The cloud-based applications software provider, Workday (WDAY) will report fiscal Q4 results tonight after the close. The options market is implying about a 7.5% one day post earnings move which is shy to its 4 qtr average one day post earnings move of about 10%, with the stock declining 12.5% following their Q3 report in early December.

Since closing 2016 on a nasty note, at 10 month lows, down more than 10% on the year, the stock has made a fairly dramatic V reversal, up a whopping 36% on the year, and only 4% from its 52 week highs made in October:

Near term the stock might find technical resistance near those prior highs, with decent support between $85 and $80. Taking a slightly longer term view, the 52 week high in the low $90s, and the recent lows, very near the 52 week lows in the mid $60s offers a better case for how a break above resistance could serve as a meaningful pivot point for the stock, and how $65ish should serve as staunch downside support, barring a market meltdown like we had in Q1 2016.

With an $18 billion market capitalization, the stock trades at a whopping 9x expected f2018 sales of $1.56 billion, which would mark a 28% year over year increase. Oh, and that 3 adjusted earnings gain in f2017, is really about a $2 loss on a GAAP basis. If the stock is trading this way in 2017 on take-over speculation, you might want to think again, as a deal from these levels would likely need to come near their all time highs, probably about 20-25% from current levels. I just don’t think there are any large cap, slower growing software companies whose shareholders would be for a deal blowing a whole like that in their balance sheet.

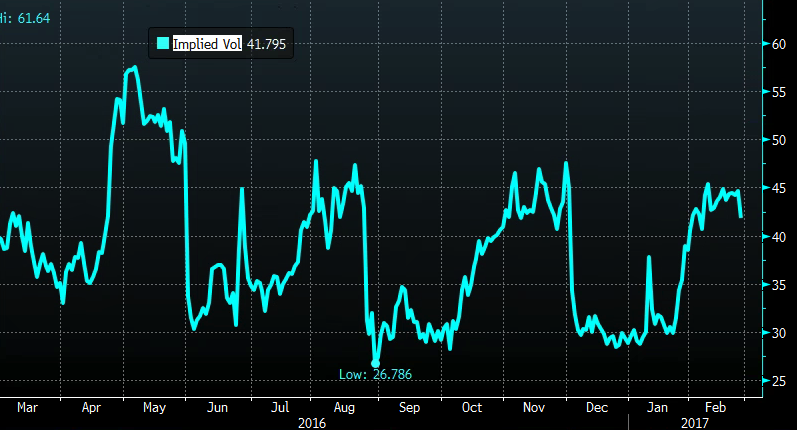

Following results, short dated options prices are likely to come in back towards 30%, this set up could present itself as an attractive calendar or diagonal situation for those looking to play for a sharp drop in short dated vols or those with a directional inclination:

So What’s the Trade?

For those long the stock, wanting to stick around for a potential breakout but worried about a fairly sharp pullback on any disappointment following the gains over the past few months, a hedge protecting against an outsized implied move tot he downside into the event makes sense:

Hedge

vs 100 shares of WDAY ($92) Buy the March 90/80/70 for 1.75

- buy 1 March 90 put for 3.25

- Sell 2 March 80 puts at .80 (1.60 total)

- Buy 1 March 70 put for .10

Breakeven on March expiration:

- Losses of up to 1.75 above 88.25 with total loss of 1.75 above 90

- Gains of up to 8.25 below 88.25 and above 71.75 with max gain of 8.25 at 80 on March expiration

Rationale – The stock has rallied dramatically into earnings and is eyeing new highs. For those that have been long and want to stock around, risking 1.75 (or about 2% of the underlying) makes sense from a risk/reward perspective.

Or for those looking to buy this stock, or replace existing stock, the elevated volatility in the weeklies offers an opportunity to finance something closer to the money in March expiration:

Stock Alternative

WDAY ($92) Sell the March3rd Weekly 100 call to buy the March regular 92.5 call for 3.30

- Sell 1 March 3rd (weekly) 100 call at .70

- Buy 1 March (regular) 92.50 call for 4.00

Breakevens on March 3rd expiration – The ideal situation is a move higher to 100 but not above. Any move higher is likely profitable and a move sideways is a small loser, a move lower a loser, but the most that can be lost is 3.30.

Rationale – This risks less than half of the implied move and will be profitable in most situations of the stock going higher on the event. Once the March 3rd 100s expire the March regular 92.5 calls can be further spread, reducing even more risk. The biggest risk to this is if the stock goes substantially lower, but that’s the idea of this trade as you can protect against a large move lower by defining yoru risk to just 3.30, rather than the potential for things to get ugly. A move higher is unlikely to blow through 100 this week, but even if it did the trade would be worth 7.50 vs the 3.30 risked, so more than a double. If the stock is higher on the event, but lower than 100, the position can make further gains over the next 2 weeks if it then breaks out above 100.