Last night on CNBC’s Mad Money, Jim Cramer had a great interview with General Electric’s (GE) CEO Jeff Immelt. Much of the conversation focused on how a CEO of a U.S, multi-national should navigate the challenges the new administration might place on doing business on a global scale, while also benefiting from potential headwinds from tax reform, de-regulation, and re-negotiated bilateral trade deals, watch here.

Cramer hit Immelt hard on the bear case for the stock, coupled with the stock’s poor year to date performance (down 6%), the massive under-performance of the stock relative to its peer group and the broad market since Immelt took over as CEO in 2001 (up 25% with dividend’s reinvested), group average (of 10 stocks) 440% and S&P 500 up 173%. His retort is that the company has been transformed during that time period, exited financial businesses and has actually out-performed the broad market over the last 5 years and the XLI over the last 2 years, and he seems fairly optimistic with stable energy markets the company should perform well in 2017, hitting double digit eps guidance, while also returning $20 billion to shareholders in buybacks and dividends.

Since Cramer brought up the 16 year performance I thought it worth taking a quick gander at the technical set up. With the stock just below $30, it’s now back at a level where the stock found its footing after the 3 year bear market in the early aughts and also a breakdown level in 2008 in the throes of the financial crisis. That breakdown ended in a peak to trough decline of 85% from its 2007 highs:

As for that five year performance that Immelt highlighted vs the group, I’d add that the August 2015 flash-crash low was $20, but since the late 2015 breakout to new highs, $28 has served as decent technical support, which also happens to be the intersection of the 5 year uptrend:

Despite Immelt’s optimism near term, investors obviously remain skeptical that the company’s 2% expected sales growth this year can translate into 10% eps growth. GE trades 18x that expected eps growth, about a market multiple which seems fair given their commitment to capital return, with a 3.25% annual dividend yield.

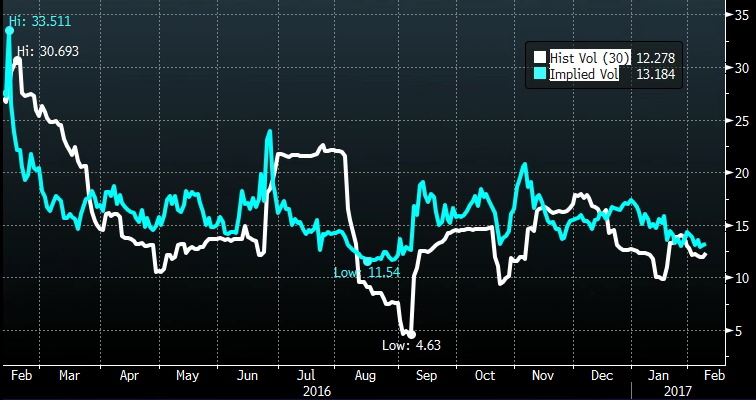

For those who think the bear case is out there, and think we get tax reform and some de-regulation this year and we also get reflation of global growth, with poor investor sentiment and management’s apparent enthusiasm, then GE should retest its 52 week highs at $33 in the not so distant future. But the under-performance of late should not be ignored, and that coupled with cheap options prices, defined risk strategies for those with a directional view make sense. 30 day at the money implied volatility (the price of options, blue line below) is very near the 52 week lows, and just a tick above 30 day realized volatility (how much the stock is moving, white line below), options look cheap:

So What’s the Trade?

Considering the poor sentiment we are inclined to play from the long side with defined risk. Cheap options prices make it easy to define risk.

The next identifiable catalyst for the stock will be Q1 earnings which are confirmed for Friday April 21st before the opening, the morning of April expiration. With the stock at $29.65, the April 30 calls are offered at 55 cents, or just less than 2% of the stock price, offering a break-even at $30.55, up just less than 3% from the current level. That’s a pretty cheap bet in itself with earnings that should keep vol bid and help offset decay. But we like offseting the even more in case it goes sideways for a bit. Either way you do it, it’s still a pretty dollar cheap contrarian bet.

Trade: GE ($29.65) Buy April 30 / 32 call spread for 45 cents

-Buy to open 1 April 30 call for 55 cents

-Sell to open 1 April 32 call at 10 cents

Break-Even on April Expiration:

Profits: up to 1.55 between 30.45 and 32 with max profit above 32 of 1.55 or 5.25% of the current stock price.

Losses: up to 45 cents between 30 and 30.45, max loss of 45 cents below 30, or 1.5% of the current stock price.