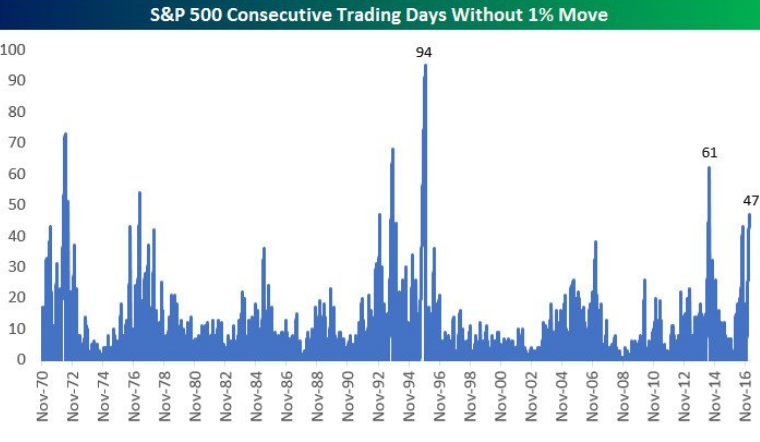

As we’ve mentioned a few times recently (most recently here and here), volatility in the broader market is at a historically significant low level, both realized and in the price of options. On the realized vol front, or how much the market is moving day to day, the SPX has gone 48 consecutive trading days without a 1% move (it looks like today will make that 49). Here’s how that compares since 1970, from Bespoke:

On Tuesday we detailed a long VIX futures strategy that would take advantage of a pop in implied vol from these low levels over the next month. Spot Vix is up nearly 10% from last week’s lows.

Today we’re going to look at a strategy to play for the first dose of realized vol that could come in the next few months. With spot VIX below 12, hedges and bearish options trades in the SPX are dirt cheap. This trade idea works as a portfolio hedge or an outright bearish positioning, risking just 1.3% to profit or protect vs a 10% move lower in SPX before May expiration:

Buy – SPY ($234.70) May 230 / 210 put spread for $2.75

-Buy 1 SPY May 230 put for $3.80

-Sell 1 SPY May 210 put at $1.05

Break-Even on May Expiration:

Profits: up to 17.25 between 227.25 and 210, max gain of 17.25 at 210, down 10%

Losses: up to 2.75 between 227.25 and 230, max loss of 2.75, or 1.3% above 230.

Here Is The “Catalyst” For The Market’s Inexplicable Surge: A $17 Billion Trade Gone Wrong | Zero Hedgehttps://t.co/9wqGR7IhGapic.twitter.com/3x87JLc9zi

— Dan Nathan (@RiskReversal) February 16, 2017

Bloomberg’s Matt Levine took shot at VolSplaining all that mumbo-jumbo in column today: Volatility Trades and Explosive Shorts .

I have no idea as to the why, but I am fairly certain at some point in the not so distant future we are likely to have a vol shock of epic proportions. I can not remember another time in my 20 year career where complacency was so high while the risks so clear and present.

The first leg lower will be down about 5%, very near the 2200 -SPX / 220 – SPY breakout level from late Nov/ early Dec. Below that there is an air-pocket to the early Nov pre-election lows: