The hope for fiscal stimulus is one of the main pillars of the new administration’s promise of increased economic growth here in the U.S.. Yesterday the president met with business leaders, and as the WSJ reported, Trump Begins to Map Out $1 Trillion Infrastructure Plan:

The president called for a $1 trillion infrastructure plan last month in his address to a joint session of Congress and added that the projects would be financed through public and private capital. The White House was considering a repatriation tax holiday to generate about $200 billion in funding, but other sources also were being considered, a senior administration aide said.

There’s little debate that our country needs to re-invest on its infrastructure, but how we get there, and what is actually spent will always be a political hot potato. And because of that, we’re not not likely to see “shovel ready” projects anytime soon.

As far as the difference between government spending on infrastructure directly, and what is emerging as a plan to use tax credits to generate construction, there is debate among economists on the stimulative effects. Pedro Da Costa of Business Insider recently wrote “The markets also seem to be vastly overstating the potential for a large fiscal stimulus“:

Despite talk of $US1 trillion in infrastructure spending, critics suspect much of that will come in the form of subsidies to private firms that are punitive to consumers rather than stimulative. In other words, taxpayers could end up paying to build a private toll road that will then turn around and charge them tolls. No extra disposable income there, negating any potential boost to overall economic growth.

The industrial sector, measured by the XLI, the S&P Industrial etf has mildly outperformed the S&P 500 (SPX) since the election, up nearly 13%. But right now congress is focused on Healthcare reform and already facing pushback from left and right. That could mean political capital spent on one thing and not another. We’ll see. For now, investors have started to price the potential for of a push out of fiscal spending and tax reform. Those aspects have fueled much of the stock market optimism since the election, and if delayed could mean a reversal of fortune for stocks expected to reap the immediate benefits.

The XLI is now down about 2.3% from its all time highs made on March 1st following the president’s speech to the joint session of congress. In that speech he reiterated his campaign pledge for a $1 trillion infrastructure plan. But today, the XLI broke the uptrend that has been place from its pre-election lows in November. The next technical support is $64, and if that doesn’t hold, $62 could be an attractive intermediate term target:

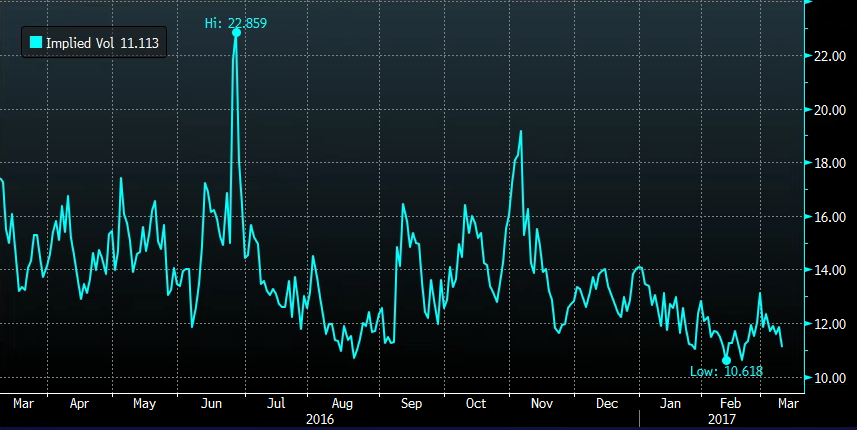

Short dated options prices are cheap as chips, with 30 day at the money implied volatility at 11.11%, nearing 52 week lows:

I’d also add that while I am positively disposed to large XLI component General Electric (GE) for a handful of reasons (read here), the stock can’t get out of its own way, and I am starting to rethink that view with the stock down nearly 6% on the year (and below the Nov 8th post election levels). This is important because GE makes up 9% of the weight of the XLI, and if were were to see other components start to under-perform, or merely retrace some of their massive out-performance (See BA), then XLI could easily re-test recent support at $62.

As we head into April and Q1 earnings season with stocks near highs, if we don’t get clarity on any timing of infrastructure spending and tax reform, some of the optimism shown by business executives might result in forward guidance that is less clear than mud.

So what’s the trade?

XLI ($65.50) Buy the June 65/60 put spread for 1.30

- Buy 1 June 65 put for 2.00

- Sell 1 June 60 put at .70

Break-even on June expiration:

Losses of up to 1.30 between 63.70 and 65 with total loss of 1.30 above 65.

Gains of up to 3.70 between 63.70 and 60 with a max gain of 3.70 at or below 60.

Rationale – This trade idea looks out to June, giving plenty of time for a pullback and a nice risk reward targeting 62 or below.