Overwrite a Call on Interpublic Group of Companies (IPG) on Favorable Valuations & Volatility

The Interpublic Group of Companies, Inc. (IPG) is a global advertising agency. Businesses large and small use IPG’s services to communicate and educate their customer, and build the value of their brand in the consumer’s mind. More specifically, the company offers consumer advertising, digital marketing, communications planning and media buying (TV, radio, print) and public relations. It also provides various specialized services such as meeting and event production, sports and entertainment marketing, brand building, and strategic marketing consulting. The company was formed through the consolidation of independent ad agencies over the past few decades. The company was incorporated in January 1961. In the last 12 months, IPG generated $0.55 billion in profits on $7.7 billion in revenues.

The price action of IPG is not one we see every day. The share price is moving decisively higher, but doing so at an ever-slowing rate along with contracting volatility. This suggests to us that the investor base may be shifting from growth investors to value and income oriented investors. Both the RSI and MACD are telling us that upside momentum had faded away. Normally, this kind of price action would tell us to be cautions. But the valuation picture would suggest consolidation rather than a reversal in price trend. So we expect sideway to modestly positive price action until such time the company is able to find the next growth opportunity.

Valuation and cash flow are supportive of a mildly bullish case. The shares are priced at a PE of 18 based on a trailing 12-month basis, and 16 based on analyst’s expectations of next year’s earnings. EV/EBITDA is a modest 10 and the company generates a healthy 5% return on assets and 27% return on book equity. The beauty of the advertising business is that it is asset light. As a result, IPG does not have large CapEx requirements. This allows the company to pay a generous dividend of $0.60 (2.5%) per year while repurchasing about 2% of the company’s outstanding shares per year at the same time.

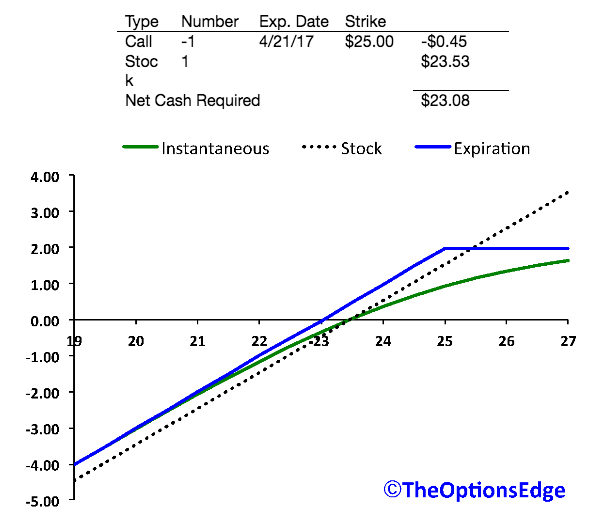

The company will be reporting their financial performance on or about 10-February-2017. The consensus EPS estimate is $0.66, which is the same as Q4-2015. We are not expecting this to move the shares one-way or the other. With the stability of the company’s financial performance, current valuation and lack of share price momentum, we think IPG is an ideal candidate for a buy-write. With the structure proposed below, this strategy will allow investors to capture a dividend, augment that dividend with some option premium, while leaving a little room for modest capital gains. With the stock trading at $23.53, we suggest the following structure.

Unless there is bullish earnings surprise, we do not expect the shares to rise about the $25.00 strike by expiration and get called away. This is because the realized 20 day volatility is about 18%, while implied volatility is about 28%, suggesting the options are a bit expense. iVol is often elevated a bit is short dated options before earnings, but this volatility looks to high to us for a 3 month option. As a bit of perspective, iVol has fallen in a range of 19% to 43% in the past year.

To initiate the trade, the investor will pay $2,308 per structure (sell 1 call, buy 100 shares of stock). The break-even level on this trade is $22.93 (including the expected dividend), which is about 2.5% below the current price of the stock. The cushion provided by the option premium and the expected dividend enables a probability of success of 54%. Like all buy-writes, this is a yield strategy. If the options expire worthless and the stock is not assigned, the investor earns an annualized yield of about 11%.