Let’s call this an exercise. I was just asked about how I might play a tech highflier for higher highs into and out of earnings season. I am not a buyer of stocks that have performed well year to date or those which have lagged but have perceived value.But for the sake of the exercise, lets take a look at Netflix (NFLX), which last month made a new all-time high, has since settled in a bit, but remains up 14% on the year. Valuation has long been one of the main pillar of the bear story, along with the fear of increased competition from the likes of Amazon, Apple, Disney and many other well-capitalized tech and media peers has always been, but one of the largest impediments to the story at this point may well be its $60 billion market capitalization, as the higher it goes the less of a likelihood that they get bought out, which has been a big part of the bull thesis.

Back in mid-August, when NFLX was trading $100 I had the following to say on the potential for a takeout:

There is little doubt that the sharp drop in net adds is a combination of both pricing pressure and rising competition, but I want to reiterate the potential stickiness of original content, which surprises like this Summer’s smash hit Stranger Things might cause a rush for new or old subs. From Aug 16th:

Oh and one last thing, over the last week I watched Netflix’s (NFLX) original sci-fi series Stranger Things, which was awesome. After it ended I thought to myself, if this company were use the currency given to them by their own little stock bubble to buy other studios, and create a seasonal schedule like Time Warner’s (TWX) HBO, why couldn’t NFLX be one of the largest media properties in the world given their installed base and first mover advantage?

But then I recalled those pesky fundamentals, like user growth that has decelerated massively, the company in Q2 adding the smallest net subscriber gains since the launch of their streaming service 5 years ago. Also, that Amazon has more U.S. streaming subs than NFLX, that the company has a market cap of $41 billion, or 66% of TWX, a company expected to have 3x NFLX’s $8.7 billion in 2016 sales.

But maybe none of that matters in the environment we are in? Microsoft just paid $27 billion for LinkedIn (LNKD), a money losing (GAAP) company that had $3 billion in sales last year. Why couldn’t we see a $55 billion deal for NFLX? Trust me, if you’ve been doing this long enough, you’ve seen Stranger Things (AOL/TWX).

The stock has since rallied 40% or about $25 billion in market capitalization, to my earlier point.

So how to play into the next identifiable catalyst will be Q1 earnings, which is not set, which estimated to be April the last week of April.

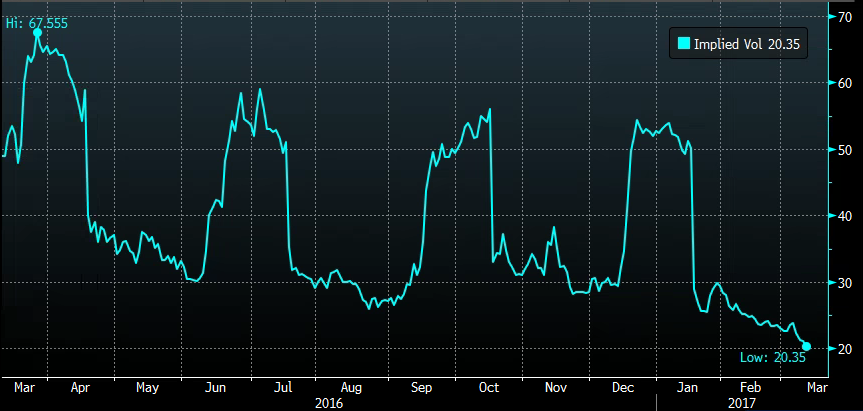

Short-dated options prices are at 52 week lows, making short premium strategies less attractive, despite the stock, and the broad market’s relative calm:

If I were long stock, but inclined to better define risk on the position, or a portion of it, while maintaining exposure into the next earnings I would look to define my risk, with exposure if the stock goes higher but limited risk of the consolidation gives way to a sharp decline.

So What’s the Trade?

Stock Replacement