Chipolte Mexican Grill (CMG) reports Q4 results today after the close. The options market is implying about a 5% one day post earnings move tomorrow, which is a tad shy of the 4 quarter one day post earnings average move of about 6%, and well below the 10 year average of 8%.

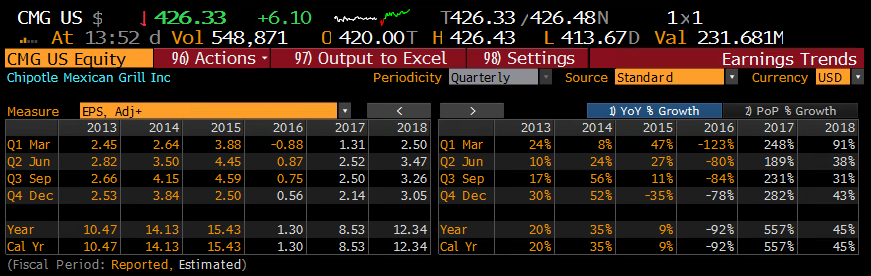

In my 20 year career in this business, aside from the dotcom implosion and the financial crisis, I have rarely seen the sort of eps implosion that occurred last year in CMG without some sort of fraud. We will know the final tally in a couple hours, but adjusted eps is expected to decline 92% in 2016 from its record in 2015, despite only a 13% expected year over year sales decline:

All that said, the stock appears to be doing its best to put a bottom in, as it approaches technical resistance at $450:

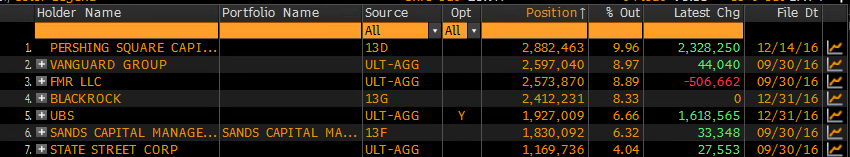

Oh and the entrance of activist Pershing Square, now the largest holder at 10% has certainly helped sentiment, and the fact that the top holders represent a little more than 50% of the shares outstanding suggest most of the fast money may be out of the stock:

And lastly, the stock has 18% short interest, and Wall Street analysts still kind of hate the stock with 10 Buy ratings, 20 Holds and 7 Sells, with and average 12 month price target of $400, below where the stock is currently trading.

Add it all up, and the slightest bit of good news and this stock is a coiled spring!

So whats the trade??

For those that would like to catch a breakout from this consolidation while giving a little room on the downside in case of another move lower, a risk reversal does just that:

In Lieu of 100 shares of CMG (425) Buy the March 400/450 risk reversal for even

- – Sell 1 March 400 put at 8

- – Buy 1 March 450 call for 8

Rationale – If the stock is between 400 and 450 on March expiration this position is like a nothing done. Below 400 you are put the stock, down $25 from the current level and you have losses below that level. $25 higher in the stock and you are long and participate in any gains above that as if you are long stock. This is a good strategy for those looking to do a little bottom feeding in a beaten down stock but one that is off the lows. You’re a buyer below on a decline, and a buyer above on a breakout. For those not allowed to sell naked puts the short put can be a short put spread, but whatever is paid for the lower put is the new cost of the trade, and that money would be lost between 400 and 450.