The etf that tracks the semiconductor space, SMH, is looking like it will make its second consecutive close below its 50 day moving average (short-term momentum indicator, the purple line below) for the first time since early December. While $75 looks like a little technical support, to my eye, the Nov/Dec breakout level at $70, which also corresponds with its 200 day moving average (yellow line below), might serve as an attractive downside target in the wake of a broad market sell-off:

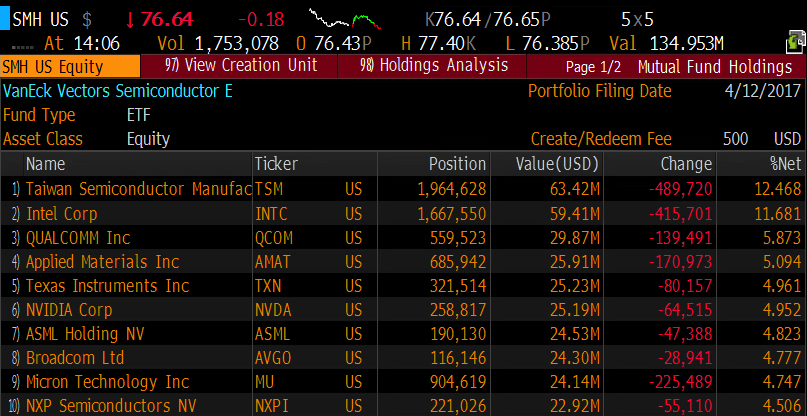

Which brings me to some options activity in the SMH. When the etf was trading $76.67 a trader bought to open 6,000 of the May 74 / 67 put spread for 85 cents. This put spread breaks-even at $73.15, down 4.5% on May expiration, offering a maximum potential payout of $6.15 if the SMH is $67 or below, down 12.5% from the trading level. That seems a tad ambitious, and would not some unexpected earnings misses from some large components in the next month or so, coupled with a broad market sell-off, for the etf to have a 6 handle. Taking a quick gander at the top holdings, most report between now and May expiration, with TSMC (TSM), the largest holding at 12.5% reporting overnight, and despite missing some estimates, the stock is barely down.

The second largest component, Intel (INTC) will report on April 27th, and I suspect the company’s $15 billion bid for MobileEye (MBLY) last month might give them a little cover in the near term as management recrafts the company narrative around two 2016 acquisitions ($17 billion deal for Altera, and sub $1 bil deal for Nervana) as they diversify away from PCs and mobile and into emerging technologies like IoT, AI and now autonomous cars.

But the 1-year chart of INTC looks to be at an interesting technical inflection point: