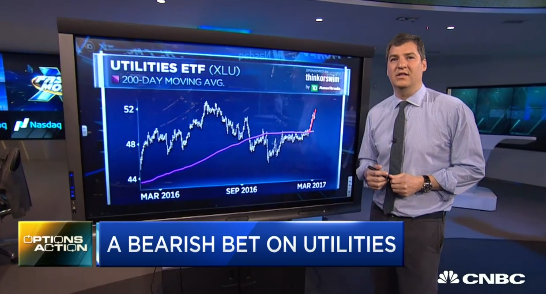

Last night on CNBC’s Fast Money I detailed some bearish options activity in the etf that tracks the Utilities sector, XLU, watch:

Yesterday there was a buyer of 20,000 of the April 49 puts when the etf was 51.65, and today the interest in puts continues, with puts outnumbering calls nearly 10 to 1. The bulk of the volume in coming from one apparently bearish roll. When the etf was trading $51.58, shortly after the open, a trader sold to close 15,000 April 50 puts at 65 cents and bought to open 30,000 April 48 puts for 24 cents.

As I detailed in last night’s segment, the year to date strength in the XLU, in the face of a rising rate expectations, and strong equity market is a bit curious.

Fed Funds futures are currently pricing in about 90% chance of the Fed’s third rate increase in a little more than 10 years at their March 15th meeting. A rising rate environment should make sectors like Utilities, viewed as bond proxies, look less attractive. The put volume in the XLU this week appears to be positioning for a reversal in the sector.

The etf has found a little technical resistance at $52, which was just 2% from its 52 week highs, and appears to have decent technical support down near $48, a level it bounced off a few times in January just prior to the recent breakout:

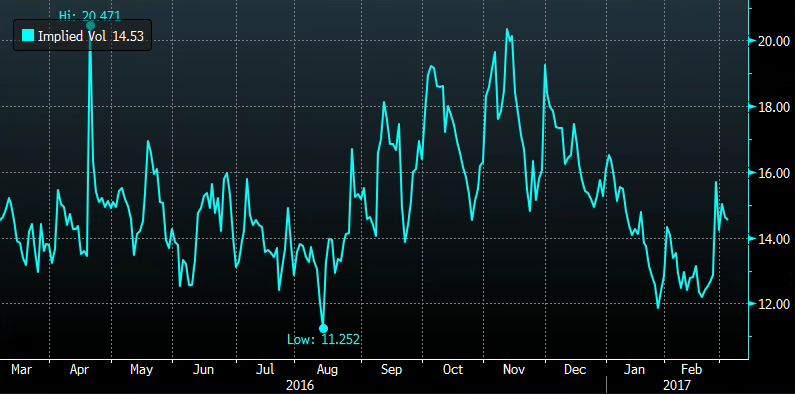

While I am not usually a fan of following the crowd when it comes to unusual options activity, the relatively low levels of options prices is compelling to play for a reversal from upside resistance:

So what’s the trade?

XLU ($51.15) Buy April 51 / 47 put spread for $1

- Buy 1 April 51 put for 1.20

- Sell 1 April 47 put at 20 cents

Break-Even on April expiration:

- Profits: up to 3 between 50 and 47 with max gain of 3 below 47

- Losses: up to 1 between 50 and 51 with max loss of 1, or 2% above 51

Rationale – The utility stocks ripped in February on a technical breakout. But we’re heading into a rising rate environment and positioning XLU to reverse some of the recent games makes sense in that environment. The 1 to 3 payout potential is nice with volatility fairly low. On the downside 49 is a realistic area to target and perhaps a place to take profits. On the upside, last Summer’s highs near 53 can be used as a stop.