I have no idea what to expect from today’s possible House vote on the AHCA, intended to “repeal and replace” the ACA. And your guess is as good as mine as to what ultimately happens on healthcare reform in general. But today’s vote is obviously coming down to the wire. And even once something passes the House, the Senate is a whole ‘nother story. What I do know is that the downward volatility in stocks on Tuesday was a clear sign of investor unease with any drama in Washington disrupting what it had assumed would be a “pro-growth” agenda of massive tax cuts and stimulus. The likelihood of quick tax reform, fiscal stimulus and industry de-regulation (outside of executive order) takes a hit for in the 2017 over/under everytime a new congressional battle takes center stage. And with the House right now torn between representatives who are worried voters may punish them if they repeal protections of the ACA, and those in the Freedom Caucus the Koch’s have promised to throw money behind to defend in the primaries because the bill doesn’t go far enough in removing those essential benefits, there seems to be a big chasm for the House leadership and the White House to overcome. And again, we’re not even talking about the Senate

And all this is against the backdrop of a fairly new coalition of voters in the 2016 election that is not likely to see eye to eye on fiscal stimulus, and deregulation in areas like banking that are clearly at odds with the portions of the President’s populist message during the campaign. Add it all up and you get to the big one, Tax reform, which is certainly a trickier subject, and the one the market is most clearly anticipating. On Tuesday morning, the WSJ laid out the challenges for 2017 Tax reform, Why Trump’s Tax Cut May Be Later and Smaller Than Investors Think and we discussed market expectations, and positioning yesterday, in Swamp Things. This was one of the main reasons we saw volatility earlier in the week and it could be a preview of things to come as all eyes on on DC.

To quote The Dude, “This is a very complicated case… a lotta ins, lotta outs, lotta what-have-yous”

So with the potential for little if anything getting done on the economic agenda in 2017 let’s look at some of the other big factors driving equities. First you have the Fed’s fairly “dovish” rate increase last week. And you have a fairly uncertain geo-political environment (EU, Trade agreements, etc). So you might have demand, in the not so distant future, for safe-haven assets like U.S. Treasury bonds. They have gotten creamed as rates ripped post-election in anticipation of a cornucopia of economic goodies. The TLT, the iShares US 20 year Treasury bond etf broke down from the nice round number of $130 the day after the surprise election result, and following a short-lived bounce in the New Year has be made a series of lower highs and lower lows:

With the April 23rd French election in the horizon, and the investigations into members of the Trump campaign happening against the back drop of an economic agenda that could get pushed back as internal politics does its thing, we could be in for a period of greater market volatility (does not exactly mean a sharp decline in equities). Under this scenario,Treasuries should remain bid at the very least, with the possibility of a gap fill back to $130 in the coming months.

So what’s the Trade? This is obviously a bit contrarian, but if you agree that a defeat by the White House’s own party on health care, bogs down much of the other important issues on the economy that have been primary driver for equity gains since November, that long TLT makes a lot of sense. Obviously, TLT just bounced off the lows below 117, but its not too far off those lows so it’s not a perfect entry, but going out to June gives some time to not have to be exact:

TLT ($120.50) Buy June 120 / 130 call spread for $2.40

Buy 1 June 120 call for 2.80

Sell 1 June 130 call at 40 cents

Break-even on June Expiration:

Profits: up to 7.60 between $122.40 and 130 with max gain of $7.60 above $130

Losses: up to $2.40 between $120 and $122.40, with max loss of 2.40 (or 2% of the etf price) below $120.

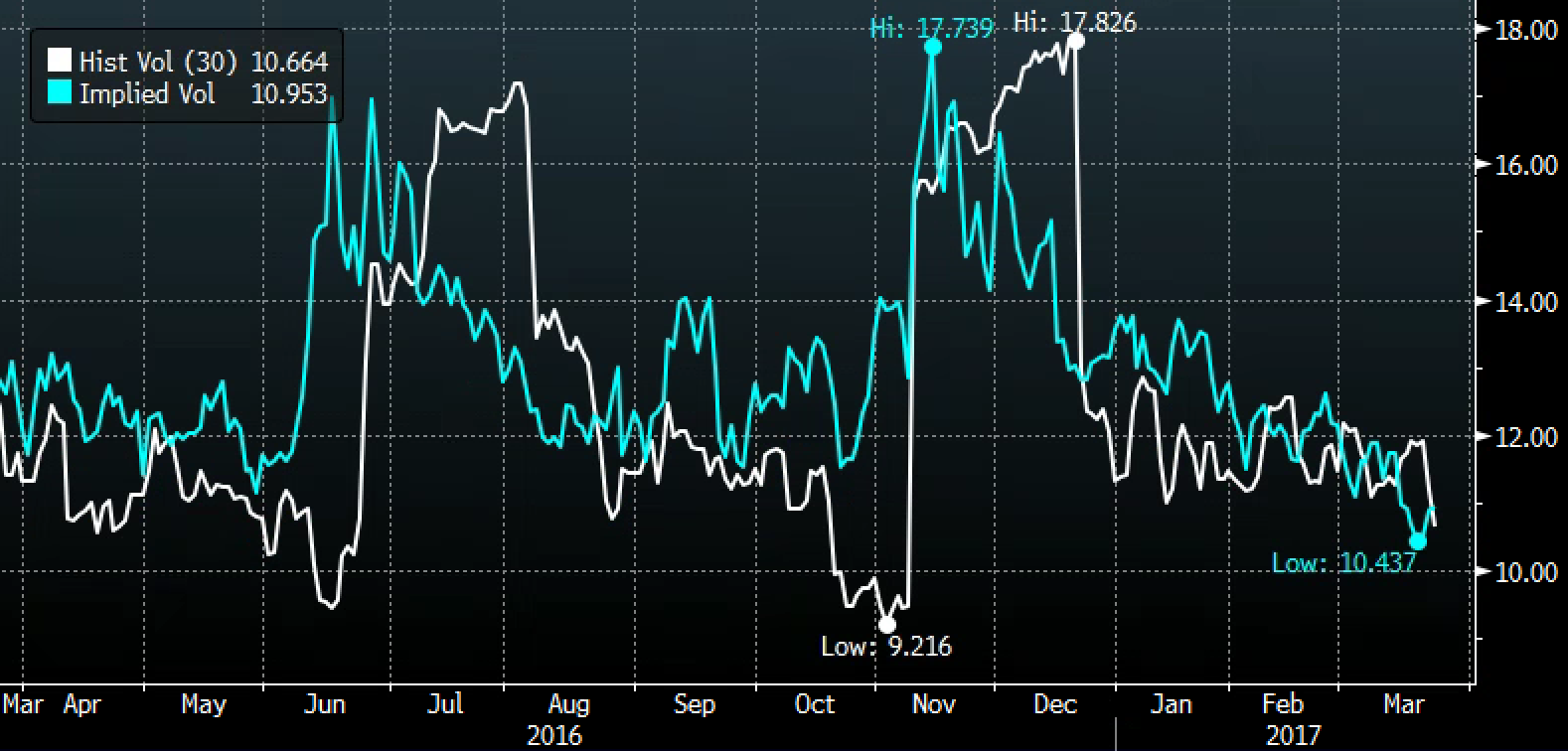

Rationale: This trade offers a potential 3 to 1 payout, risks 2% of the etf price and is already 50 cents in the money. Options prices in TLT are some of the cheapest vol in the board for a major risk asset with 30 day at the money implied vol (blue line below) just off of its 52 week and multi-year lows, just a smidge above realized volatility (how much the underlying etf has been moving: