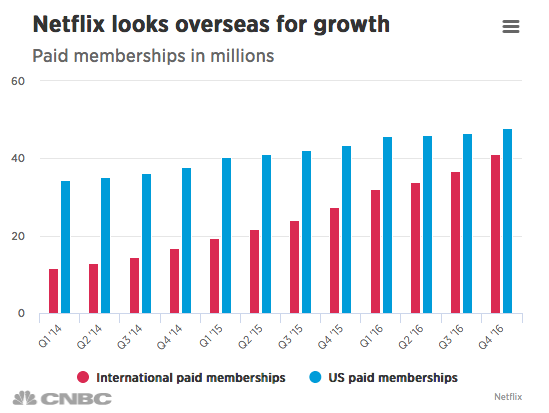

Two days ago we previewed Netflix (NFLX) Q4 earnings and detailed two trade ideas, one as a hedge for those long the stock, and another a defined risk trade for those looking to play for a breakout but worried about a failure at the all time highs. Netflix is higher on the report, with international subscriber growth a big factor:

The company said it added 7.05 million subscribers during the fiscal fourth quarter. Not only was that figure well above its own expectations of 5.2 million, but Netflix said it was the largest-ever quarterly subscriber growth in its history.

For the quarter, Netflix added 1.93 million memberships in the U.S. and 5.12 million internationally. Those figures came in well above the streaming giant’s forecast that it would add 1.45 million subscribers in the U.S. and 3.75 million subscribers internationally.

Analysts expected subscriber numbers to come in slightly below those levels, about 1.44 million in the U.S. and 3.73 million internationally, according to StreetAccount consensus estimates.

The stock is above 140 on the report so let’s check in on the trade ideas.

First, the hedge:

Hedge vs 100 shares of NFLX (133.30) Buy the Jan 123/108 put spread, 150 call collar for 1.00

- sell 1 Jan 150 call at 1.00

- Buy 1 Jan 122 put for 2.20

- Sell 1 Jan 108 put at .20

This was January expiration, with a call sale above the implied move. The idea here was to spend the smallest amount for decent disaster protection, while giving enough room on the upside to not be called away in what looked like a chart that could easily break out. With the stock 140.50 it worked out precisely how you want a hedge to work, costing $1 for the protection but with gains in the stock of $7. The 150 calls are offered at .04 and can be closed for those worried about a run towards that level before tomorrow’s close. The put spread can just be left on.

Now to the stock alternative. Here was the trade idea:

Stock Replacement/Alternative to 100 shares of NFLX (133.30) Buy the Feb 130/155/180 call fly for 6.75

- Buy 1 Feb 130 call for 9.50

- Sell 2 Feb 155 calls at 1.50 (3.00 total)

- Buy 1 Feb 180 call for .25

This trade looked out to February and was a call fly to best define risk (and lower the amount spent). Because the mid point was 155 though, it would do better on a small move higher than a tighter fly. With the stock at 140.50 the fly is worth about 10.50, or almost $4 in gains versus the $7 gains in the stock. That’s pretty good for having defined risk. As far as trade management, it’s really a stock call at this point. The Feb fly is about 60 deltas here. As we get closer to Feb expiration those deltas will approach 100 and it will be like being long stock. Of course 10.50 is now at risk rather than the initial 6.75, without an event on the horizon, so defining risk may not be as important now. For those looking to reduce some delta exposure, the fly strikes can be adjusted or the entire thing can be turned into a call vertical, like the 140/150, which would book profits while keeping long exposure in case the stock makes a run to 150 over the next month.