With the stock market making new highs daily, and having its best day of 2017 today, it’s worth noting that options volume in the SPY, the etf that tracks the S&P 500 (SPX) is skewed towards puts 1.9 million to 1.4 million calls, but not to the extent of the average over the last 20 trading days which has been about 1.6 to 1.

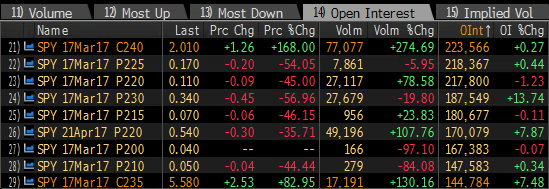

Total open interest in SPY options is massively skewed to puts with 15.1 million to 7 million calls. The single largest strike of open interest is 223,000 of the March 240 calls, which depending upon what they are against, could become a bit of a magnet. The next 7 strikes of open interest are all calls in March:

A ton of March puts traded today, many look to be closing, and there was a trade in April puts that caught my eye. It suggests some rolling activity. It was when the SPY was $240, just before 1pm:

Bought the SPY ($240) April 210/ 220/ 230 put fly for .54, 17.500 /35,000 /17.500

- Bought 17,500 April 230 puts for 1.32

- Sold 35,000 April 220 puts at 53 cents

- Bought 17,500 April 210 puts for 28 cents

This trade, if an outright put butterfly breaks-even at 229.46, offers gains of up to 9.46 between 229.46 and 210.54 with the max payout of 9.46 or $16.55 million at $220 on April expiration. The max loss is the 54 cents (or $945,00 in premium) above 230 or below 210.

The choice of strikes are interesting because $230 was the early February breakout level, while 220 appears to be massive technical support at the November post election breakout level: