Something fairly extraordinary happened yesterday. AppDynamics was on the eve of their hotly anticipated IPO that would value the company near $2 billion. Now there won’t be an IPO. Because AppDynamics was bought by Cisco Systems (CSCO) for nearly 2x the IPO range, and nearly double AppDynamics’ latest private fund raise from late 2015. What’s shocking about this acquisition is the timing. Also, m&a had been ruled out by AppDynamic’s bankers on its road to IPO, per TechCrunch:

Although many companies seek acquisition offers in the months leading up to an IPO, also known as a “dual-track process,” that wasn’t what happened with this one. Investment banking firm Qatalyst, decided to play matchmaker and floated the idea to Cisco, a source with knowledge of the deal tells TechCrunch.

On a side note, AppDynamics was expected to be the first tech ipo of 2017, and one of the largest deals in months. This deal was widely thought to be a little warm up to the main event, Snapchat. Snapchat will soon hit the road to tell its story to investors in the coming weeks, with an IPO as soon as March. But does the Cisco deal provide the playbook for Google or Facebook to make a knockout bid for the mobile social media property before it IPOs?

CSCO’s buy of the cloud based application performance management company seems to mesh with a handful of software acquisitions of the last few years on a strategic transition towards cloud-based software and services. CSCO CEO Chuck Robins explained the intent of the deal to CNBC this morning as an attempt to combine the (watch interview here):

“synergies between application analytics they can drive and infrastructure analytics we can drive across both private and public clouds”

Robbins highlighted the company’s rapid revenue growth, but failed to mention their mounting earnings losses on those sales, per Forbes:

AppDynamics — which faces competition from many places including New Relic — is growing fast and losing bundles of money. For the nine months ending September 2016, AppDynamics’s revenue grew 56% to $158 million and it lost a whopping $95 million according to its prospectus issued December 29.

But they face a massive revenue opportunity:

AppDynamics is going after a $12 billion market. The company believes that its “application intelligence software platform replaces legacy products across various well-established categories of IT spending.” Gartner, estimated that the IT operations market in 2016 would be $23 billion and the business intelligence and analytics market would reach $17.1 billion — resulting in a total addressable market (TAM) of $40.1 billion. AppDynamics targets a segment of that TAM — global companies with greater than $50 million in annual revenue in 2015 — totaling $12 billion, according to its prospectus.

While $3.7 billion is no small chunk of change, CSCO has $71 billion in cash on their balance sheet ($36 billion net of debt), and should be a massive beneficiary of proposed tax reform that will include cash repatriation.

Back on Nov 15th CSCO reported fiscal Q1 results and guidance that was met with investor disappointment. The stock declined 5% the next day with mixed results from key product segments. They blamed much of the weakness on the macro environment, per Barron’s Online:

Switching sales declined 7%, year over year, to $3.72 billion. Revenue from “Next-generation-networks” routing products was up 6%. The company’s “collaboration,” “data center,” “wireless,” and “service provider video” categories all declined, but security products revenue was up 11%.

CSCO will report FQ2 results on Feb 15th. I suspect that this deal today, the timing and the premium paid is done from a position of strength and optimism. That does not mean that they are going to post a huge beat and raise, but for a stock that has traded most of the last seven months in a $2 range, we could be poised for a breakout on the slightest bit of good news. $30 is important technical support dating back to early 2015:

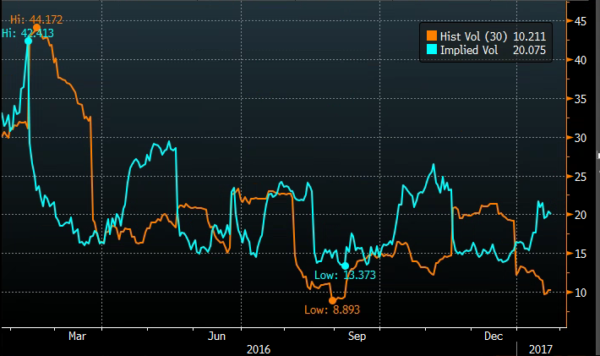

Short dated options prices appear cheap with 30 day at the money implied volatility (blue below) at 20%, but trading at a massive spread to realized volatility (brown below, how much the stock is moving) at just 10%, making long premium directional strategies challenged:

With the stock at $30.70 the Feb 17th (will catch earnings) 30.50 straddle (call premium + put premium) is offered at about $1.35, if you bought that, most of which is for earnings, and thus the implied move between now and Feb 17, you would need a rally above $31.85, or a decline below $29.15, or about 4.4% in either direction. That is basically in line with the 4 qtr one day post earnings average, but below the 10 year average of about 6%. The move appears fair.

So what’s the trade?

If you are long or inclined to be long, think the implied movement seems fair between now and Feb expiration, then defining your risk with long calls seems like the way to play.

In Lieu of 100 shares long at $30.75, buy to open 1 Feb 31 call for 55 cents, or 1.8% of the stock price.

Break-Even on Feb expiration:

Profits: above $31.55

Losses: of up to 55 cents between 31 and 31.55 with max loss below 31.

Rationale: this trade defines risk to less than 2% of the stock price, stops you out at key technical support near $30, and offers a favorable risk reward for a breakout to the 10 year high up towards $34: