Back in early December we highlighted a bullish view on large cap pharma stocks (here). While it was not exactly contrarian at the time, the sector had given back much of its initial post election gains by December, as investors started to consider that drug pricing had become a bi-partisan issue. Since December we’ve seen some strenght in the shares and they are indeed back to the post election highs.

But it’s headlines like these that might have pharma and biotech shareholders considering taking recent gains, or at the very least lighten up on holdings and look for a better entry:

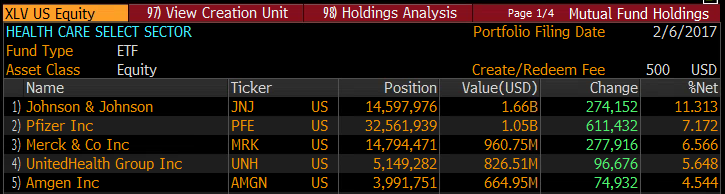

The XLV, the S&P Healthcare Select etf is dominated by the companies in the sights of the new administration, with the top 5 holdings making up nearly 35% of the weight:

Despite the uncertain headlines, and the weakness of its largest component (JNJ down 4% ytd) the XLV is up nearly 4%. But the technical set up pivotal, with the etf now approaching resistance at a level its has failed at on numerous occasions over the last year:

A check back to the uptrend that has been in place since early November could be in the cards (just below 70) with a break-below leading to a re-test of the Nov lows near $66.

Short dated options prices are cheap as chips, with 30 day at the money implied volatility (the price of options – blue below) just off of the real 52 week lows at 11.8%, just a tad above realized volatility (white below – how much the etf has been moving), making long premium directional trades attractive if one thought the underlying were about to move:

So What’s the Trade?

If you agree for a check back to the uptrend, and think there is a tape-bomb lurking that could send the etf back to the high 60s in the coming weeks, it makes sense to define ones risk...

Buy the XLV (71.50) March 24th weekly expiration 71.50 / 67.50 put spread for $1

- Buy to open 1 March 24th 71.50 put for 1.35

- Sell to open 1 March 24th 67.50 put at 35 cents

Break-Even on March 24th weekly expiration:

- Profits: up to 3 between 70.50 and 67.50 with max gain of 3 below 67.50

- Losses: up to 1 between 70.50 and 71.50 with max loss of 1 above 71.50

Rationale – this trade offers a good risk reward for a pullback in the etf, with a breakeven a dollar below where the etf is currently trading. IT can be worth up to $4 at or below If the etf were to breakout above resistance (recent highs around 72) a stop should be in place to limit losses.