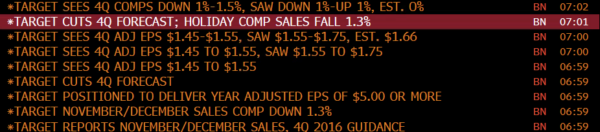

Yesterday shares of Target (TGT) declined 5.5% on a disappointing Q4:

I think Jeff Macke’s tweet speaks to the magnitude of the pre-announcement and the sell-off:

$TGT guides lower 2mo 2 days after guiding higher. Ecommerce still <5% total biz. Did they think $AMZN was going away? (Earnings hits…) pic.twitter.com/lLbRK2sxCG

— Jeff Macke (@JeffMacke) January 18, 2017

Eye-balling the stock’s wild ride over the last year you see just how bad Target is at guidance:

5% plus gaps lower following results says management’s visibility beyond a couple months is either useless or intentionally bad.

Technically speaking, $65 is important technical support for TGT dating back to 2012:

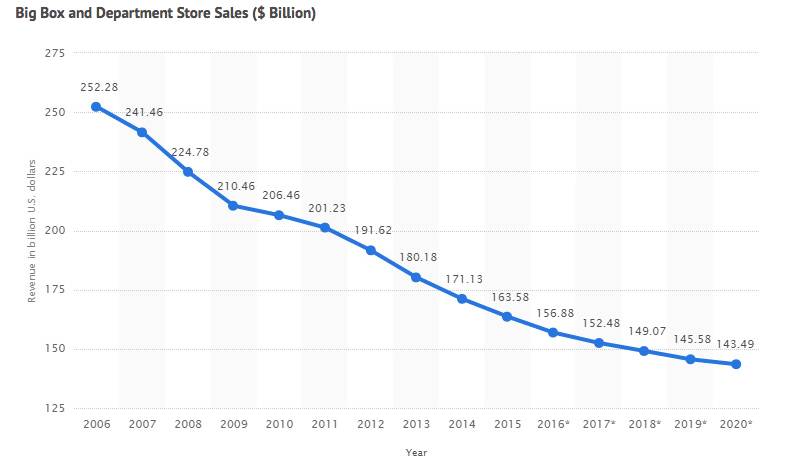

Obviously, all box store retailers have felt the heat from Amazon. A recent set of charts from VisualCapitalist that marked the end of 2016, demonstrate just how much has changed in the past few years:

But what’s also shocking is that TGT’s market cap now half of their 2016 sales of almost $71 billion. That $71 billion is half of Amazon’s (AMZN) $137 billion in sales, yet Amazon (now) sports a market capitalization of $384 billion. The market is forward looking and it doesn’t think this trend will slow.

So what can Target do? They still do 95% of their sales in their stores. I suspect TGT will be forced to spend in 2017, the way Walmart did in 2016. Walmart paid $3.3 billion for Jet.com, a two year old ecommerce company that had less than $200 million in sales last year. They also sold their online business in China to JD.com, the number 2 retailer in the country behind Alibaba, and doubled their stake in JD.

For the stock now, weak earnings and sales, coupled with the strong potential for greater spending means continued pressure on the stock and a possible breach of long term support in the not too distant future.