For Gap, Inc. Slow and Steady Wins the Race

Gap, Inc. (GPS) is a worldwide apparel retailer. Most if not all of us have shopped at one of their stores at one time or another. The company has a traditional suite of offerings comprised of apparel, eyewear, jewelry, shoes, handbags, and fragrances. In recent years they have expanded into performance and lifestyle apparel for use in yoga, strength training, and running, as well as seasonal sports, including skiing and tennis. GAP has something for every member of the family and those products are designed for men, women, and children under the Gap, Banana Republic, Old Navy, Athleta, and Intermix brands.

GPS offers its products through company-operated stores (3,300), franchise stores 450), and has expanded its e-commerce effort over the last decade. We think the company’s strength lies in its brand, quality products offered at a reasonable price, delivered through an inviting brick and mortar footprint. From the perspective of style, the products offered are traditional with a bit of spin to keep up with a modern look.

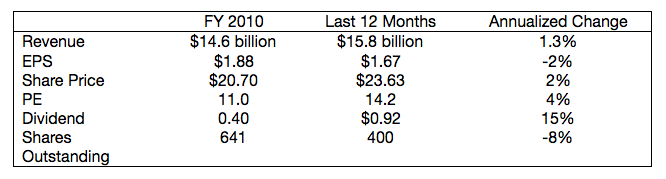

GPS is a very slow but steady financial performer. As a result, the typical institutional investor tends to ignore the company and this is reflected in the company’s share price. When other investors ignore a company, we get interested.

The company’s share price has not changed much over the last 6 years and neither has its sales. But this does not mean that patient investors have not been rewarded. Dividend per share started at $0.40 and grew at a 15% compounded annual rate to $0.92 currently. Since the company built out of its brick & mortar footprint is essentially complete, CapEx is limited to maintenance leaving plenty of free cash flow for dividends and share repurchases. Since 2010, the company bought back stock at an aggressive 8% annualized rate and it is only a matter of time before this begins to accelerate EPS and the company’s share price.

The company will be reporting Q4 earnings on or about February 23, 2017. The company hinted that their financial performance will be above current expectation as January sales (company’s fiscal Q4 ends in January) was up 2% from last year. Retail has been having trouble the last few years, but we think GPS will ultimately be a beneficiary of other retailers retrenching or closing down. While 1 to 2% revenue growth is not likely to ignite a fire under the share price, it does suggest there is little downside risk, making it an interesting situation for an options play.

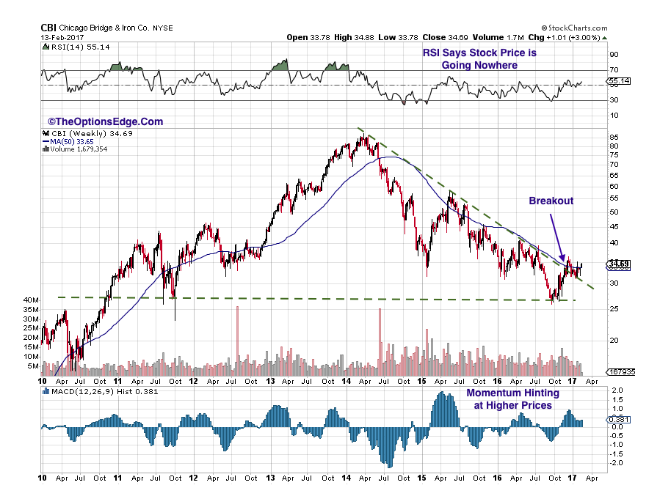

The chart above reveals that the company’s share price came down and touched levels not seen since the Q1-2012, and as far back as Q2-2009. We believe the selloff of 2015 was due to industry factors, not necessarily company specific ones. With the baby getting thrown out with the bathwater, we think this reflects negative sentiment driven by sector issues creating a potential investment opportunity. The company’s share price hit a near term bottom in Q1-2016 when the market as a whole hit a bottom as well. It then rallied strongly, eventually braking out above its short-term down trend. That rally was short lived and now the priced has come back to touch that trend line, which we think is now represents a support line.

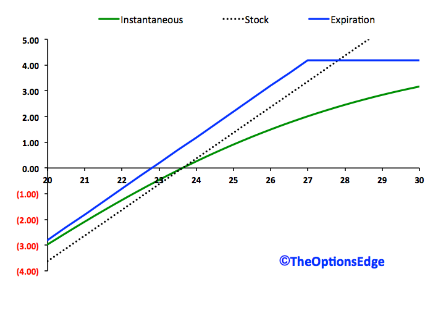

We look at the company’s valuation, the price action, and investor’s sentiment picture and believe the share price is more likely to rise than fall. If it does fall, it is probably not vulnerable to a substantial one. If you agree with our thesis there is more upside than downside risk, you might what to buy the shares or you may want to buy the stock and sell a call against it. With the stock trading at $24, selling the June $27 call leaves some room for some upside and dividend collection.

Buy 100 shares of GPS (24)

Sell 1 June 27 call at 1.10

To initiate this trade, the investor will pay $22.90 per share up front per buy-write. The breakeven price is the same figure, which is 4% below the current price. The efficient market hypothesis suggests there is a 67% chance of success on this trade, which is consistent with our view. Given our bullish view, we think an out of the money call makes sense. This give us an opportunity for a $3 capital gain on top of the $1.10 premium collected on the option sold, and the $0.23 dividend we expect to collect on or about 4-April-2017.