Event: Wireless semiconductor company Skyworks Solutions (SWKS) is scheduled to report fQ1 results tomorrow after the close. The options market is implying about a 5% one day post earnings move which is a tad shy of the 4 qtr average of about 5.5% and well shy of the 10 year average of 8%. With the stock at $78, the Jan 78 straddle (the call premium + the put premium) is offered at about $4.25, if you bought that and thus the implied earnings move (most of that is being priced for earnings) than you would need a rally to $82.25, or a decline below $73.75 to just break-even on Friday’s close.

SWKS stock moves have been fairly tied to the smartphone industry, their three largest brand customers are Samsung, Apple and Alphabet. But the company, like most in the PC and Smartphone supply chain are desperately trying to diversify into emerging technologies, like autonomous cars. For now the company has to settle for 5% of their sales coming from autos driven by boring real people.

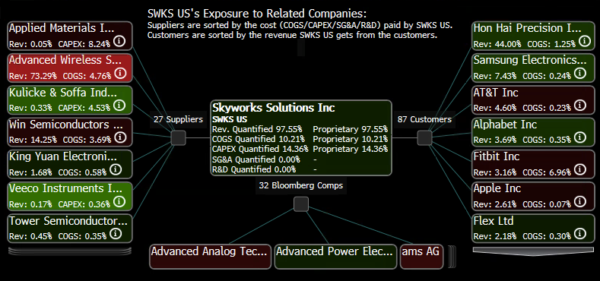

A quick gander at their revenue exposure away from the big brand names and you see 44% of sales come from the Taiwanese contract manufacturer Hon Hai Precision:

[caption id="attachment_69543" align="alignnone" width="600"] Bloomberg[/caption]

Bloomberg[/caption]

As Bloomberg noted last week, Hon Hai saw its first year over year sales decline last year, with half of their sales coming from Apple:

That may all be a bit backward looking as smartphones saw their slowest growth ever in 2016. Apple was a big part of that slower growth as they slowed the upgrade cycle with their third iteration of the same iPhone form factor. And then you had Samsung’s Galaxy Note 7 debacle which had high end Android users considering other options, and the rise of Chinese rivals taking share from the the established leaders. Samsung’s April release of the Galaxy 8 and Apple’s 10 year anniversary iPhone in the Fall could be a make or break growth moment for an industry that already established high penetration in the developed world and i the midst of a lack of innovation and seeing longer upgrade cycles. Which is why companies like SWKS are desperately trying to diversify into emerging technologies like Internet of Things and autonomous cars.

Price Action / Tehcnicals: While the rest of the sector with in an M&A and AI chip frenzy last year, SWKS stock was left for dead, closing unchanged on the year vs the Philadelphia Semiconductor Index (SOX) closing up more than 35%.

But, SWKS has been in a fairly well defined trading range over the last few months, holding the uptrend from the July lows. The stock appears to be at an inflection point, with little support below the trend down to the low $70s…

[caption id="attachment_69577" align="aligncenter" width="600"] SWKS 1yr chart from Bloomberg[/caption]

SWKS 1yr chart from Bloomberg[/caption]

while if it gets through resistance at $80, it could be off to the races… next stop $90

[caption id="attachment_69580" align="aligncenter" width="600"] SWKS 5yr chart from Bloomberg[/caption]

SWKS 5yr chart from Bloomberg[/caption]

Valuation: SWKS is a cheap stock, trading 12.7x f2017 eps, expected to grow 10% on a 7% sales increase (11.25x f2018). The company has $1.1 billion cash on their balance sheet, 7.5% of their $14.5 billion market cap, and no debt, trading about 4x their expected $3.55 billion in sales this year.

If the company were able to make some meaningful inroads in emerging technologies, away from Smartphones, it might find itself on a short list of takeout candidates in the semi space.

So What’s the Trade?

Picking an entry in a stock like this is hard. For those sniffing around in the the stock and considering a new long, it might make sense to give yourself a little room to play for a breakout by selling a downside put and financing the purchase of an upside call. That way, any small movements within a range aren’t significant:

In Lieu of 100 shares of SWKS (78) Buy the Feb 72.5/82.5 risk reversal for even money

- Sell 1 Feb 72.5 put at 1.50

- Buy 1 Feb 82.5 call for 1.50

Rationale – This trade gives some room to the downside in case the stock declines on earnings. The put sale at the 72.5 strike is just above the support level of the 200 day moving average. Any move below and you are put the stock and own it for 72.50. So this structure is only for those willing to do that. A breakout above recent highs and this trade will act like stock above 82.50. For those whom margin requirements are a concern, the short put can be turned into a short put spread (e.g. by buying the 65 put) making the trade a slight debit, or to make it even once again the calls can be turned into a call spread.