I think I do this once a quarter, but it’s always a good reminder to look at the concentration in the Nasdaq 100 Index (NDX) among a handful of household names.

Top 5 stocks in Nasdaq 100 make up ~43% of its $6.25 trillion market cap, or ~$2.7 trillion

Top 5 NDX components by Market Cap:

Apple (AAPL) – $755B

Alphabet (GOOGL) – $582B

Microsoft (MSFT) – $507B

Amazon (AMZN) – $425B

Facebook (FB) – $408B

The QQQ, the etf tracks the Nasdaq 100 is up 12% ytd, powered by the gains of a few stocks… interesting to note that MSFT and GOOGL lag the index.

Year to Date Gains of Top 5 QQQ components:

AAPL up 24% ytd

GOOGL up 7% ytd

MSFT up 5% ytd

AMZN up 18% ytd

FB up 23% ytd

The one year chart of the QQQ is astounding, essentially at an all time high, up 30% from its post-Brexit lows last summer. There is no overhead resistance, and close support at last week’s lows, very near $129. Below that seems to be an air pocket to near $125 and then possibly as low as the Dec/Jan breakout near $120:

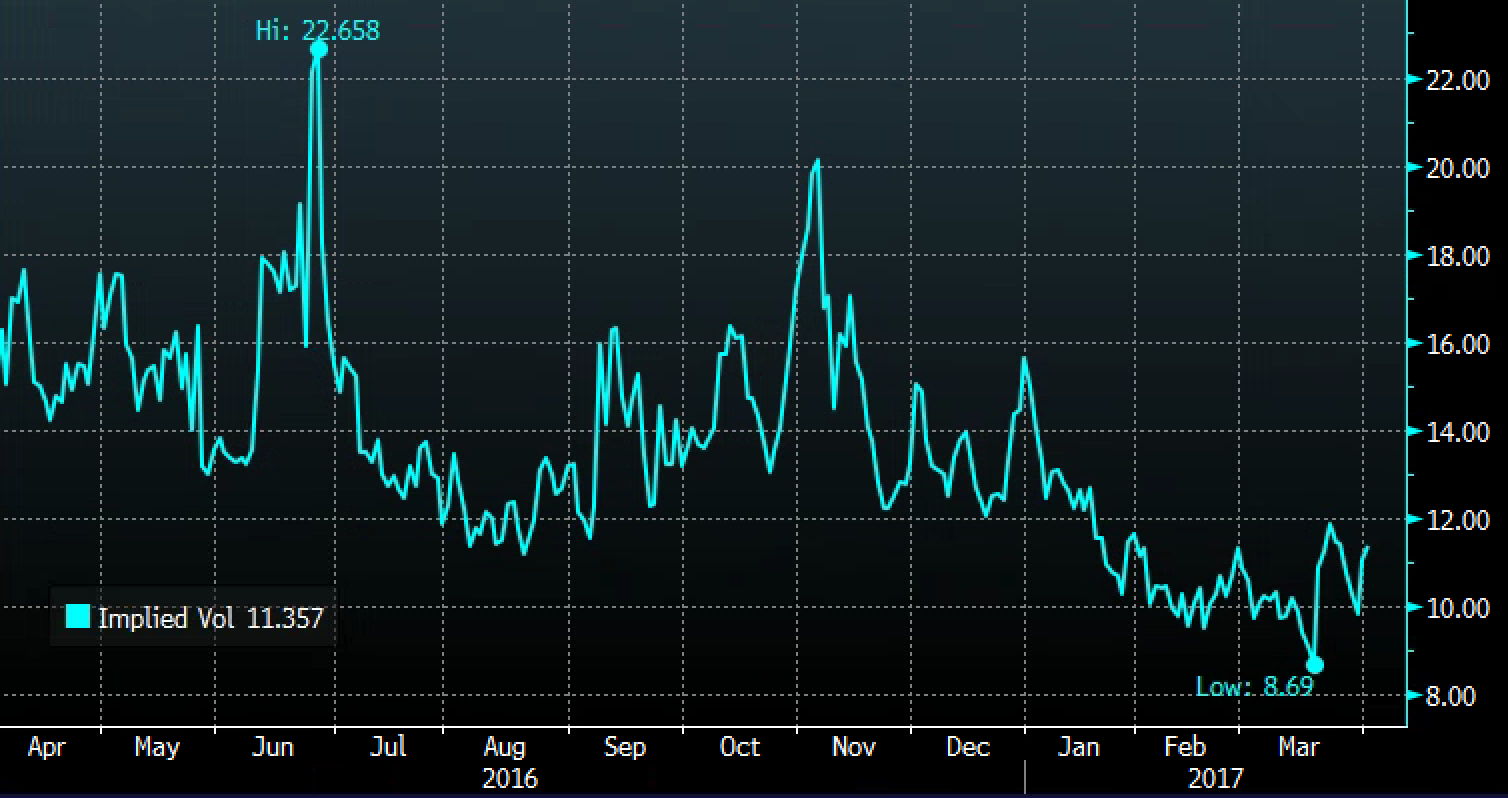

While short dated options prices have recently popped off of mutli-year lows, 30 day at the money implied volatility just above 11% is fairly low given the potential for anyone of those concentrated holdings to have a meaningful adverse effect on the index.

For those who own the big five, and don’t want to take profits, it might make sense to at least protect in a tactical fashion as we head into Q1 earnings season in the coming weeks. Protection is cheap and you can limit portfolio downside and let winners run to the upside into what is likely to be an uncertain time for the broad market as the new administration rolls out its tax agenda and the FOMC looks towards more rate hikes.

So what’s the trade?

Consider a tactical portfolio hedge over the next couple months:

QQQ ($132.50) Buy July 132 / 120 put spread for $2.50

- Buy 1 July 132 put for 3.50

- Sell 1 July 120 put at 1

Break-even on July Expiration:

- Profits: up to 9.50 between 129.50 and 120, with max gain below 120, could mitigate 7% of potential losses in the QQQ

- Losses: up to 2.50 between 129.50 and 132, max loss above 132, or less that 2% of the etf price.

Rationale – For 2.50 this hedge offers protection from at the money down to the breakout level from end of 2016 beginning of 2017. Ideally on a hedge like this your holdings out perform and continue higher. But if we were to see a correction, a QQQ put spread at these low vol levels will soften the blow and can be used in lieu of taking profits and missing upside.