On December 6th we looked at the constructive set-up for IBM stock and detailed an alternative to stock that looked to take advantage of an end of the year vol crush by selling a Dec30th …

Continue readingCC and I wanted to take the opportunity to thank our readers for their continued commitment to Risk Reversal. We hope that we have delivered on our promise to help investors understand the uses of …

Continue readingA couple weeks ago we highlighted the poor relative year to date performance of shares of General Electric (GE) to many of its peers in the industrial space and the broad market, up only 2%: vs …

Continue readingThis morning, the WSJ’s Moneybeat column pointed to a market that may get a tailwind from the proposed economic policies of the incoming president and congress —> Another Trump Trade: Japan. The article specifically cited the “Key …

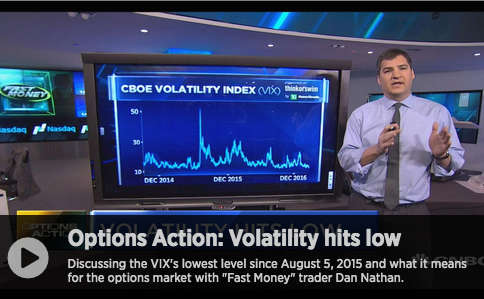

Continue readingLast night on CNBC’s Fast Money they asked me to take a quick look at the VIX (CBOE Volatility Index) trading at 2016 low, briefly below 11 for the first time since Aug 5th, 2015: …

Continue readingAbout a month ago we highlighted what appeared to be a bullish roll in calls of AMD when the stock was considerably lower: AMD: the semiconductor maker is up 200% on the year, and up …

Continue readingAbout a week ago we took a look at YELP after some unusual call activity. Someone bought 2500 of the Feb 38 calls to open and that got us looking at the stock from a …

Continue readingLast night Fedex Corp (FDX) reported fQ2 results that disappointed on eps ($2.80 vs $2.91 expected) with weaker than expected operating margins (7.8% vs 9.1% expected). That was despite booking record sales at $14.93 billion …

Continue readingDoug Kass of Seabreeze Partners earlier issued a Tweet-memo to “talking heads”: Memo to all the “talking heads” in the business media: 20K in the DJIA is meaningless. It is meaningful to those that need …

Continue readingEvent: Nike (NKE) reports fiscal Q2 results tonight after the close. The options market is implying about a 4.5% one day post earnings move. With the stock at $51.50, the Dec23rd weekly 51.50 strangle (the call …

Continue reading