This weekend French citizens will cast the first of two votes that could likely determine the fate of the European Union. You know the drill by now, the election of right-wing nationalist Marine Le Pen probably means Frexit, while a vote for Macron may merely push out the inevitable until Germany’s election in the fall.

Given the massive volatility in most risk assets following the surprise Brexit vote last June, it makes sense that traders and investors are focused on the potential for a surprise outcome in France.

There was some interesting options activity today in the FEZ, the U.S. listed etf that tracks the Euro Stoxx 50 equity index. Shortly after 1 pm when the FEZ was trading $36, a trader sold to open 20,000 Aug 32 puts at 60 cents (receiving $1.2 million in premium) and used the proceeds to finance the purchase of 40,000 of the Aug 39 calls for 40 cents (or $1.6 million in premium) resulting in a $400,000 net debit for the position. Net of the premium paid, this position makes money above $39, up 8.3% from the trading level and losses money below $32, down 11% from the trading level. Aside from the trader’s comfort with being put 2 million shares of stock down at $32, what sticks out to me is the ratio of the risk reversal, selling 20,000 puts to buy 40,000 calls. This trade structure was designed to offer extra leverage to an upside move.

Late last year the FEZ finally broke a 2 and a half year downtrend it had been in since mid-2014, and to my eye after initial technical support near $35, the etf has solid support in the low $30s near the short put strike of this trade:

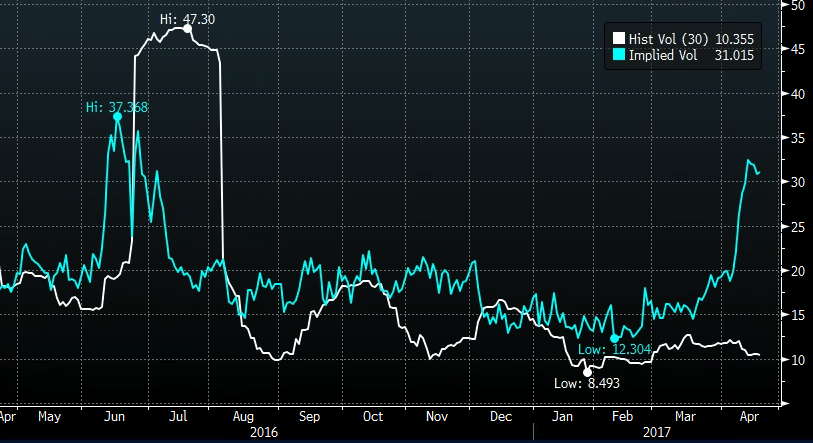

Lastly, one reason for the risk reversal trade structure, where the trader sold puts to finance the purchase of calls is the ramp in options prices in the FEZ over the last few weeks, despite what has been low levels of movement in the underlying etf. The chart below shows the 10 point spike in 30 day at the money implied volatility (the price of options, blue line below) in the FEZ to just above 30%, while 30 day realized volatility (how much the etf has been moving, white line below) sits very near 1 year lows at 10%:

Options are expensive for those looking to make directional bets into a very uncertain event. Conventional wisdom after Brexit was that it was probably contained so it did not spell doom for the EU and the Euro. Frexit would change that narrative quickly and vol buyers may have this one right regardless of the vote as it’s likely to be market moving one way or the other.