Yesterday in this space we had a little link-fest for those trying to get their arms around the impending SnapChat IPO, expected mid next week (SnapTastic!). In years past, when popular social media services were selling shares to the public I was routinely asked the question by those in the investing public “should I get in??”. Oddly, I have not had a single person (from outside the business) ask me that question about Snap. I am not exactly sure what that means. It most likely demonstrates that most adults don’t use the service and therefore don’t see it in their daily life like LinkedIn, Facebook, and Twitter. Heck, in the roadshow material the company created a ‘How to Use Snapchat’ video for the Wall Street oldsters.

For a greater sense of recent history, let’s take a look at the few “pure play” social media companies that have gone public. All of them came at much lower levels in the S&P 500 (SPX) and the trading patterns have been less than predictable.

On May 18, 2011 the S&P 500 (SPX) closed at 1340, LinkedIn sold 9 million shares in their IPO at $45, closing up 109% the next day at $94.25, placing its value at $9 billion. The company was bought by Microsoft last year for $26 billion, but in the year prior to the deal, the stock had a 60% peak to trough decline from its all time highs in 2015 before its $195 takeout bid.

On May 17, 2012 the S&P 500 (SPX) closed at 1304, Facebook (FB) sold 421 million shares in their IPO at $38, closing up less than 1%, placing its value at $104 billion. After initially being cut in half from its IPO price in the next few months, FB has since risen 600% and is worth $386 billion.

On November 6, 2013 the S&P 500 (SPX) closed at 1770, Twitter (TWTR) sold 80 million shares in their IPO at $26, closing up 72% the next day, placing its value at $25 billion. In the few months after the IPO the stock rose nearly 200%, but since its Dec 2013 highs the stock has lost 75% of its value and now sports a market cap of little less than $12 billion, 40% lower than its IPO price.

I guess the main takeaway here is that it’s very unlikely that the opening price of SNAP will be your one shot “to get in on the deal”. I would also add that for those who suggest that with the stock market at all time highs, SNAP’s IPO at what could come at 50x sales valuation is in some way a sign of the top, I’ll just remind you that the market has a lot bigger fish to fry. The SPX has gained more than $6 trillion in market cap since the LinkledIn IPO, and it’s ovbiously not just a handful of expensive social media companies trading at rich valuations, per Axios’s Christopher Matthews:

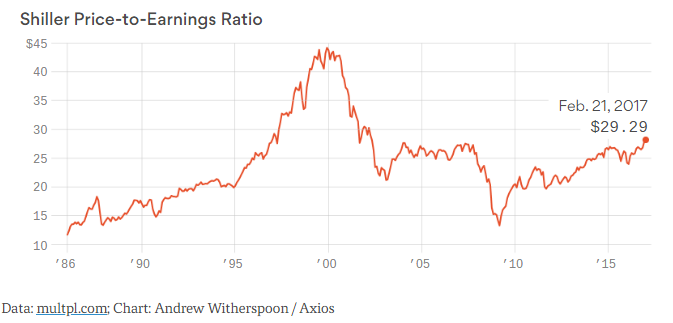

The Shiller PE ratio compares today’s stock price with a 10-year average of corporate earnings. Investors are paying more today for a dollar of earnings than at any point during the lead up to the financial crisis,

How and when this resolves itself is anyone’s guess. As you can see on the above chart, we’ve seen much higher during the dotcom boom. In the aughts it was the financial and real estate sectors that were ready to burst. This time around it’s fairly evenly spread out within equities.