One of the largest single stock options trades so far today was in the oil patch, in refiner Tesoro Corp (TSO). When the stock was trading $80.15 shortly after the opening a trader bought to open 11,000 of the May 80 puts for $3.20, or about $3.5 million in premium. These puts break-even at $76.20, down 5% from the trading price. The next identifiable catalyst for shares of TSO should be their Q1 earnings results that should fall in the first week of May.

If these puts are directional, possibly a near-term bearish bet, or a hedge of an existing long, the choice of expiration (which catches earnings) and the strike is interesting as $80 appears to be an important technical level, what might be the neckline of a head and shoulders top formation. Additionally, if the stock is gonna hold, this would be a great spot, as last week it broke the first line of support at the uptrend that has been in place since the 52 week low made in July.

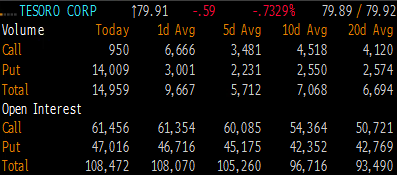

Lastly, this trade is significant as it represents about a quarter of the existing put open interest in the stock and nearly 10% of the total, per Bloomberg: