Who Will Win the Tug of War in the Oil Markets, The Bulls or the Bears?

Until recently, the oil markets had been front and center in investor minds. Recall that the price of oil began to collapse in the middle of 2014. At that time, the consensus view was that the price was going higher. People pointed to issues like production cuts in the North Sea due to depletion as a reason for tight supplies in the future. At the same time, many commentators said their would be plenty of oil due to the shale oil boom, but one would simply have to pay higher prices for it. Major integrated oil companies like Chevron Oil Group raised the price deck they used to evaluate new projects from $79 to $110 for Brent crude (Financial Times 11-March-2014). We do not mean to pick on Chevron. CBCNews reported that gasoline prices would likely go higher on 15-April-2014. GasBuddy.Com, a group that collects and reports the price of gasoline at the retail level, predicted gasoline would rise by 0.15 to $0.49 above its current price of $3.30 (CNBC 12-February-2014). Then there were articles like this one from TheGuardian.Com titled “Write-down of two-thirds of US Shale oil explodes fracking myth” (22-May-2014).

But oil prices eventually respond to short-term supply/demand issues and while putting the long-term fundamental factors the bulls were pointing at to justify their predictions on the back burner. In Q3-2014, the price of oil began an aggressive selloff. Price eventually bottomed in Q1-2016 as the last of the bullish speculators was squeezed out of the market.

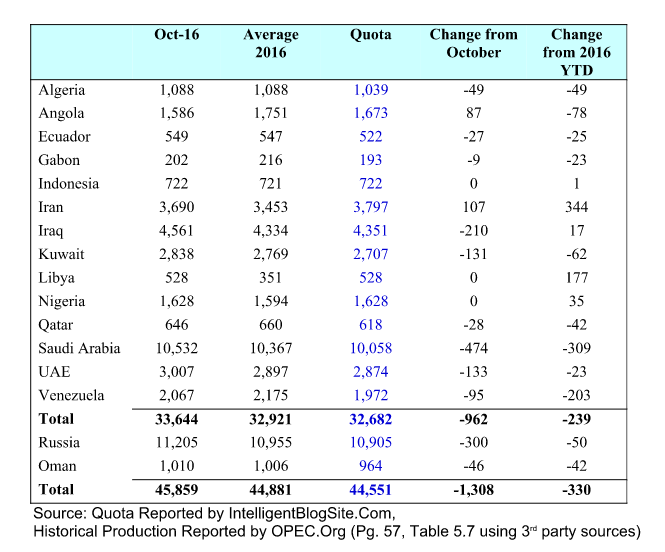

Since that historic bottom when the price traded in the mid 20s, oil has had a sharp rally. Prices began to consolidate when in 30-November-2016, OPEC agreed to production cuts to reduce above ground supplies. This caused the price of oil to rip higher by about 11% in just a few days. The headline number was OPEC would cut production by 1.2 million barrels a day. Our analysis at the time was that the cut was not that big, just 0.33 million barrels a day. The following table summarizes our analysis.

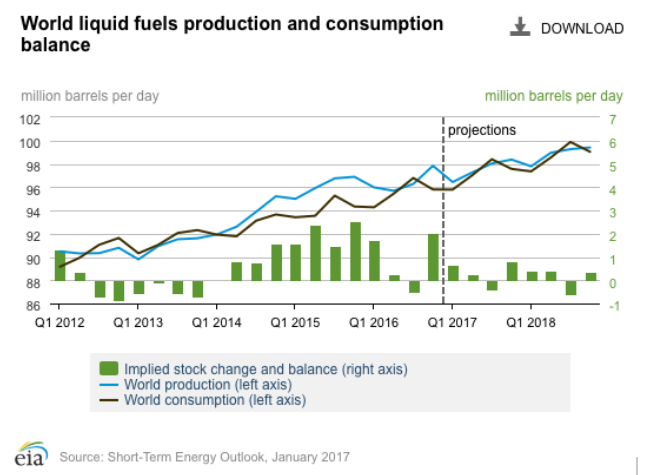

Ever since the price rip after the OPEC announcement, the price of oil has struggled to move higher. We believe the “puffery” around the production cut is one reason price has struggled to move higher. Another reasons for a stagnating price is the growth in production of shale oil in the United States. Put this together and the Energy Information Agency confirms there is still a production glut in the short-term.

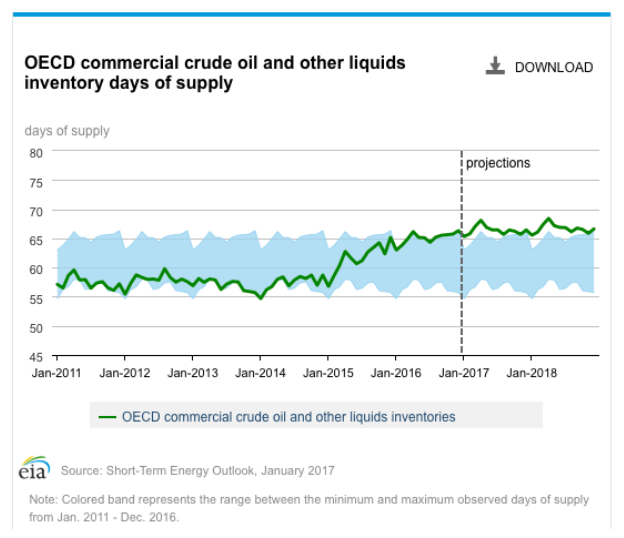

It is clear the production cuts have not had an effect on above ground supplies in storage for OECD countries. Nor does the EIA think it will have an effect over the intermediate term. As the following shows, they predict above ground supplies will remain elevated for some time.

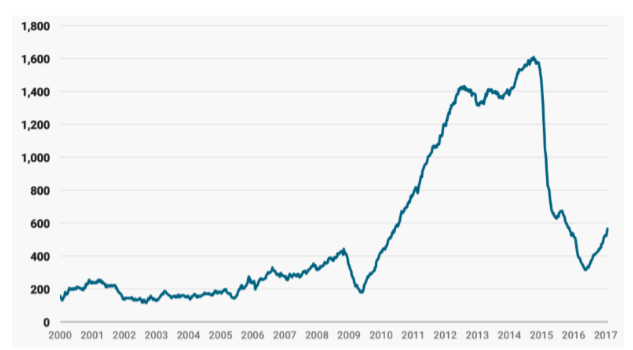

The shale oil producers have found a way to reduce the cost of production, particularly in the Permian Basin (i.e. West Texas). The chart below shows that the number of rigs working to produce oil and gas is rising at a nice clip. The number of oil rigs grew by 15 to 566, and the number of gas rigs, which produce natural gas liquids in addition to natural gas, rose by 3 to 145.

Source: Baker Hughes

When we look at the supply fundamentals, we think the price of oil should probably fall. When we look at the chart for the price of oil, we see the potential of a diagonal triangle forming. This is an ending pattern and when complete, price should fall to at least the origin of the formation. That would suggest that the price of oil could fall in to the $38 to $40 range once a price breakdown get under way. The timing of this is a bit tricky. There needs to be another down-up sequence for the ending diagonal pattern to complete. It is also possible that the rebound in price from the Q1-2106 low is complete or nearly so. This has more near term bearish implications.

In the final analysis, we think investors need to remain vigilant and keep a sharp eye on their exposure to oil the commodity, the Exploration & Production companies that make a living producing oil and gas along with the Oil Service companies that help the E&Ps. Our analysis suggests the price of oil could roll over at any time.