FedEx Corp (FDX) will report their fiscal Q3 results tonight after the close. The options market is implying about a 4.5% in either direction vs the 4 quarter average one-day post earnings move of only 6.7% but above the 10 year average of 3.3%

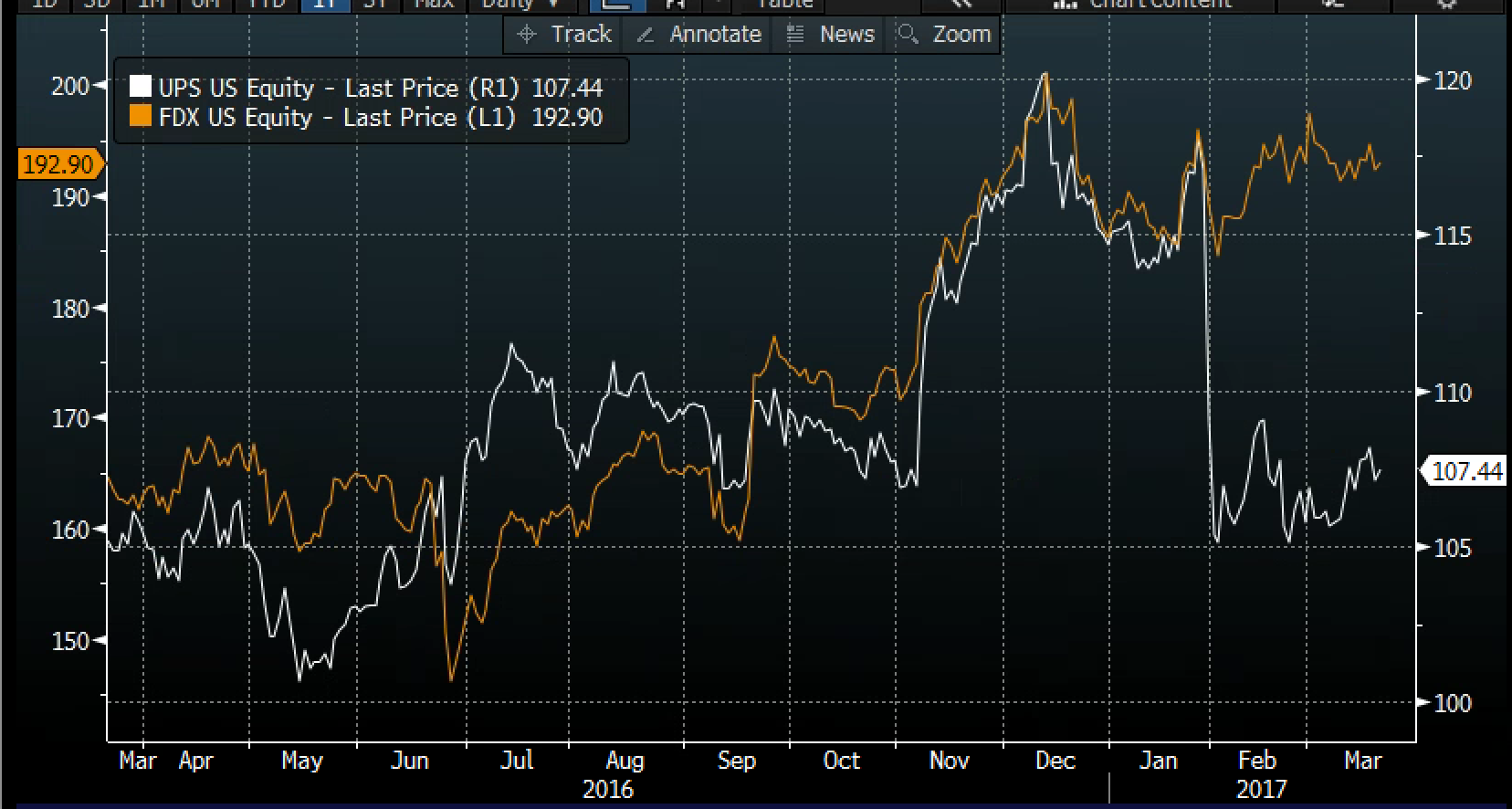

Shares of FDX are up 4% year to date, outperforming peer UPS which is down 6% on the year, and the IYT, the iShares Transports etf, of which FDX makes up 13% of the weight, which is up a mere 1% ytd.

Both FDX and UPS made all time highs in early December, and both have lagged the broad market, with the S&P 500 (SPX) seemingly making new daily highs in 2017. FDX is 4% from its all-time highs while UPS is about 10% from its highs which also includes a nearly 7% one day decline in late January following its disappointing Q4 results and forward guidance.

FDX and UPS were fairly well correlated until the most recent disappointment from UPS, and to suggest that FDX might be at a technical inflection point is a bit of an understatement. Draw the lines any way you like, but FDX is either on, or very near the uptrend that has been in place from its late June post-Brexit lows which has yielded gains of 33%, far better than the 20% gains in the SPX, but the stock’s recent consolidation in the face of UPS outlook shows healthy relative strength:

A beat and raise and the stock is back near its all-time highs of $202, just a tad above the implied move of $9, a miss and a guide down and it likely outperforms the implied move and is testing the November breakout in the high $170s in the coming days/weeks.

But here is the thing, FDX is a cheap stock, trading below at market multiple at 16x expected fiscal 2017 eps growth of nearly 11%, on sales growth of about the same, vs UPS that trades 18x expected 2017 eps growth of 4% on 5% sales growth. Given investors response to UPS’s guidance on Jan31/Feb1, I suspect an inline quarter and guidance will be viewed as a relief, while guide down will likely be met with a shoot first ask questions later response.

And I have not even mentioned you know who yet, from WSJ in Sept:

Amazon’s Newest Ambition: Competing Directly With UPS and FedEx

To constrain rising shipping costs, the online retailer is building its own delivery operationThis logistical dance wasn’t performed by United Parcel Service Inc., FedEx Corp. or the U.S. Postal Service, all longtime carriers for the online retailer. It was part of an operation by Amazon.com Inc. itself, which is laying the groundwork for its own shipping business in a brazen challenge to America’s freight titans.

Defined risk strategies into the event make sense for those looking to express a directional view. Short-dated options prices are extremely elevated into the print, with 30 day at the money implied volatility (the price of options, blue line below) at 26%, while 30 day realized volatility (how much the stock is actually moving, white line below) at 14%, one of the widest spreads over the last year, signaling options prices to be expensive. Strategies that sell short-dated to buy longer-dated options also make sense:

So What’s the Trade?

Those that are long can lean on the previous highs (also in line with the implied move to sell a near term call to finance a protective put spread:

Hedge

vs 100 shares of FDX (193) Sell the Mar24th 202.50 call to buy the Mar24th 185/177.5 put spread for even

- Sell 1 Mar24th 202.5 call at 1.10

- Buy 1 Mar24th 185 put for 1.50

- Sell 1 Mar24th 177.5 put at .40

Breakeven on Friday/Rationale – This means being called away in the stock above 202.50, but that is above the implied move and the all time high. Below 185 and down to 177.50 long shares are protected completely. For those that feel 202.50 is too tight to the upside that call sale can be a higher strike like 205 but that means the package costs money.

And for those long shares or bullish overall defined risk is certainly the name of the game here:

Stock Alternative/ Replacement

in lieu of 100 shares of FDX (193) Buy the Apr 192.5/202.5/212.5 call fly for 2.30

- Buy 1 Apr 192.5 call for 6.30

- Sell 2 Apr 202.5 calls at 2.35 (4.70 total)

- Buy 1 Apr 212.5 call for .70

Breakeven on April expiration – Defines risk to just 2.30, much less than the implied move. Gains of up to 7.70, targeting just above the implied move and the all time high. IF the stock goes higher it’s likely to find resistance near the target. If it tanks risk is defined.