We talk about implied volatility in each individual stock post and try to relay whether options are cheap or expensive historically and versus the realized vol of the stock itself. As far as broad measures of volatility we of course refer to the VIX and compare it to historical levels. We have a semi-regular trade idea in VIX Futures. And we also have written in the past about Vol ETNs, which are popular (although some of them should be banned). I wanted to dive a little deeper into volatility as an asset class and make it a regular feature on the site, combining some of these thoughts into a regular post. Hopefully this will helpful for both those looking to trade vol as an asset class, or those simply trying to get a sense at what the options market is offering as far as long and short vol opportunities (like this morning’s post).

On RiskReversal we tend to concentrate on directional trading and investing, offering stock alternatives, replacements, hedges and sometimes yield enhancement, and leverage. Because a lot of the posts are event driven with a focus on risk, they tend to be long premium trades. That’s a great tactic for defining risk, and can be quite profitable over time in comparison to active management of equities, as defining risk helps avoid bad decision making during moments of euphoria or panic, both in individual equities and the market as a whole. But as an options trading strategy, long premium is a losing one over time as you’re basically the one buying insurance, rather than the one selling it. Therefore having a sense of where vol is at any given time can help balance the options part of a portfolio over time.

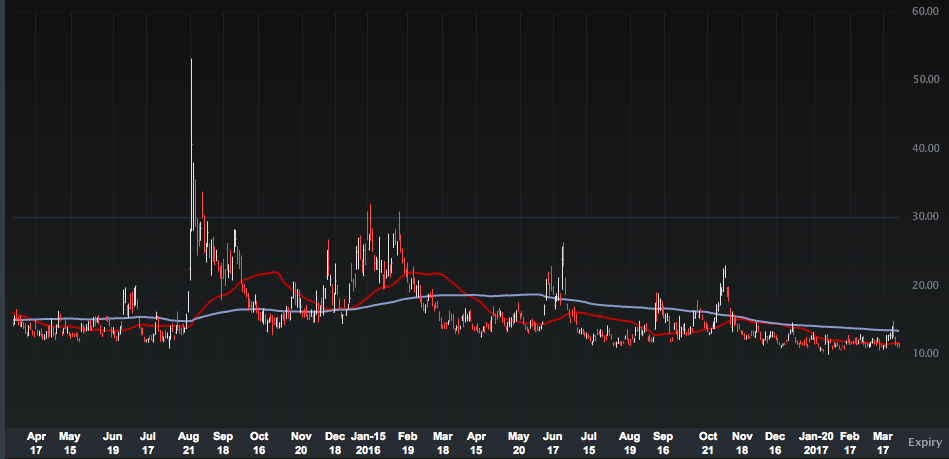

First, let’s check in on the spot VIX. Spoiler alert, it’s really low, and has been since the Fall:

During last week’s slight downturn in the market the VIX briefly spiked, getting above 14. But when the Dow and SPX successfully held their 50 day moving averages on Monday of this week, the VIX got smoked and is back near its lows of the year. This trend feels like it could last sometime without a major catalyst. A lot of catalysts seemed like a possibility in the recent past, whether it was Brexit, the US election, an FOMC raising rates or most recently the Republican’s failed efforts on health insurance and what that means for tax cuts. All saw brief moments of vol, but markets quickly settled and the VIX went back down.

It’s hard to tell if all these potentially volatile events were no big deal all along, or if something has changed. The most obvious answer is active market participants wishcast volatility. This is where money is made and lost and where the fun is. When the VIX is 11 and the market slowly marches higher, any dummy can make money. But what fun is that? Why have a job on Wall Street at all?

But that’s where things get interesting because I’m not even sure what most people are doing on Wall Street anymore besides checking the power in a room like this each morning:

I swear things feel different right now. You mean to tell me that a potential break-up of the European Union, an FOMC raising rates (10 of the last 13 rising rate environments have ended in recession), a brand new administration with a legislative agenda in turmoil within its own party, with tax cut, infrastructure spending and debt ceiling negotiations in the near future, wouldn’t cause jitters that lasted more than 2 days a few years ago? I think the market drawdowns would have been more severe and the vol spikes higher for sure. Buy the damn dip levels seems to be asymptotically approaching wherever the market is at the moment. It certainly feels like the computers are in charge.

But what’s that mean for vol trading? If my theory is correct, as I wrote in a post (Do Algos Dream of Electric Crashes?), the new normal is probably long periods of low volatility disrupted by sudden and brief crashes. That’s with the assumption that a bull market continues and algos and passive investing continue to increase. The human element is being removed from the day to day aspects of the market. But as our friend Peter Boockvar pointed out the other morning in (“…what happens if this trend reverses?”) no one quite knows what all these passive investors and the algos directing the money do when we have an actual correction based on economic fundamentals. Remember, the economy itself isn’t passive investing (yet!) only the stocks tracking its public companies. Recessions will still happen.

So to expand upon my original point, I think we see long periods of low volatility, only disrupted by sudden flash like quick crashes as long as we’re in a bull market. In a bear market, we probably see orderly selling into the close every day for what will feel like forever. With sharp rallies only lasting a day or 2… like the current selloffs. You’ll know it when you see it, it will be the same pattern recognition the computers are using for buying the dip, buying into the close, and other day to day market aspects that feel like Groundhog Day right now, but in reverse.

I for one welcome our new robot overlords. There are a ton of jobs in finance that don’t need to exist and a lot of really smart people still go to work on Wall Street instead of say… getting the world off fossil fuels… or finding a cure for cancer. It’s always been a mis-allocation of resources.

But let’s get back to the current vol environment. The long vol ETN’s are horrible under almost any environment as they lose money on contango over time. As I’ve been arguing for years, they should probably be banned as they’ve taken a ton of money away from the average investor who thinks they’re just “buying vol”. The short vol ETN’s do just the opposite and actually benefit from contango (meaning under normal conditions the ETN makes money each day rolling VIX futures). They have their worst moments on vol spikes but usually recover well unless the VIX futures go into backwardation (meaning it costs to roll short VIX futures each day).

The most popular short near term vol etf is XIV. Here’s a 2 year chart:

And here’s a 2 year comparison to the spot VIX so you can see the timing of moves in both:

And here’s the SPX during that same time, you can see how quick the selloffs in equities were that spiked the VIX and crushed XIV, each really only lasted a few days:

Being short vol through an instrument like the XIV is the right move during a bull market. VIX futures are in contango far longer that periods of backwardation. But you need to have robot cajones to not panic through one of those 50%+ drawdowns in XIV. Remember, the only thing keeping those 50%+ XIV sell-offs from turning into 90% “correction” is that Buy The Damn Dip in equities has brought the VIX right back down after spikes. In a more extended period of selling backwardation (front month VIX future higher than a month beyond) could last for longer and the XIV would bleed each day, even if the VIX didn’t move.

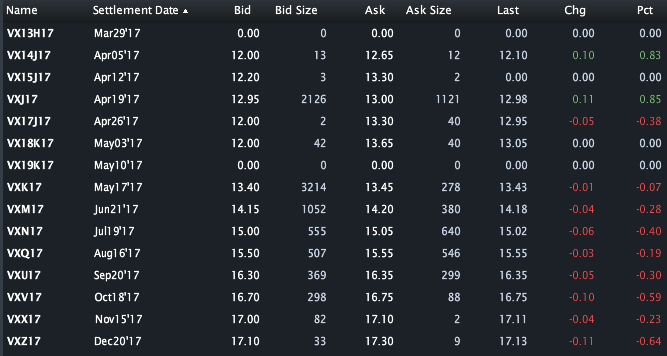

As I mentioned, the spot VIX is low for sure, near 11. As far as the futures curve (that affects XIV and other vol ETNs) here’s how they look at the moment:

That increasing value you see as you move down the list is contango. The ETNs that track VIX futures need to keep the same balance each trading day, meaning they have to buy or sell at different prices in those futures settlement dates, if it’s for a credit the ETN makes money that day and if it’s a debit it loses money (in addition to its overall movement of all the futures contained in the ETN going up or down). Right now the curve is not that steep, meaning the farther out months as you get later in 2017 are also really low, even in comparison to a spot VIX near 11. That level of complacency in the farther out month futures is maybe even more significant than any near term VIX moves as it seems like on each sell-off and subsequent Buy the damn dip market participants get even more confident that that action will continue. And they’re right, it will until it doesn’t.

As far as owning the XIV itself, a contango level of only about 5% is probably not the best time to own, not to mention you’d prefer to catch this thing after a serious spike in the VIX where this would correct in a significant way. The ideal timing to buy the XIV is following a market selloff where the VIX spikes, the VIX futures go into backwardation (the front month is higher than back month) and backwardation is about to reverse to its normal contango. (e.g. VIX spikes to 30, back months spike to 22, then VIX comes back into low 20’s on its way to teens and farther months remain above 20) The best example of that condition is Jan 2015 til now on the XIV chart above.

But the only way to make money overtime being short vol is being able to survive those massive spikes in the VIX. So how does one do that? There are no options on the XIV so it can’t be hedged directly. But that VIX futures structure we detail fairly regularly on RiskReversal makes for an imperfect one. Here’s what strikes you get in May VIX futures for zero cost at the moment:

VIX (11.50) May 12.5 put 14/20 call spread risk reversal for even

- Sell 1 May 12.5 put at .75

- Buy 1 May 14 call for 1.30

- Sell 1 May 20 call at .55

If you’re selling vol elsewhere in your portfolio as a strategy, that is a pretty good hedge with not too much risk (the risk is the VIX settles below 12.50 in May but it’s unlikely to be more than a dollar or two lower than that at any time between now and then) and good reward of up to $6 if the VIX is above 20. And versus a long XIV position this makes a ton of sense.

This was a long winded post as I wanted to thoroughly explain these elements of VIX as a tradeable asset class. The follow up posts will be more to the point (become a member here, ask us about membership specials in the chat box).

To recap:

VIX: low!

VIX Futures: flattish curve right now, small contango

XIV: excellent over time, but not a great entry at the moment with VIX low and contango low

VXX: still bad, always bad

VIX Futures Zero Cost long: MAY 12.5p vs 14/20c (risk about $1-$2, reward $6), Attractive