From its lows in 2012 near $11 to its all time highs made in late 2015, shares of Under Armour (UAA) could not be stopped, gaining nearly 400%. The rally was fueled by a handful of post-earnings gaps to then new all-time highs that would usually set the stage for another multi-month leg higher. Since mid-2016 though, those earnings gaps have gone from flares to fire retardant, sending shares to new 52 week lows followed by months-long consolidations, as investors wait for their next set of results. At the moment, UAA is hovering below what might prove to be crucial long term technical support in front of tomorrow morning’s Q1 results.

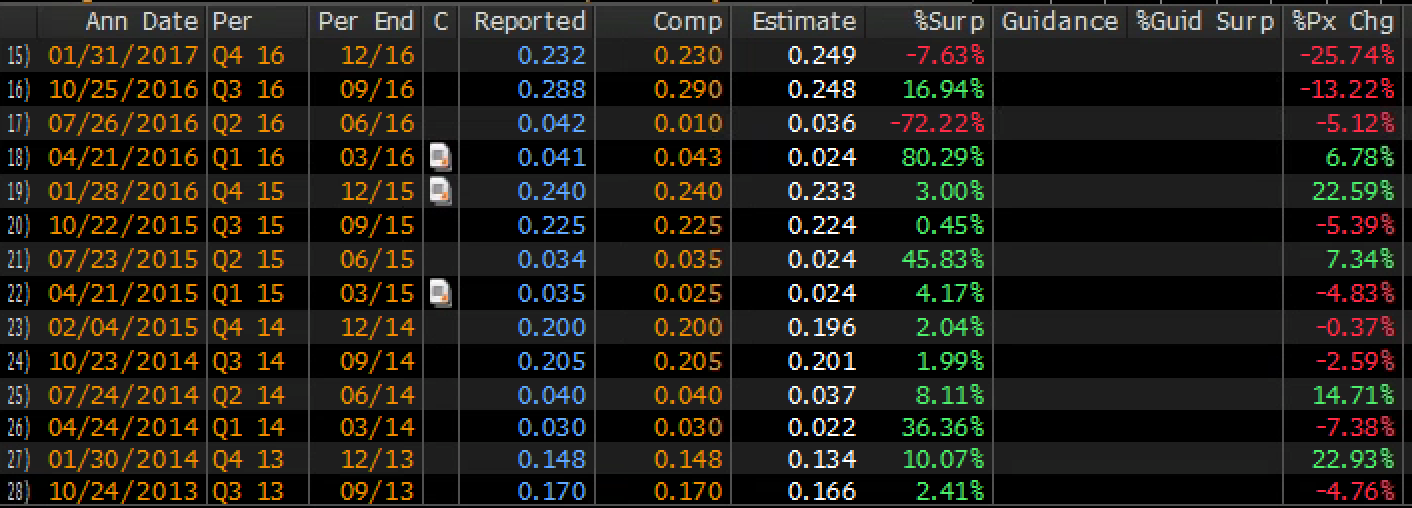

Look at the far right column showing UAA’s one-day post-earnings moves, clearly, earnings and guidance have been the catalyst driving major stock swings.

The options market is implying about a 10% move in either direction tomorrow, which is above the 8% average over the last ten years. But it’s deserved given the controversial nature of the stock and the company’s positioning. Wall Street analysts hate the stock with only 8 rating it a Buy, 21 holds and 6 sells with an average 12-month price target of $20 (essentially where the stock is currently trading). The stock’s 33% year to date decline speaks to investor abandonment of the growth story. The 27% short interest suggests that traders and long/short investors see lower lows.

