In the Precious Metals Arena, Choosy Investors Prefer Platinum

Trading commodities is a very tricky endeavor on the very best of days. While one can make an attempt to interpret the supply (production, recycling, etc.) and the demand (industrial production, food production, investment, etc.) picture, it is very difficult to do so in real time. It is particularly difficult with the precious metals. Physical gold tends to be bought and put away. Paper gold (futures, options & ETFs) is a vehicle for trading. The global inventory of gold tends to rise year-by-year. While gold is used in electronics, it is only used in special cases where conductivity and corrosion resistance is of paramount importance. At the end of the day, very little gold is used in production. What little is used gets recycled at the end of the products life. What drives the price of gold is fear of inflation, economic disruption, faith in government, central bank portfolio policy, etc.

Central banks use gold as a reserve asset. Depending on their interpretation of economic and political events, they change their allocation to gold, trading it for government bonds. We think one of the big drivers of the price of gold comes from the actions of investors and traders attempting to capitalize on its price movements. Given the opacity of data associated with the trading of gold, price action is governed by emotions, at least on an intermediate term basis as much as it is by investor interpretation of the fundamentals…

As you can from the chart above, we can see that gold has been in a contained downtrend since its intermediate term peak established in August 2016. Ever since the beginning the middle of December, gold has had a strong move higher. It is worth watching this trend to see if it breaks about the upper trend line. If it does, this would represent a breakout and a positive sign for the bulls. A rejection at this trend line would be negative. If the price of gold is gong to breakout, the RSI and MACD suggest there could be a pause or a pullback before that occurs.

Silver is the poor man’s gold as it trades for a fraction of the price of gold. Silver is used far more as an industrial metal than a precious metal. Historically, silver is used in electronics, medicine, photography, mirrors, heat resistant ball bearings, silverware, just to name a few. Silver is no-longer used in photography, but silver is still in a tight supply/demand balance because of it industrial uses. One of the biggest uses of silver now is in the production of solar panels. A typical solar panel can have as much as 20 grams (0.7 ounces) of silver layered on it. In the final analysis, silver acts as a precious metal due to its history in coinage and an industrial metal because it is used in so many products we use everyday. As a result, one should expect the price action of silver to be correlated with gold, but not move in lockstep.

As you can from the chart above, silver has also been in a contained downtrend since its intermediate peak in August in 2016. And just like gold, it started to move higher in the middle of December. Until a few days ago, it was trading a bit weaker, but has now caught up. This is rather curious. If the $1 trillion infrastructure spend the new administration advocates comes to pass along with a renaissance of manufacturing, one would have thought the price of silver might outpace the price of gold. But this is not the case, as they are trading together. This provides us with a valuable lesson. It is always important to judge an investment thesis against what market prices are doing to confirm or refute that thesis. One should take pause if the price action does not support ones thesis.

Platinum is also an industrial metal. It is primary used as a catalyst in chemical processes, such as those that take place in oil refineries and chemical plants. The most common use of platinum (and palladium for that matter) is in the catalytic converter that cleans automobile emissions. Like gold, platinum is recycled after its use. Platinum is also considered a precious metal due to its scarcity and many investors own platinum in addition to silver. As a result, the price of platinum is correlated to the price of gold. But like silver, it will no move in lockstep with gold.

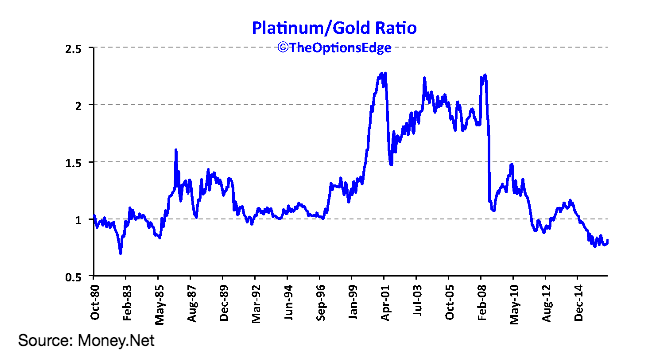

The chart above shows the ratio of the price of platinum to the price of gold. Over the past 35 years, palladium has traded at a premium to gold 21% of the time, and the average premium was 29%. Where it stands today is a different story. Platinum is trading at a 19% discount to gold. If there is any reversion to the mean, platinum should handily outperform gold in the years ahead. There are good reasons to expect a reversion to the mean. Amount of platinum mined each year is only about 10% of the amount of gold production. Furthermore, the all in cost of mining platinum for a typical mine is about $1000. With platinum trading below that level, there is little reason to open or expand a mining operation.

The technical picture of platinum is much clearer than gold. After the precious metals peaked last year, platinum fell in a contained trend channel. Price broke out of that channel. Then price traced out a contracting triangle pattern. Contracting triangles are ending patters, which come along at the end of a move. The trend change is confirmed with price breaks above the upper line of the triangle. As you can see, the price of platinum as blown through that line and has signaled that the path of least resistance is higher. After such a swift short-term move, we would expect a pullback before the next leg higher, and this is indeed taking place. Once complete, we expect platinum to outperform gold and silver.

If you are bullish the precious metals and want an allocation to this asset class to balance out your portfolio, investors should consider platinum in their precious metals mix. One can take a position in platinum with an ETF called Physical Platinum Shares (PPLT). Self directed, retail options traders are out of luck. There is not a good liquid options market alternative to construct an allocation with limited risk.