United Parcel Service (UPS) will report their Q4 results Jan 31st before the open. The options market is implying about a 2% one day move following the report, which is rich to the stock’s trailing 4 qtr average one day move of less than 1%.

Shares of UPS are up 33% from its Jan 2016 lows, and up about 2% on the year, out performing the the S&P 500 (SPX) by 700 basis points during that period but matching its performance year to date.

UPS trades at 20x trailing eps, and 19x expected 2017 eps growth of 6%, extremely rich to peer Fedex Corp (FDX) that trades 16x expected F2017 eps growth of 11%.

Both UPS and FDX topped out at new all time highs in mid Dec prior to FDX’s fiscal Q2 results on Dec 19th that sent the shares lower by 3.3% the following day after weeks results in their ground delivery business with greater than expected spending on logistics and distribution centers.

Aside from rich valuation, two weeks ago, Barron’s highlighted potential headwinds to UPS business in 2017 emanating from what appears to be a brewing trade war between the new administration in the U.S. and trading partners like Mexico and China:

The bigger unknown is the growing sentiment against global trade, which accounts for about a third of the shipping giant’s earnings. In the worst case, the fallout wouldn’t just ding the company’s profitable international-parcel business; it would trigger a broader increase in the cost of goods, crimp consumer spending—and damage e-commerce sales.

Even in a less-drastic scenario, it is likely that the Trump administration will pull out of the Trans-Pacific Partnership, eliminating a source of future earnings growth for UPS, says Loop Capital analyst Rick Paterson. He has covered the company for more than a decade and has a Hold rating on the stock.

Let’s not forget the double edged sword of Amazon.com (AMZN), they have been a massive boon for UPS and FDX, but AMZN has made it pretty clear they plan to compete with FDX and UPS with Prime Air (and eventually drone delivery) in the not so distant future.

For the very near term though, shares of UPS could pull back to the post election breakout level on the slightest bit of bad news that is likely squishy forward guidance:

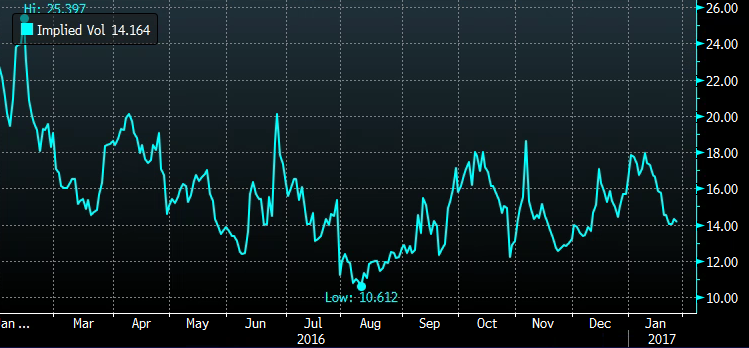

Short dated options prices are pretty fair in UPS, with 30 day at the money implied volatility at 14%, making long premium directional trades fairly attractive for those with short term conviction:

So what’s the trade? If you agree that weak guidance, especially emanating from any uncertainty around US trade policy could cause shares of UPS to pull back in the coming weeks to its Nov breakout level near $112, then consider the following defined risk strategy:

UPS ($117.75) Buy Feb 118 /110 put spread for $2

- Buy to open 1 Feb 118 put for 2.25

- Sell to open 1 Feb 110 put at .25 cents

Break-Even on Feb Expiration:

Profits: between 116 and 110 of up to 6

Losses: up to 2 between 116 and 118 with max loss of 2, or 1.7% above 116

Rationale: This trade defines risk to less than 2% of the underlying but can make up to $6 if the stock is at or below 110 on February expiration. It starts slightly in the money so it’s breakeven is not too far away at 116. With only a few weeks until February expiration it is a bit binary as a large move higher could make it worthless but the risk reward accounts for that as a large move lower will be favorable risk reward.