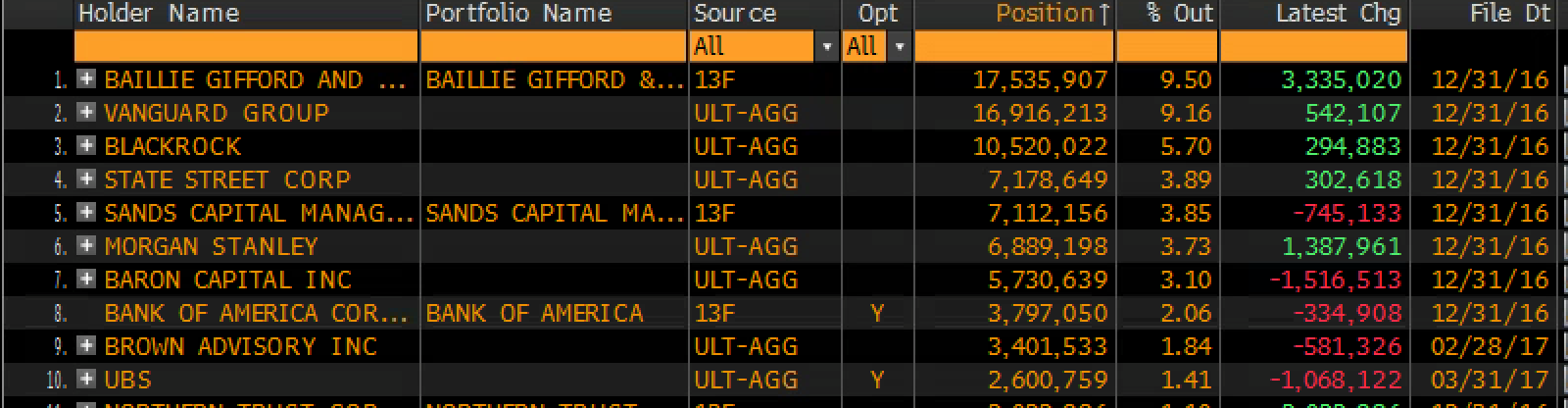

BUT. As of the most recent 13f filings, it appeared that the top 5 holders of the stock have begun to add to their positioning. We will know more in a few weeks when Q1 holdings data is released:

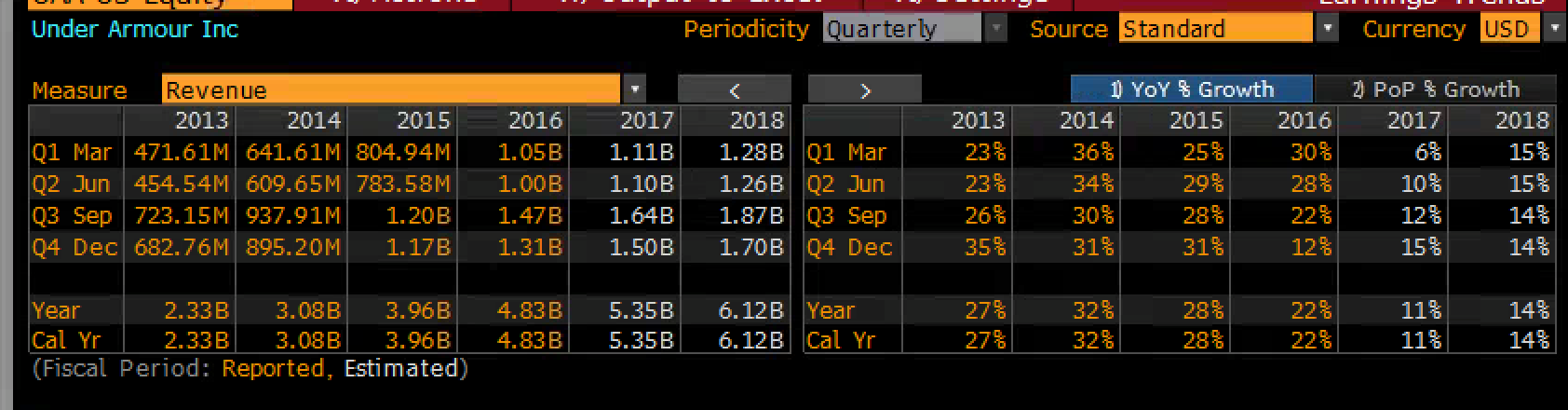

While the company is expected to break $5 billion in annual sales this year, doubling from its 2013 total, it’s the deceleration in sales growth that has investors spooked, from 22% last year to an expected 11% this year:

The question with the stock more than halved from its all time highs last year is whether or not expectations have overshot to the downside near term? If they have, the horrible sentiment and high short interest will likely result in another one of those eye-popping gaps higher. That said, if there is another shoe to drop, then the gap goes the other way and the stock will be on its way to the mid teens. Given the controversy surrounding the story, I see few scenarios where the stock does not move at all tomorrow. We have seen some similar pops of late from beaten up consumer names like Chipotle (CMG) and Whole Foods (WFM). Those looking to play for a move above 20 and this stock getting off the mat would be best served by risking as little premium as possible as near term vol is pumped, with an implied move almost as wide as the high and lows for the stocks 2017 trading range.

One way to do that is to sell a call in the weeklies, outside the implied move to help finance an at the money call later on:

Stock Alternative in Lieu of 100 shares of UAA (19.75)

Buy the April28th 22.5 / July 20 vertical call calendar for 1.20

- Sell 1 April28th 22.5 call at .20

- Buy 1 July 20 call for 1.40

Breakeven on April 28th/ Rationale: This trade does best on a move higher in line with the implied move, with the stock close to 22.50 but too much above. If the stock does gap higher than 22.50 the trade is still profitable but maxes out at a gain of 1.30. The ideal situation is a move higher that allows for rolling the short April28th 22.5 call out and up vs the July 20 call. The biggest risk of this trade is a move lower because the short April28th calls won’t help much beyond .20. But the entire trade looks out to July so it is not binary and it risks less than the implied move.