I’ll offer one of our usual disclaimers when it comes to discussing unusual options activity, we don’t place a whole heck of a lot of credence in it, without intimate knowledge of the trade, the trader’s intent and what the options trade may be against. In other words, don’t blindly follow. That said, what I do like about unusual options activity is that it often times gets me looking at a stock or an etf that I might not have been on my radar, and ones that traders are clearly positioning in for some reason.

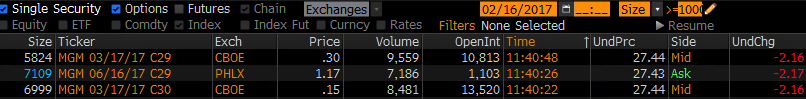

For instance today when MGM Resorts International was trading $27.43 a trader paid $1.17 for 7100 June 29 calls to open. This was the report that I got from the floor of the Philadelphia Options Exchange, the PHLX:

MGM jun 29 calls cust bot 7109 for 1.17 x’d all.

What’s interesting is that these printed on the PHLX, while it appears that a block of nearly 6,000 Mar 29 calls and March 30 calls were sold to close at the same time on the Chicago Board of Options Exchange (CBOE):

So this clearly looks like a bullish roll despite the trade not being reported as such. It’s neither here nor there though as the trader was selling nearly worthless out of the money calls that expire next month. The important part was they are committing a little more than $800,000 to extend the exposure through June expiration. Again, was the long call position a stop against a short, leverage on top of a long, and outright bullish defined risk bet? Who knows, only the trader which is why it makes little sense to base any investment / trading decision off of this information.

But it got me looking at casino stocks, and the chart of MGM is pretty interesting. After making a series of higher highs and higher lows, and consolidating above its Nov 9th gap level since early Dec, the stock broke two key levels of support on a massive volume gap:

Taking a 10 year view, today’s gap also is a failure at the prior high from early 2014, and don’t even get me started where is relative to the all time highs made in late 2007:

So thanks a lot unusual options activity, MGM is now on my radar, without me reading to much into what me be a bullish call roll.