Yesterday, Steven Russolillo, the WSJ’s Ahead of the Tape columnist highlighted the initial outperformance of small cap stocks immediately after the election in November to their large cap brethren (Small Caps Are Losing the Earnings Race):

the vast majority of that gain came between the election and Thanksgiving. That is when many traders bet President Donald Trump’s tax cuts and infrastructure spending plans would be most beneficial to smaller companies, which tend to be less reliant on exports and more domestically focused than larger firms.

and their relative underperformance in 2017 is a result of “earnings growth”:

as earnings season kicks off this week, a key change should play out: Domestically oriented companies aren’t expected to grow as rapidly as those that derive more of their revenue from overseas.

A team of analysts at RBC Capital Markets led by Jonathan Golub project that S&P 500 companies with more global exposure are expected to report twice the earnings growth as companies that are more domestically focused. RBC divided each S&P 500 sector in half by how much sales each company generates outside the U.S.

If Steve is correct, and Q1 earnings season (most importantly forward guidance given) holds the key for small cap stocks, then it makes sense to get a feel for just how nervous investors are in small caps. To gauge this on a relative to basis, let’s look at the at the money straddle (the call premium + the put premium) in the SPY (the etf that tracks the S&P 500) and the IWM (the etf that tracks the Russell 2000). This gives us the implied movement in either direction between now and May 19th, which should incorporate the lion’s share of U.S. corporate earnings.

Off of the SPY’s $235.34 close the May 235 straddle went out offered at ~$7.20, if you bought that and thus the implied movement between now and May 19th you would need a rally above $242.20, or a decline below $227.80 to make money, or about 3% in either direction.

Off of the IWM’s $135.82 close the May 136 straddle went out offered at ~$6, if you bought that and thus the implied movement between now and May 19th you would need a rally above $142, or a decline below $130 to make money, or about 4.5% in either direction.

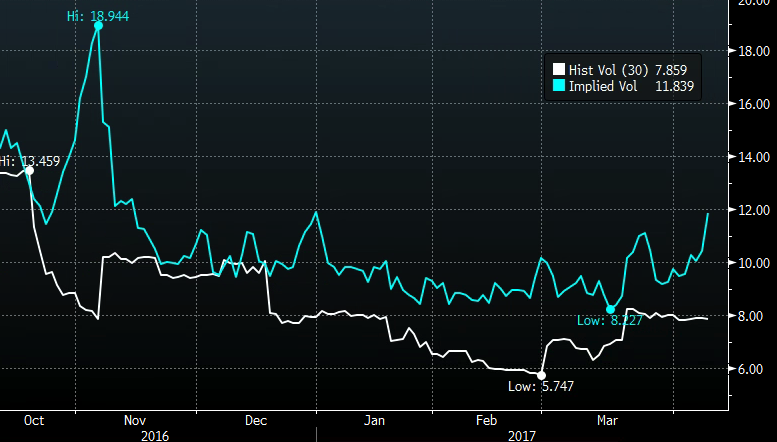

Investors are paying nearly 50% higher premiums to make directional bets in the IWM than they are in SPY. Obviously, this is a function of the underlying’s movement. Small caps move more than large caps. But we can then gauge the implied volatility of each to its own realized volatility. The chart below shows 30 day at the money implied volatility in the SPY (blue line, the price of options) at just below 12%, while the 30 day realized volatility (white line, how much the underlying is moving) at just above 8%:

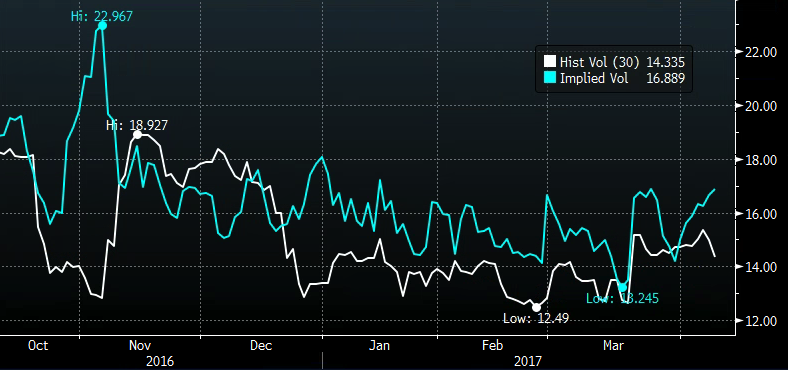

For the IWM, 30 day at the money implied volatility is at just below 17%, while realized is at just above 14%:

On a percentage basis no one seems that much more worried in small caps going into earnings relative to large caps. In fact the gap between realized and implied is less than the SPY. But the IWM has also been moving around a bit more, the greater the movement, the greater the price of options. And IWM is trying to get above its 50 day moving average, while SPY is above its and trying to hold.

However, the higher volatility in the IWM over the last few months, the period where it has sorely lagged the SPY (up 1% ytd vs up 5.3% ytd) has all been in a fairly narrow range. At some point, probably fairly soon, all the bouncing around resolves itself and a period of outperformance to the upside or underperformance to the downside ensues:

On a another note the big talk yesterday was on the United Airlines situation. The video was shocking, the backstory fairly appalling and the company’s tone deaf response embarrassing. For those of us old enough to remember Seinfeld, here was his take on companies surprised that you expected what you paid for to be honored: