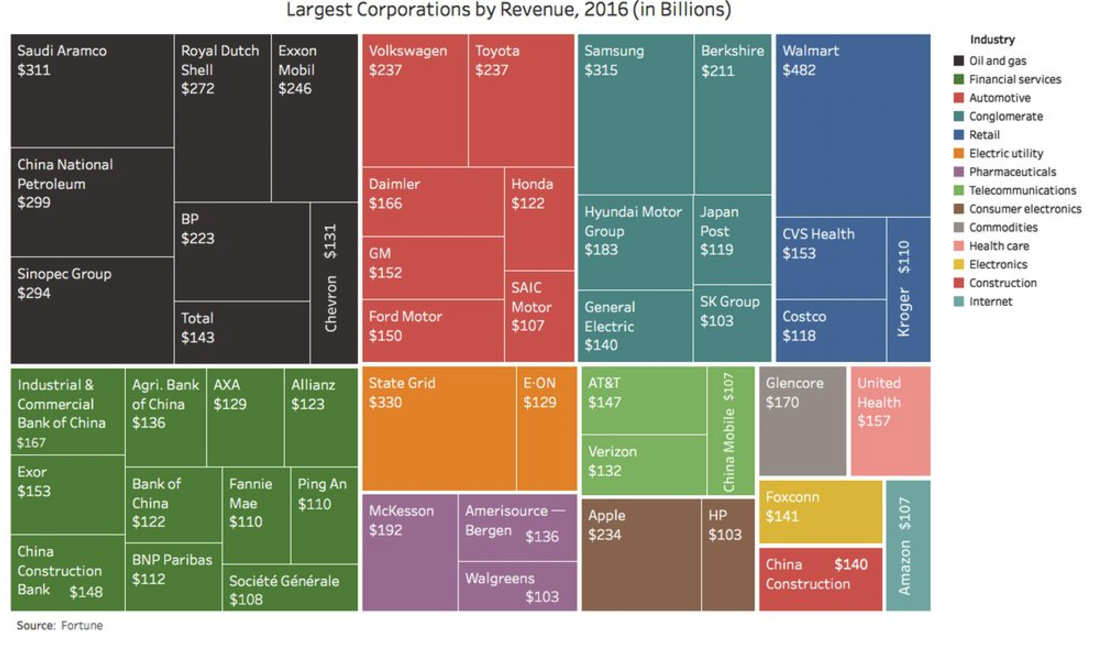

This chart from Visual Capitalist is pretty fascinating, AMZN barely squeaks onto the list of 50 Largest cos by sales globally, while both GOOGL and MSFT (sub $100 billion) do not, despite being two of the top largest by market cap on the planet.

What’s all mean? Nothing really. The most interesting connection for me is the concentration of these three stocks in the NDX, while immensely profitable, yet don’t make it onto the top 50 global list of companies by sales. That seems like some crowding by investors, and if it continues it will result in some inexplicable valuations. For now, they seem to cancel each other out. GOOGL trades 26x expected 2017 eps growth of 20% on 19% sales growth. That seems reasonable. Yet MSFT trades at 23x expected f2017 eps growth of only 5%, which is very near a post dot-com crash high. And AMZN? I won’t even get into that.

Moving on from this week, we will get March qtr earnings from Apple (AAPL) on May 2nd and Facebook (FB) on May 3rd. That’s $1.2 trillion in combined market cap, so another 20% of the NDX. AAPL is considered undervalued relative to the market but expensive to its recent self, while (FB) trades at a hefty premium to the market, but not really relative to expected growth.

The fate of the Nasdaq, heck the whole market, rests in a handful of companies. Those companies dominate our information and spending flows. And it’s extraordinary to think about how these companies have come to change our lives in the past decade or so. And they’re seemingly getting deeper and deeper into our psyche, equipping us with supercomputers in our pockets, replacing our memories in the cloud, listening to us in our homes, hanging out on our heads and wrists, telling us what and when to buy things etc etc.

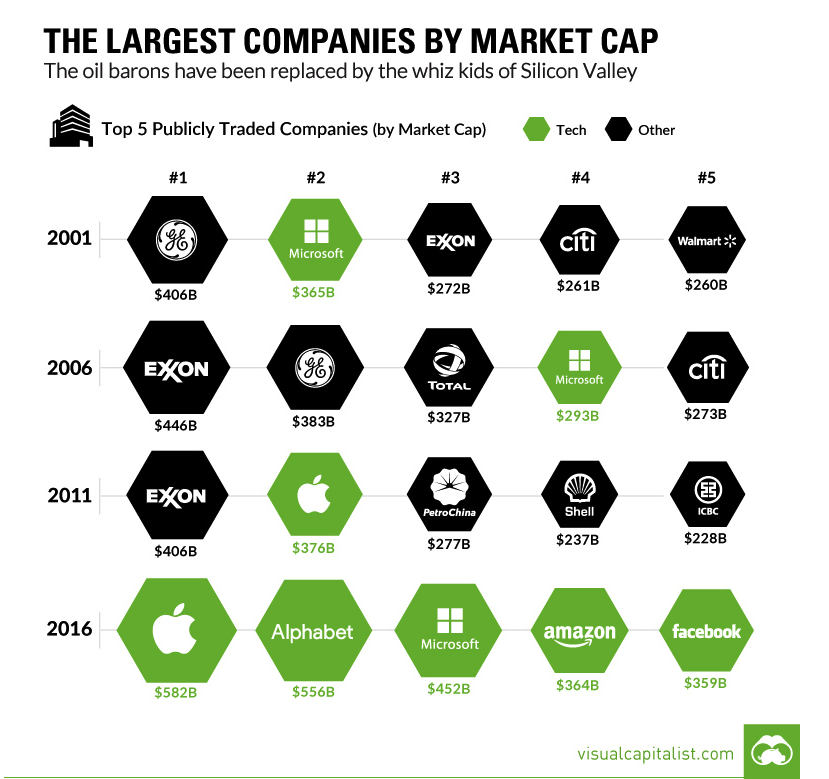

The concentration of these stock’s weighting in the stock market in many ways mirrors these companies products influence in our daily lives. Visual Capitalist ran this chart last fall, showing the five largest US companies by market cap in 2001 compared to 2016. It makes perfect sense to me: