Volatility Speaks: But what is the Message?

In an efficient market, expected returns are a function of market risk as measured by the standard deviation of returns. Implied volatility on market indexes, such as the S&P500, or the Russell 5000 is an estimate of the investor’s expectation of volatility over some defined time period. The VIX Index is the industry standard measure for an unbiased estimate of future volatility on the S&P500.

It is important to realize that one cannot trade the VIX directly. It is simply a representation of the market expectation for volatility over the next 30 days. It is calculated and quoted by the Chicago Board Options Exchange (CBOE). To capitalize on the fluctuation in volatility, one can only do so through derivatives (such as VIX futures and options) or by gamma scalping S&P500 options against futures contracts.

VIX tells us something about investor uncertainty and risk aversion, both of which fluctuate over time, and driven, at least in part, by emotion. When the VIX is high, investors are typically cautious or scared. When VIX is low, investors are typically confident or complacent…

The movement in volatility provides some explanation of the dynamics of asset prices. When the VIX is rising, so are risk premiums. These higher risk premiums demand higher expected rates of returns. To get those higher rates of return, the price of the asset must fall. Assume for a moment that S&P500 is priced at $2270 and that investor expectation suggests that 6% annualized rate of return over the long term, with an annualized volatility of 15%. Now assume that investor expectation changes and they now believe volatility will be 20% over the long-term. If we assume investor risk aversion, earnings and interest rate expectations remain constant, investors would probably demand an expected rate of return of 8% (6% x 20% / 15%) going forward. As a result we should see equities fall by 33%. We would expect the opposite to occur if investor expectations changed to a lower level of volatility. This is indeed what we see in the market place. When stock prices go up, VIX will be falling at the same time. When stock prices are falling the VIX index generally rises.

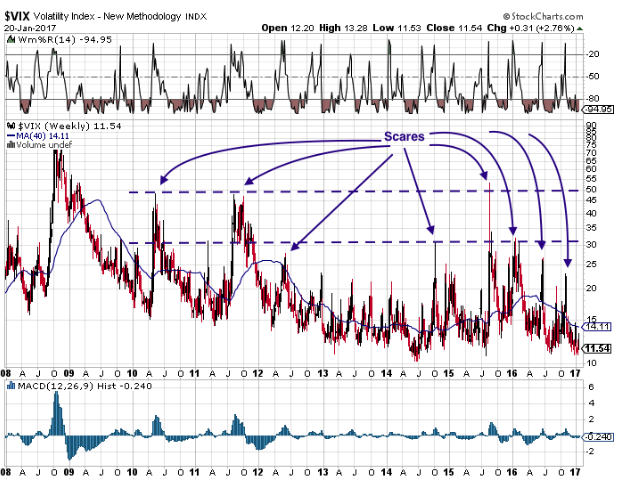

The markets and the economy have been in recovery mode since the end of the financial crisis in in 2009. There are been a few scares along the way, to be sure. But those scares were short lived. The chart below shows that after the financial crisis, the markets went through 8 scares, but these volatility spikes did not last long.

Throughout this time period, the VIX averaged 21% with a 10% standard deviation. There was a big skewness to higher volatility as well. The absolute high was 79% and the lowest reading was just 10.3%.

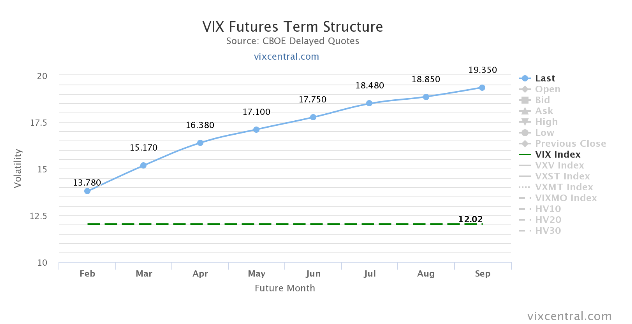

The term structure of volatility is very generally upward sloping. This is a condition known as Contango. Contango is typically a reflection of the cost of carry. The more it cost to store and insure a commodity, the higher the forward price of that commodity. In the case of the VIX, the term structure is a reflection of risk premiums or the cost of hedging as people tend to price long-term volatility higher than short-term volatility.

Contango is what creates a cost for holding a futures contract. Let’s say you bought the April VIX futures contract at 16.38%, held it for a month and nothing happened. You could sell that futures contract at 15.17%. In doing so, you would take a loss of 7.4% (1-15.17/16.38). This is the cost of using a VIX futures contract as a hedge.

Contango is what creates a cost for holding a futures contract. Let’s say you bought the April VIX futures contract at 16.38%, held it for a month and nothing happened. You could sell that futures contract at 15.17%. In doing so, you would take a loss of 7.4% (1-15.17/16.38). This is the cost of using a VIX futures contract as a hedge.

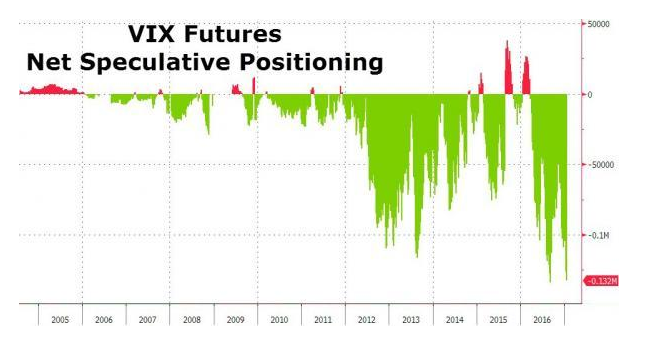

Investors can either buy insurance or sell insurance, and it seems speculators are selling insurance in droves. The chart below shows the net position of speculators in VIX futures. This data comes from the CFTC (Commodities Futures Trading Commission).

This chart is telling us that speculators believe the equity markets will be trading flat to higher over the foreseeable future. They believe they can sell insurance against a price drop in the price of equities with little risk of loss. They expect to collect some gains as the position rolls down the curve. We have done this trade in the past by taking a very small short exposure by selling out of the money calls on VXX, which is an EFT that holds short-term VIX Futures contracts. Anyone buying or selling VXX should do so in very small size. It is not uncommon for short-term VIX futures to trade with volatilities more than 5 times that of individual stocks. It is very easy to get run over.

We are not suggesting anyone take a position, long or short at this time. It is entirely possible that a sharp correction is due after such a strong post election rally. If this is the case, there could be significant short covering that would roll over anyone that is short VIX Futures. It is also possible that the markets will stay in low volatility mode in which case the longs will pay time decay as their position rolls down the term structure. We bring this issue to your attention as a potential indication of investor complacency. When we see large positions in the Futures market, we know that at least the fuel is in place for a sharp move, and this is one of those times.