Autodesk (ADSK), the technical design software company, reports fiscal Q4 results tonight after the close. The options market is implying about a 6.5% in either direction tomorrow, which is rich to the stock’s 4 quarter average one day post earnings move of about 4.5%.

Shares of ADSK have had a monster year so far, 18%, at all time highs, and up an astounding 75% from its 52 week lows made in late June:

About a month ago the company announced that its CEO was stepping down immediately and the board had initiated a search:

Autodesk, Inc. (NASDAQ: ADSK) today announced that Carl Bass has decided to step down as president and chief executive officer, effective February 8. The company’s board has instituted a CEO search to consider candidates inside and outside Autodesk and has formed an Interim Office of the Chief Executive to oversee the company’s day-to-day operations. Bass will remain on staff as a special advisor to the company in support of the transition to a new CEO. He will continue to sit on the Autodesk board of directors and will be nominated for reelection at the 2017 annual meeting of shareholders. Crawford W. Beveridge will remain non-executive chairman of the board.

“I’ve worked with Carl through his tenure as CEO of Autodesk, and I’ve always valued his focus and vision, as well as his rare combination of business and technical expertise,” said Beveridge. “We have seen exponential growth in the last decade, both in the business and in Autodesk’s market opportunity. Carl has always been a driven and passionate change agent for the company, and under his direction Autodesk has transformed from a 2D design company into the worldwide leader of 3D design and engineering software.

The swiftness of such a departure after the notice was odd.

Giving credit where it is due, back in late September when the stock was near $70, Barron’s suggested it could be poised for a run – Autodesk’s Bet on the Cloud Will Generate Big Returns for Shareholders… as the design-software pioneer transition could lead to short-term earnings pain but long-term stock gains. Barron’s compared to other software providers who have shifted their models towards cloud based subscriptions:

Shares of Adobe are near record highs, up 154% in the past three years. The company has successfully expanded its user base by offering a seemingly affordable subscription. Photoshop, which used to cost $700, is now part of a $10 monthly package. Adobe’s transformation is probably three-quarters complete, Auty estimates, and the benefits are hard to miss. Earnings are forecast to grow 61% this year and 56% in 2016, when operating profit margins could reach 36%

You get the point. But ADBE is not ADSK. And with ADSK’s expected sales growth flatish, trading nearly 10x sales, with eps having imploded due to the transition to subscription, the stock could be priced to perfection at a time when there appears to be, at least near term, a leadership void.

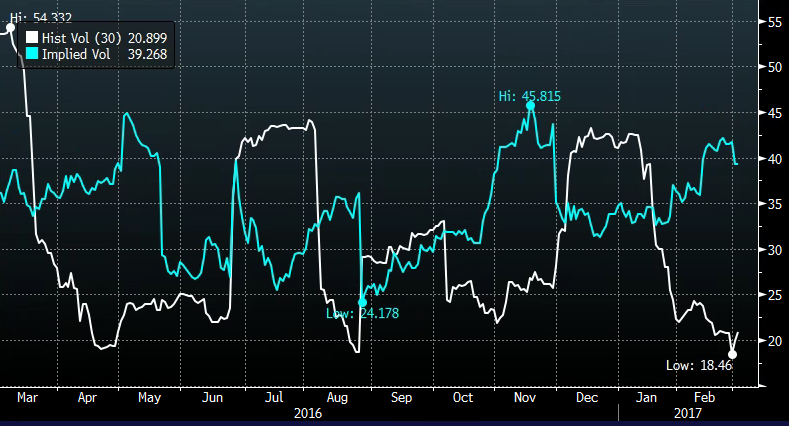

Short dated options prices are elevated into the print as one might expect, with 30 day at the money implied volatility (the prices of options, blue line below), at a massive gap to 30 day at the money realized volatility (how much the stock is moving, white line below) which is basically at 52 week lows, making options prices appear very expensive:

So what’s the trade? Could the stock be a take-over candidate? Sure, the promise of a trillion dollar infrastructure package over the next 10 years could clearly spurn demand for ADSK’s cutting edge design software. But with the stock at all time highs, uncertainty surrounding leadership, and the potential hiccups with the company’s business model transition, existing longs, or interested longs should consider defined risk strategies and hedges after such a parabolic move higher in the shares.

Hedge

vs 100 shares of ADSK ($87.50) sell the March 100 call to buy the 82.5/72.5 put spread for .85 total

- Sell 1 March 100 call at .35

- Buy 1 March 82.5 put for 1.40

- Sell 1 March 72.5 put at .20

Break-even on March Expiration: Losses of up to .85 (in addition to gains or losses in the stock) between 81.65 and 99.15. Protection in the stock for up to 9.15 in losses below 81.65. No protection below 72.50. Called away in the stock above 99.15 but that’s more than 13% higher, much more than the implied move.

Rationale – This hedge protects more than 10% of the downside while risking a little less than 1%. It’s unlikely that the short call on the upside will mean being called away, and if the stock tanks on the event you’re protected from the breakdown level near the 50 day moving average and then $10 below.

Stock Alternative

in lieu of 100 shares long of ADSK ($87.50) Buy the March 87.5/100/110 (unbalanced) call fly for 2.75

- Buy 1 March 87.5 call for 3.40

- Sell 2 March 100 calls at .35 (.70 total)

- Buy 1 March 110 call for .05

Break-even on March expiration: Losses of up to 2.75 below 90.25 with total loss of 2.75 below 87.50. Gains of up to 9.75 above 90 with max gain at 100. Profits trail off above 100 but can only lose .25 above 110 (as it’s unbalanced) and a move above 100 is unlikely.

Rationale – This risks much less than the implied move but will behave very similar to stock from 90 to 100. Those playing for higher highs can define their risk in this way and know that they can only lose 2.75 if the stock tanks.