United Rentals, Inc. (URI) Well Positioned for the Government’s Infrastructure Rebuilding Plans

United Rentals, Inc. (URI) is an equipment rental company organized into two operating Segments. (1) The General Rentals segment rents and leases construction and industrial equipment, such as backhoes, skid-steer loaders, forklifts, earthmoving equipment, and material handling equipment; aerial work platforms, such as boom lifts and scissor lifts. They also rent general tools and light equipment such as pressure washers, water pumps, and power tools. This segment serves construction and industrial companies, manufacturers, utilities, municipalities, and homeowners. (2) The Trench, Power, and Pump segment rents specialty construction products, such as trench safety equipment, line testing equipment for underground work, power and HVAC equipment, electrical distribution equipment, and temperature control equipment; and pumps primarily used by energy and petrochemical customers. This division serves construction companies involved in infrastructure projects, municipalities, and industrial companies. The company also sells some of the same equipment is rents as well…

URI is in the sweet spot of the federal government’s infrastructure building program. Yesterday, the President signed an executive order easing the regulatory burdens to building pipelines and put the go ahead in place of the Keystone and Dakota Access Pipelines. He also signed orders instructing the Commerce Department to streamline their approval process so that manufacturers can get their permits in a matter of months instead of years.

The share price of URI responded very positive to these events. It popped $3.50 or 3.18% on the back of this news. In a market were so many of the blue chip names trade with PEs in the low to mid 20’s, URI trades at a comparable discount. Its PE is about 18 on a trailing 12 months basis and 13 based on analyst’s expectations of earning over the next 12 months. With infrastructure expected to rise, analysts are expecting 20+% earnings growth in the year ahead. With that kind of growth ahead of it, URI should be trading on par or at a premium to the median company in the S&P500. The valuation story looks compelling.

The technical picture looks pretty good as well. In the final analysis, the technical picture is one of momentum. The share price is trading in a bullish multi-year trend channel and the shares have rallied sharply since the market scare that occurred at the beginning of 2016. After a consolidation, it looks like the share price wants to trade higher in the year ahead.

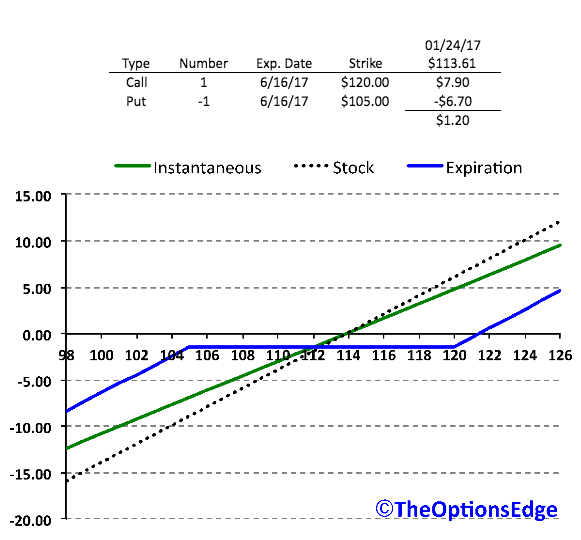

If you agree with this thesis, we think the shares of URI would make a nice addition to a well-diversified portfolio of common stocks. But if one prefers to define their risk using options, one might consider buying a bullish risk reversal as a stock replacement strategy. With the stock trading at $113.61 (last night’s close), we like the following structure in lieu of 100 shares of stock:

To initiate this trade, the investor will pay a nominal $120 up front per risk-reversal. The June 2017 expiration was selected to give the trade time to develop. We thing the story develops over time if investors are convinced the government will follow through on the promise to make the investments necessary to improve the infrastructure of the US. As projects are announced, we think URI will trade higher. The breakeven level is $121.20, which is 6.6% above the current price. The efficient market hypothesis suggests there is a 34% chance of success on this trade. This makes sense, as the share price has to rally over the strike price of the upside call before it becomes profitable at expiration. The benefit of this structure is that it outperforms stock on the downside, and there is a modest debit upfront. If the share trade at $105 at expiration, one would only lose the premium paid to initiate the trade. If one held the stock, one would lose $8.61. Any close on expiration between $105 and 120 means the $1.20 paid is lost.